A sharp rebound since early October has propelled Reliance Industries Ltd (RIL), India's biggest firm, to outperform the Sensex and Nifty in 2025, powered by stronger earnings across its key businesses.

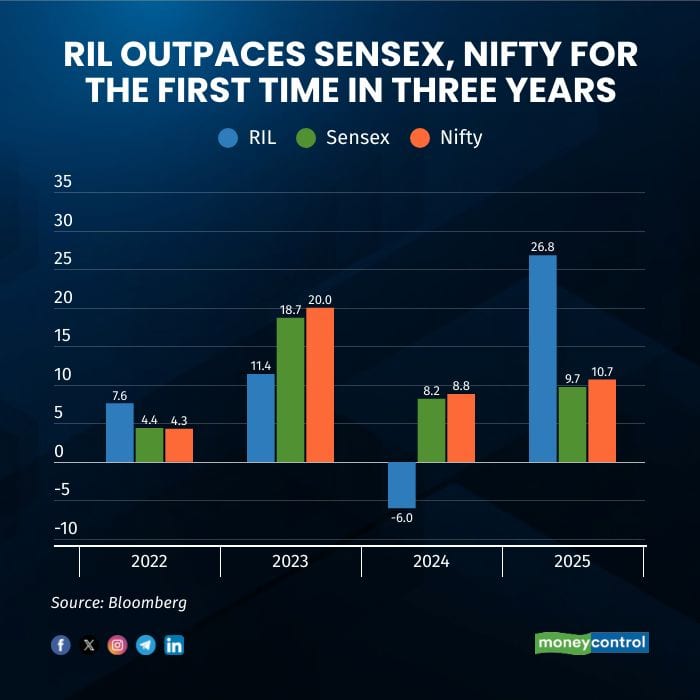

The stock has surged 27 percent so far in 2025 — its best annual performance since 2020 — compared with gains of about 10 percent in the benchmark indices, which are on track for their tenth consecutive year of advances.

This is the first time in three years that India’s most valuable company in the private sector has outperformed the benchmark indices.

RIL’s rally picked up sharply from October, when the stock climbed more than 14 percent as foreign brokerages turned positive on its outlook, adding to the 12 percent gains recorded between January and September. Analysts say the momentum is being fuelled by broad-based earnings strength across its energy, retail, and telecom arms, all of which are delivering double-digit growth in FY26 so far.

Alongside earnings improvement, investors are positioning for triggers ahead. Jio’s proposed IPO has raised expectations of tariff hikes, while RIL’s FMCG foray is seen ripe for value discovery in 2026.

New-energy ventures and a data-centre partnership with Google add further optionality. Importantly, analysts believe the earnings drag from the weak refining and petrochemical cycles through FY24–25 is now behind the company.

RIL faced steep earnings cuts through 2024 as refining and petchem margins fell. But consensus estimates have stabilised in recent months, with upgrades flowing into FY27 projections.

JPMorgan noted that its tracker for RIL’s refining margins is up about $3.8/bbl quarter-on-quarter. Even after adjusting for a $1/bbl hit from the loss of discounted Russian crude, current gross refining margins could lift FY27 EBITDA forecasts by around 6 percent if sustained. Diesel cracks, supported by winter-season supply disruptions, appear strong in the near term. Petchem margins remain weak, but analysts say currency depreciation is offering some offset.

The next leg of growth is expected to be driven largely by consumer-facing businesses. Jio is likely to raise tariffs ahead of its IPO, while further hikes post-listing remain a possibility. Reliance Retail, having completed its restructuring, is positioned to maintain double-digit EBITDA growth. Early revenue from the new-energy platform is expected from the first half of FY27, while momentum continues to build in media and real estate.

Before RIL’s pivot to consumer businesses, its earnings trajectory was heavily tied to capital-expenditure cycles in refining and petrochemicals. Currently, Retail and Telecom together contribute roughly 54 percent of FY25 consolidated EBITDA and are expected — according to JPMorgan — to drive nearly all net EBITDA growth over the next three years.

After three years of materially negative free cash flow, driven by heavy telecom investments, RIL is now positioned to turn FCF-positive. With an EBITDA run-rate of around $20 billion a year, the company is expected to generate surplus cash despite elevated capex on new energy, retail expansion and petchem upgrades, Jefferies in its recent note said. Management’s guidance to keep net debt to EBITDA below 1x further signals confidence in sustainable FCF generation, experts added.

Disclaimer: Moneycontrol is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.