Indian benchmark indices witnessed a euphoric rise on June 3, reaching new record highs as exit poll numbers favouring Prime Minister Narendra Modi boosted positive sentiment. A strong short-covering rally has propelled the Nifty to 23,180, while the Bank Nifty is trading around the 50,500 level.

At 11:26 hrs on June 3, the Sensex was up 2,162.10 points or 2.92 percent at 76,123.41, and the Nifty was up 651.20 points or 2.89 percent at 23,181.90

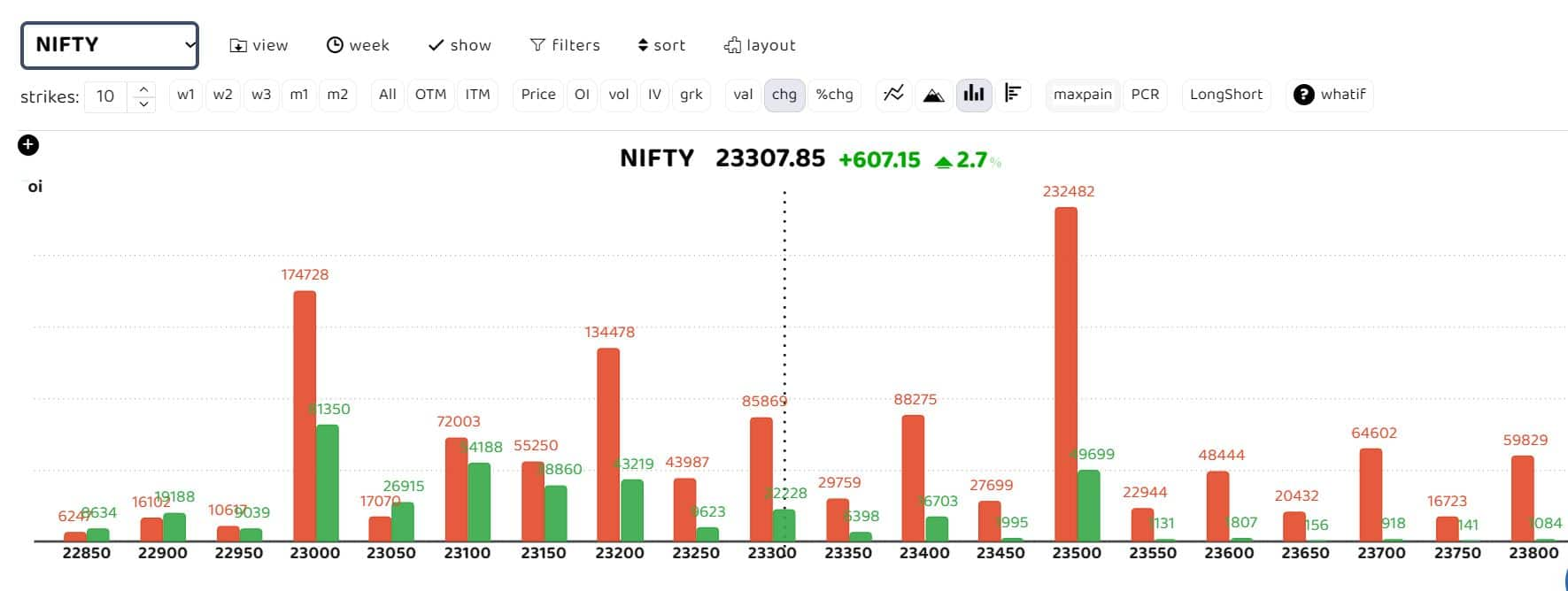

Bars in red indicate the change in open interest (OI) of call writers, while the green bars show the change in OI of put writers

Options data suggests heavy call writing at the 23,500 and 23,700 levels, acting as major hurdles. According to Soni Patnaik, Assistant VP of Derivative Research at JM Financial, "Resistance remains at 23,000 CE, above which short covering can be expected towards the 23,500 level. Immediate support is at 22,500 on a closing basis."

"After a huge gap-up opening, Nifty can find support at 23,200, followed by 23,100 and 23,000. On the higher side, 23,650 can be an immediate resistance, followed by 23,700 and 23,800," said Deven Mehta, Research Analyst at Choice Broking.

"The charts of Bank Nifty indicate that it may find support at 50,000, followed by 49,900 and 49,800. If the index advances further, 50,300 would be the initial key resistance, followed by 50,500 and 50,700," he added.

"Traders holding long positions are advised to book profits after a gap-up opening before the results of the general elections in 2024. Investors are advised to hold long positions with a trailing stop loss of 23,000 on a closing basis," advised Mehata.

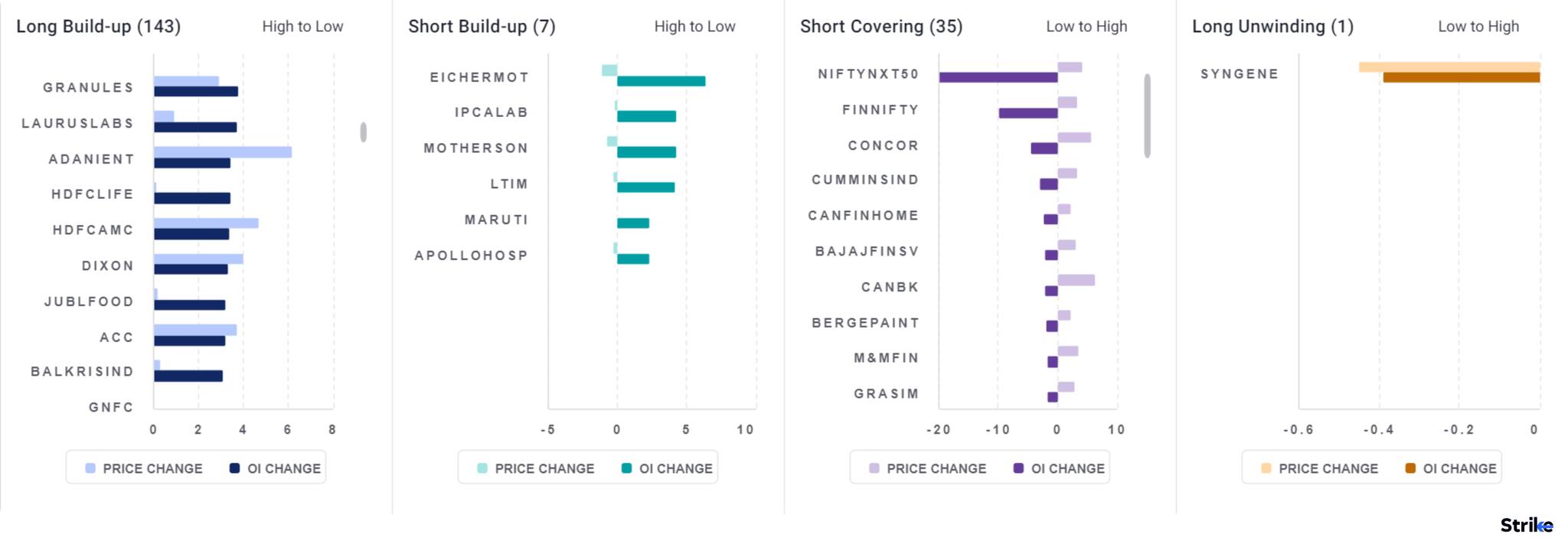

Among individual stocks, 143 have witnessed a long buildup, while a short buildup has been observed in only seven stocks: Eicher Motors, IPCA Labs, Motherson, LTIM, Maruti, and Apollo Hospitals.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.