Sideways momentum seem to be plaguing the Indian benchmark indices, driving the bull run to a halt on December 12.

The BSE Midcap and Smallcap indices are treading cautiously with marginal gains. Notable gainers on the Nifty include Hindalco, UltraTech Cement, HDFC Life, Bajaj Auto, and ITC, while BPCL, Coal India, Eicher Motors, L&T, and Apollo Hospitals find themselves among the top losers.

As of 11am, the Sensex reflects a dip of 25.98 points or 0.04 percent, settling at 69,902.55. Conversely, the Nifty shows a modest uptick of 7.10 points or 0.03 percent, reaching 21,004.20. Market dynamics reveal 1762 advancing shares, 1354 declining shares, and 77 unchanged.

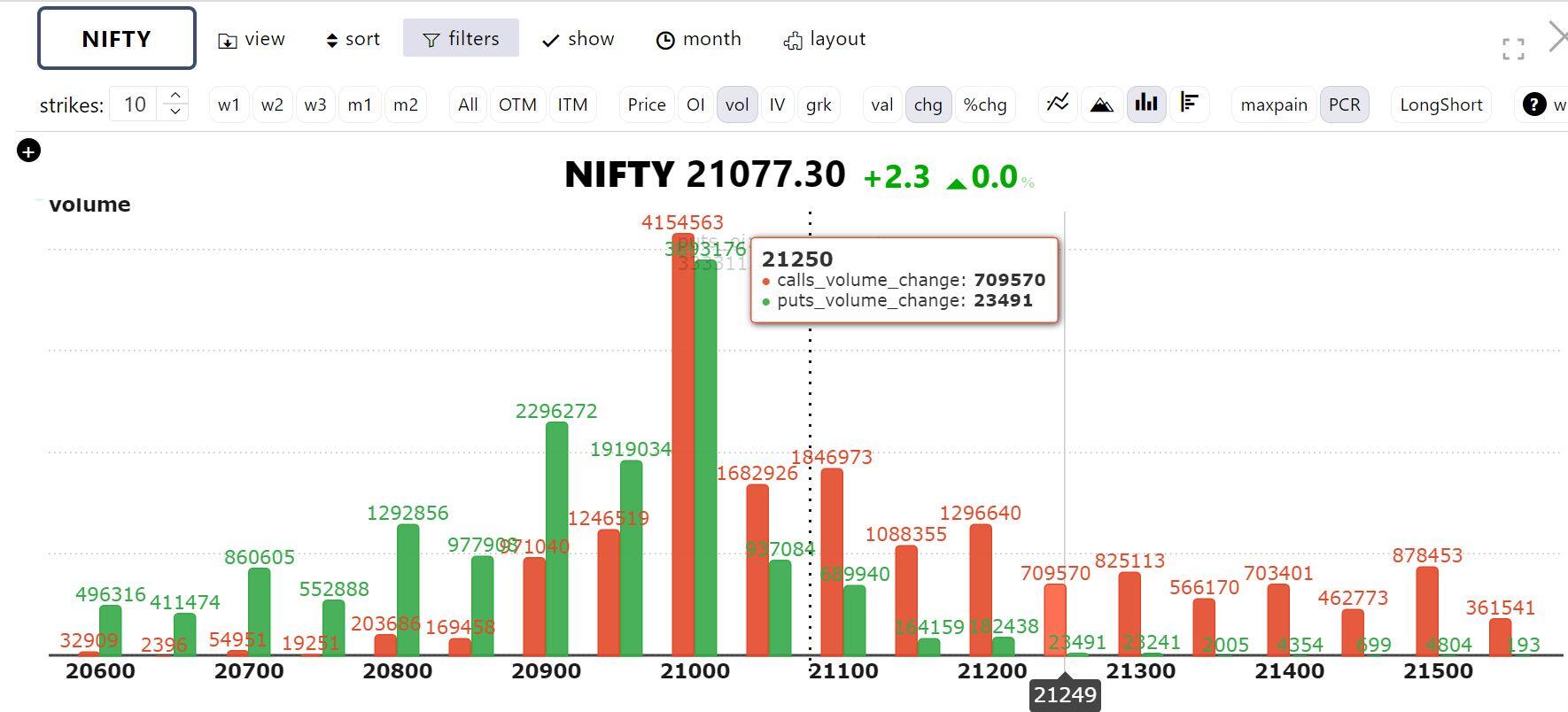

Bars in red show the change in open interest (OI) of call writers and in green show the change in OI of put writers

Bars in red show the change in open interest (OI) of call writers and in green show the change in OI of put writersOpen interest data suggests a tussle between call and put writers around 21,000 levels. "Technically, the emergence of a small-bodied candle on the daily time frame signals a potential exhaustion in the recent momentum. Proximity to a milestone mark warrants caution for aggressive traders. Despite the slowdown, minor dips favor the bulls, and a gradual upshift in the support base signifies a positive development technically," Sameet Chavan, research head for technicals and derivatives, said.

"The level 20,900-20,850 presents an immediate cushion, followed by the robust support of the 20,800-20,700 subzone. On the flip side, the 21,100 level, representing a reciprocal golden (161.8 percent) retracement of the recent fall, acts as intermediate resistance," Chavan said.

"In the current overbought conditions, it's prudent to secure profits and implement efficient risk management. Additionally, the looming FOMC meeting could influence the near-term trend in both global and domestic markets."

Among individual stocks, long build-up is witnessed in Adani Enterprises, IndiaCem, Hind Copper, GMR Infra while short covering is seen in ACC, BHEL and PFC.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.