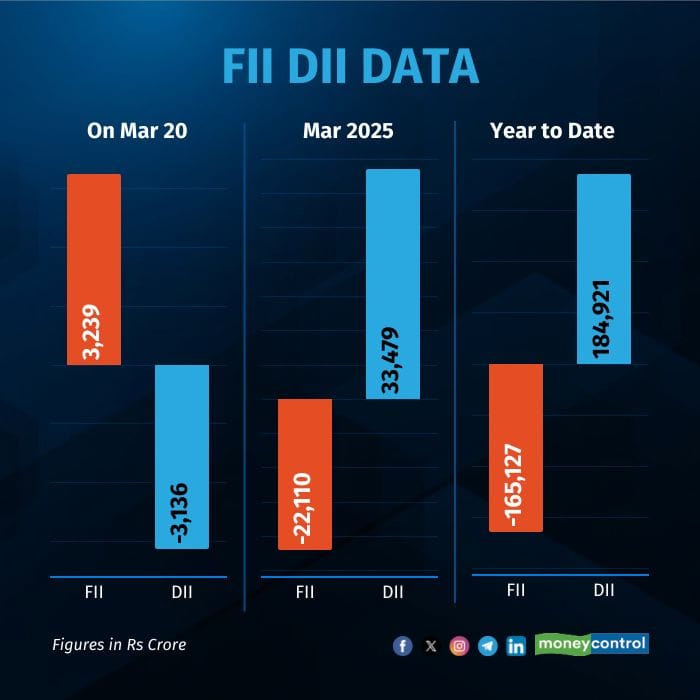

Foreign institutional investors (FII/FPI) turned net buyers again on March 20, purchasing shares worth Rs 3,239.14 crore while domestic institutional investors (DII) were net sellers of shares worth Rs 3,136.02 crore, provisional data showed.

During the trading session of March 20, FIIs net bought shares worth Rs 16,328.06 crore and sold shares worth Rs 13,088.92 crore. DIIs purchased shares worth Rs 11,784.06 crore and sold shares worth Rs 14,920.08 crore.

For the year so far, FIIs have been net sellers of shares worth Rs 1.65 lakh crore, while DIIs have net bought Rs 1.85 lakh crore worth of shares.

Benchmark indices Nifty and Sensex surged on March 20, extending their winning streak as a broad-based rally lifted all sectoral indices by over 1 percent. IT stocks spearheaded the gains, rebounding sharply after global markets reacted positively to the Federal Reserve’s steady rate cut outlook.

By the closing bell, the Sensex climbed 899.01 points or 1.19 percent to settle at 76,348.06, while the Nifty gained 283.05 points or 1.24 percent to close at 23,190.65. Market breadth remained positive, with 2,296 stocks advancing, 1,554 declining, and 124 remaining unchanged.

Despite a brief dip into negative territory, midcap and smallcap indices recovered to post gains of about 0.7 percent each. However, analysts remain cautious, citing stretched valuations despite the recent rebound.

All 13 sectoral indices ended in the green, with Nifty IT leading the charge just a day after tumbling over 2 percent in the previous session. Heavyweights TCS, Infosys, and Tech Mahindra powered the recovery. Auto stocks extended their rally with a 1.47 percent rise, while Nifty Realty, Oil & Gas, and FMCG gained between 1.2 to 1.4 percent. Nifty Pharma, Metal, Energy, and Bank indices also rose over 1 percent.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.