Trent Ltd — once the standout performer of India’s retail space — has stumbled sharply in 2025. After a blockbuster 2024, the Tata group retailer has become the worst-performing Nifty stock this year, plunging nearly 40% year-to-date and wiping out over Rs 1 lakh crore in market capitalisation. Shares now trade at nearly half their all-time high, reflecting concerns over a cooling growth engine and intensifying competition.

The reversal follows Trent’s slowest revenue growth in four years. The company delivered 17% year-on-year growth in Q2 FY26, well below its long-term aspiration of 25% and a far cry from the ~65% surge it recorded in the fourth quarter of FY23. The question now: has growth bottomed out, or is this the start of a deeper reset?

.Has revenue growth hit its floor?

.Has revenue growth hit its floor?Most analysts expect Trent’s growth to stabilise from here. ICICI Direct’s Kaustubh Pawaskar sees revenues rising 18–20% over the next few quarters. “Despite rapid expansion, margin pressure is unlikely thanks to disciplined cost control and efficient execution,” he said.

Bernstein echoes the same view, arguing that the slowdown has “likely bottomed out” with a gradual recovery ahead.

Others remain cautious. Motilal Oswal Financial Services (MOFSL) notes that deceleration has been driven by weak like-for-like (LFL) sales trends. This means that even though Trent is opening many new stores, which adds to overall revenue, the older stores aren’t growing at the same pace. As a result, the company’s overall growth rate has slowed.

With demand subdued and store productivity normalising, MOFSL says a revival in revenue will be the next key trigger for the stock even as EBITDA growth remains resilient.

Also Read: Rating disconnect widens as investors outpace analysts in Nifty 50 moves

Same-store sales lose steamTrent’s same-store sales growth (SSSG) slipped into low single digits in Q2, weighed by aggressive expansion, cannibalisation, weak consumer sentiment, unseasonal rains and GST-related disruptions. (Cannibalisation occurs when new outlets open too close to existing ones, splitting customer traffic rather than expanding it.)

Analysts also highlight that Tier-II and Tier-III markets — a major thrust area — are yet to replicate metro-level productivity, while the value-fashion battleground is becoming increasingly crowded.

Pawaskar expects SSSG to remain subdued in the near term as newer stores stabilise.

Expansion remains Trent’s biggest growth leverEven as SSSG cools, Trent is doubling down on footprint. Store additions, muted in Q1FY26, rebounded in Q2:

* Total fashion stores: 1,101 (+33% YoY)

* Westside: 13 net additions, now 261 stores across 88 cities

* Zudio: 40 net additions, now 806 stores (+40% YoY) across 244 cities

MOFSL expects the pace of expansion to accelerate in the second half, reiterating that footprint scale—not SSSG—will remain the biggest driver of growth.

Nirav Karkera of Fisdom agrees: “Trent’s push into smaller cities, combined with improving store-level efficiency, positions it well for structural growth. Competition is thinner outside metros.”

Also Read: Rs 2.55 lakh crore IPOs in the pipeline in New Year

Zudio remains the engine — and continues to fireBrokerages remain aligned on one point: Zudio is Trent’s growth engine.

Macquarie, with an Outperform and a Rs 6,000 target, notes that the brand is undergoing a store revamp to counter rising competition. While splits have dented near-term SSSG, the upgrades aim to lift long-term productivity.

Bernstein expects Zudio’s store network to expand at a 20% CAGR over the next three years, backed by sustained demand for affordable fashion.

Pawaskar adds that Zudio’s growth will “continue to outpace overall revenue” as newer formats mature.

Burnt Toast enters the Gen-Z fightTrent’s new youth-focused brand, Burnt Toast, is seen as a longer-term opportunity amid increasing competition from Reliance Retail’s YOUSTA and Aditya Birla Fashion’s OWND.

“It is a promising entry into fast-fashion,” says Karkera, “but meaningful scale will take time as the segment heats up.”

Star business: The missing shine

Star, Trent’s grocery format, remains a drag. Revenue slipped 2% YoY in Q2 after a 7% rise in Q1, as store upgrades disrupted operations. Revenue per sq ft fell 14% YoY, while rival DMart managed a modest 1.5% increase on a larger base.

Still, MOFSL sees a long runway as Star is present in only 10 cities.

.Valuations reset, but long-term runway intact

.Valuations reset, but long-term runway intactEven after the sharp correction, brokerages say Trent’s structural story remains intact.

Axis Securities highlights improving margins, organised retail tailwinds and diversification beyond Zudio — including Zudio Beauty, jewellery, and the UAE pilot — as emerging contributors to long-term growth.

“At current levels, the risk-reward looks favourable,” says Pawaskar.

MOFSL’s Siddhartha Khemka is more cautious: “The stock may remain in a consolidation phase until growth revives. Near-term investors may consider trimming exposure.”

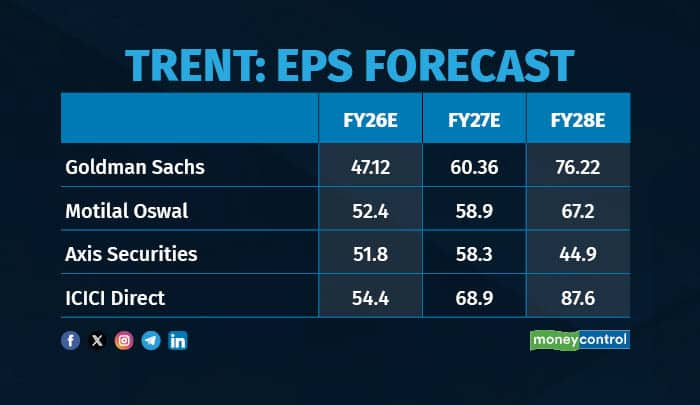

Despite the correction, Trent still commands premium valuations, about 80–90 times FY26 earnings, expected to moderate as growth returns.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.