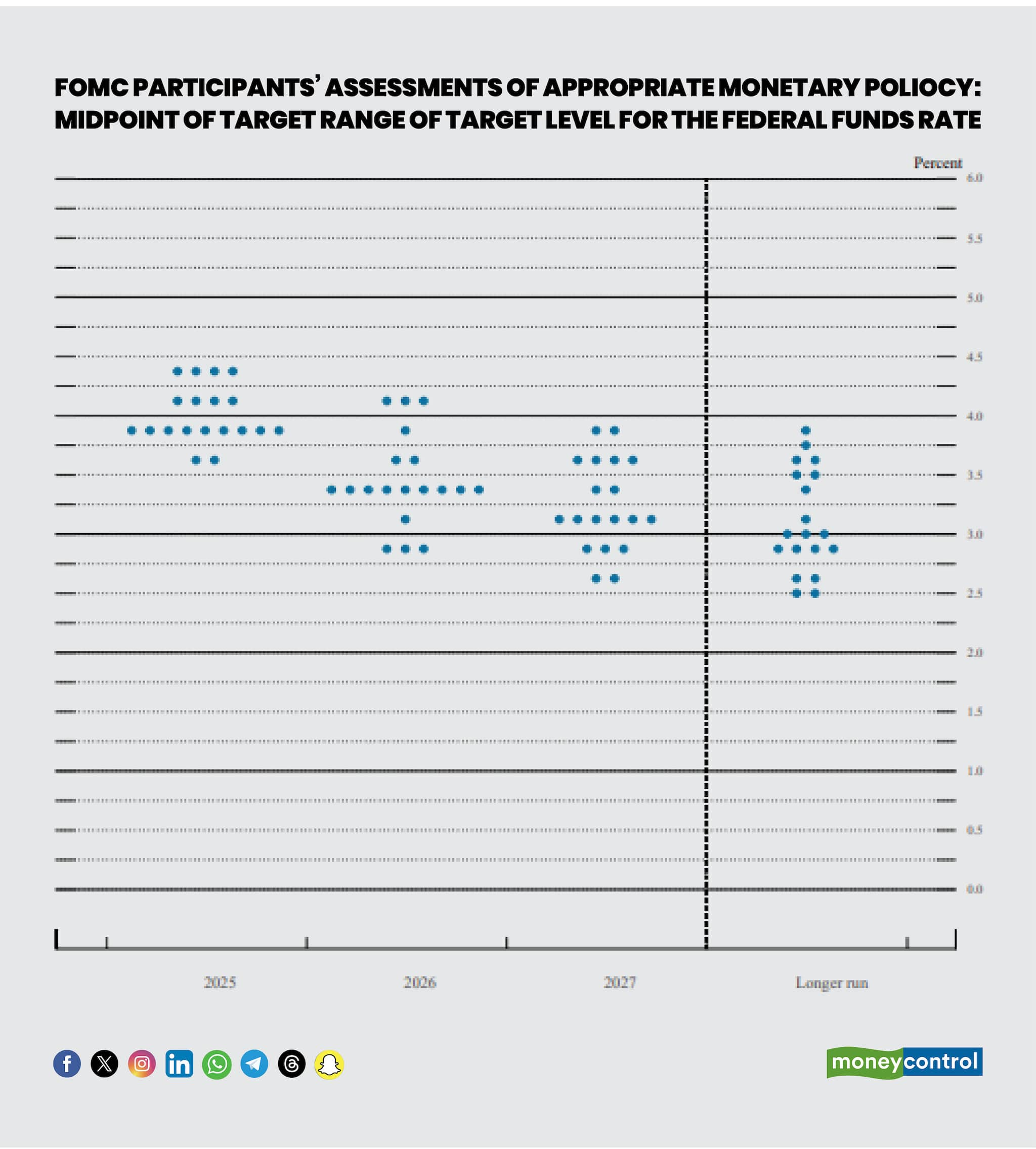

The US Federal Reserve is expecting to cut interest rates twice for the rest of 2025, according to its latest 'dot plot,' similar to its previous projections.

A majority of Fed officials anticipate two rate cuts this year, with nine voting members forecasting a reduction to a range of 3.75 to 4.0 percent. However, four members projected no cuts at all, while another four expected just a single 25-basis-point reduction. The overall support for two rate cuts was much milder compared to the December meeting.

The dot plot is a graphical representation that displays how frequently a particular value appears using dots. It is a simple charting method used for small data sets. The Federal Reserve’s dot plot specifically illustrates the interest rate projections of Federal Open Market Committee (FOMC) members over different time periods.

Currently, the FOMC consists of 19 members, including Federal Reserve Chair Jerome Powell. Analysts closely examine changes in dot plots across FOMC meetings to gauge shifts in the Federal Reserve’s policy outlook over time.

The latest projections were largely in line with market expectations. According to the CME Group’s FedWatch tool, investors do not anticipate a rate cut before the Fed’s June meeting, with most expecting just one additional reduction in 2025. Economists have also broadly projected two or three cuts for the year.

As for its latest policy decision, the Fed opted to keep interest rates unchanged, citing increased ‘uncertainty’ surrounding the economic outlook in recent weeks. Additionally, the central bank highlighted upside risks to inflation, particularly in response to former President Trump’s proposed tariffs.

Reflecting these concerns, the Fed raised its median core inflation forecast to 2.8 percent from 2.5 percent by year-end. Meanwhile, economic growth projections for 2025 were lowered to 1.7 percent from the previous estimate of 2.1 percent, and the unemployment rate forecast was revised slightly higher to 4.4 percent from 4.3 percent in December.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.