The IPO market may well be picking up with many public issues lined up but HNI – high net worth individuals -- interest in the primary market clearly appears to be dwindling.

Data from Prime Database shows that the average number of HNI applications has dipped in the current calendar year - first time in many years. More importantly, some of the recent IPOs including Ather Energy, Dr Agarwal's Healthcare and Quality Power among others saw only a few thousand applications in the HNI segment. This is a huge fall as most of the IPOs that hit the market in January saw the number of HNI applications in lakhs.

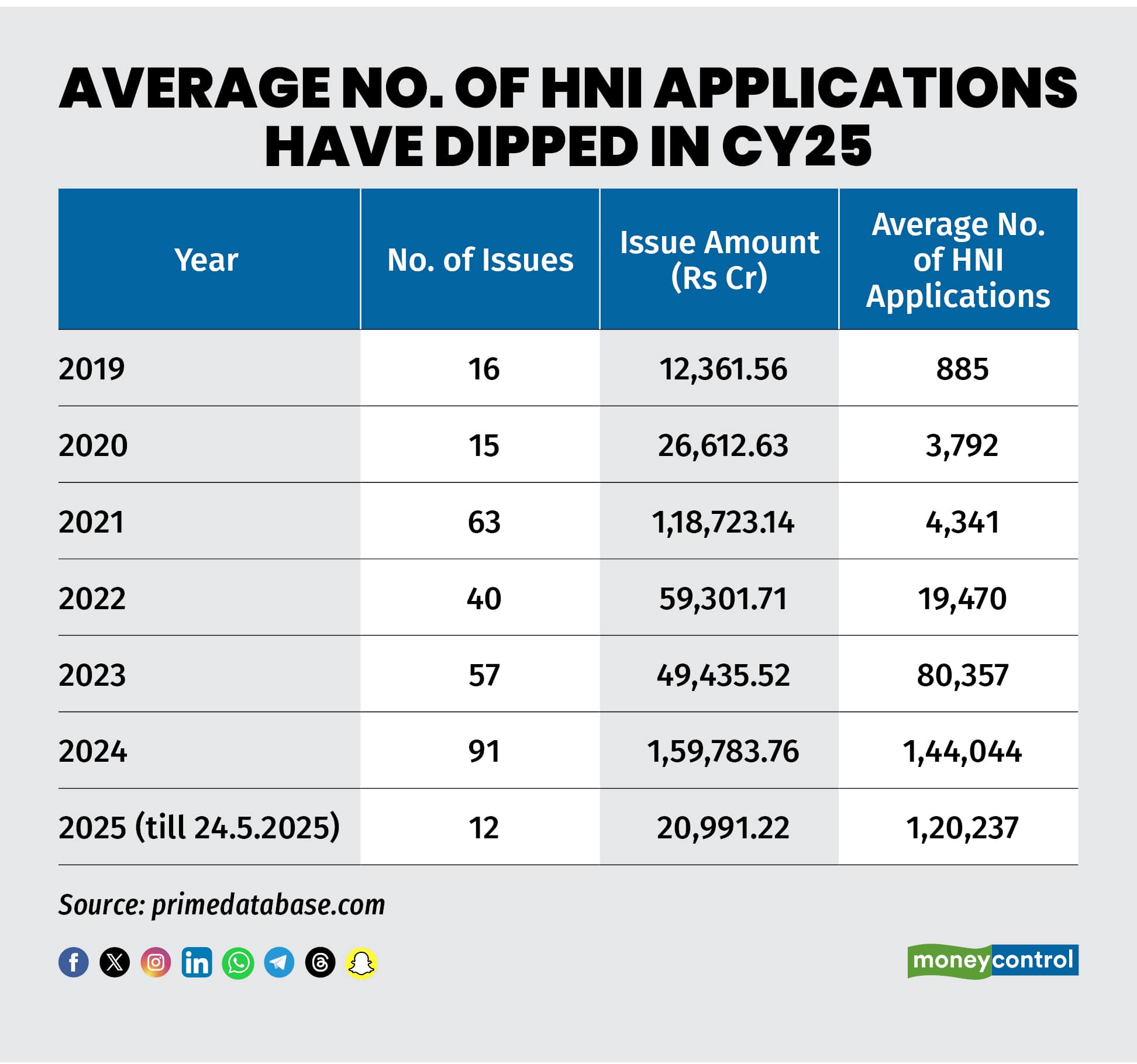

In the current calendar year till May 24, a total of 12 initial public offers (IPOs) have been launched raising a cumulative amount of nearly Rs 21,000 crore. The average number of HNI applications is pegged at 1.2 lakh, lower than last year’s 1.44 lakh.

Incidentally, the CY25 number is above the one-lakh mark only because of some of the IPOs that hit the market in January saw a strong interest from HNIs.

The first five IPOs of the year -- Standard Glass Lining Technology, Quadrant Future Tek, Laxmi Dental, Stallion India Fluorochemicals, and Denta Water & Infra Solutions – all saw HNI applications in the range of 2 -3.5 lakh each.

But since then the trend has seen a huge reversal as IPOs of companies like Dr. Agarwal's Health Care, Ajax Engineering, Hexaware Technologies, Quality Power Electrical Equipments and Ather Energy saw the number plunge to just a few thousands.

For instance, the Rs 8,750 crore offer of Hexaware Technologies saw just 3,540 applications in the HNI segment. Ather Energy, which launched its IPO in April to raise Rs 2981 crore saw a mere 3,940 applications.

Experts, meanwhile, say that the last couple of months experienced a dip in HNI response due to the overall uncertainty of the markets following global and domestic headwinds.

“The first 3-4 months of the year saw huge concerns related to the global tariff war and it was reflected in the lacklustre response from HNIs,” said an investment banker who saw subdued HNI demand in one of the IPOs that he managed last month.

Also Read: The IPO buzz: 58% IPOs deliver positive returns, 6% double investors' money

“The sentiments in the primary market closely follow that of the secondary markets. Trump assumed office in late January and since then equities became quite volatile amidst an uncertain outlook. Hence the drop in the number of HNI applications post January. If market sentiments improve, we would see an uptick in the (HNI) response,” he added, wishing not to be named.

This assumes significance as the IPO segment is seeing heightened action with as two IPOs currently open and one more scheduled to open on Tuesday. The IPO pipeline is also looking strong with nearly 70 offers waiting on the sidelines with a valid SEBI approval in place.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.