Indian benchmark indices fell on May 16 amid choppy trade, failing to sustain morning gains. In late morning, NSE Nifty 50 was trading down 54 points or 0.25% at 22,146. The index had climbed as much as 130 points earlier in the morning to an intra-day high of 22,330.

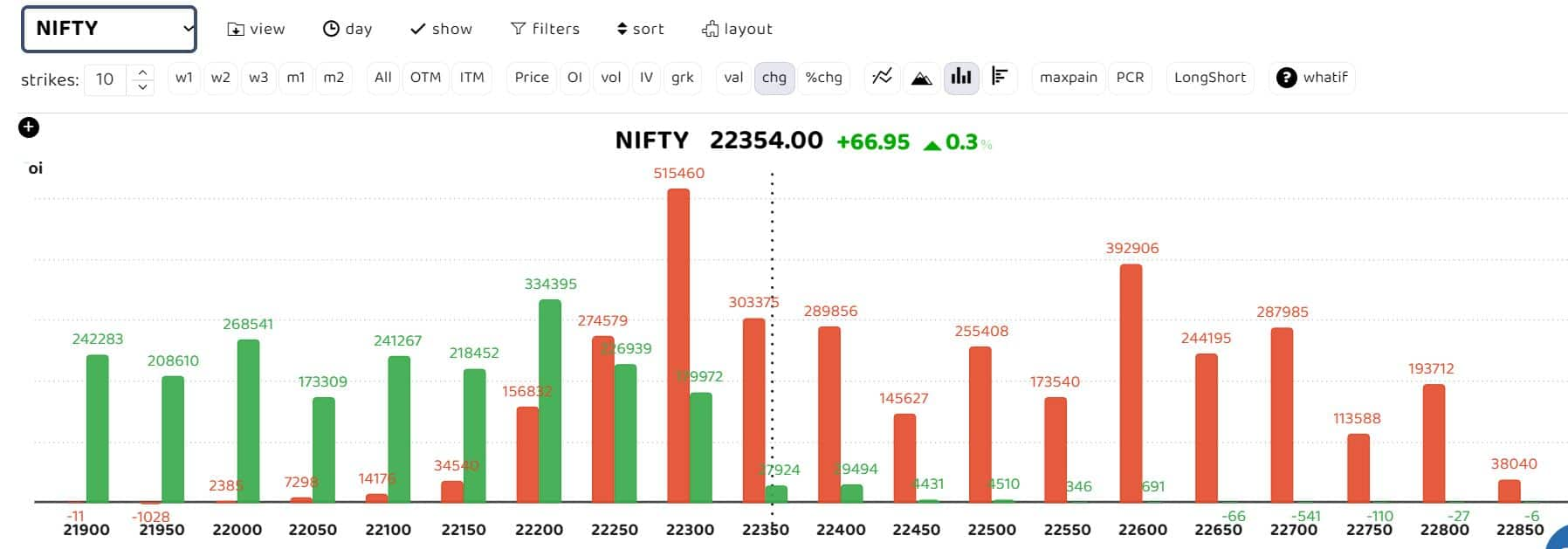

According to experts, the Nifty must break resistance at 22,300 for further gains. It has support at 22,000.

Bars in red indicate the change in open interest (OI) of call writers, while the green bars show the change in OI of put writers

Prabhudas Lilladher: A decisive breach above 22,300 is needed to continue with the positive upward movement and aim for next targets of 22,550-22,600. The support would be maintained near 22,000 as of now, which needs to be sustained.

SBI Securities: "On Wednesday, the Nifty Index witnessed price rejection near the 20-day EMA & 50 DMA zone of 22,290-22,310, and thereafter, it witnessed a minor correction. However, considering the gap-up opening, the zone of 22,330-22,350 will act as a crucial hurdle for the index," said Sudeep Shah, DVP and Head of Technical and Derivative Research. EMA is Exponential Moving Average, and DMA is Daily Moving Average.

“Any sustainable move above the level of 22,350 will lead to the continuation of this rebound move in the index up to the level of 22,500 in the short term,” he added.

Angel One: "Technically, the price action remained muted, and hence, there is no significant change in the market outlook. The broader view remains intact with the bullish biases, but it seems really challenging to hold on to higher grounds with conviction. Hence, one is required to have a pragmatic approach of 'Buy on dips' and 'Sell on the Rise' until we see a decisive participation of the bulls in carrying momentum," said Osho Krishan, Senior Analyst - Technical & Derivative Research, Angel One.

"Simultaneously, the resilience of the 20 DEMA is expected to act as a daunting task for the bulls in the near term, and an authoritative breach could only dictate the next leg of the rally in the index. On the lower end of the spectrum, the support lies around 22,150-22,100, which is expected to cushion any intraday blips, followed by the sacrosanct support at the 22,000 mark," added Krishan.

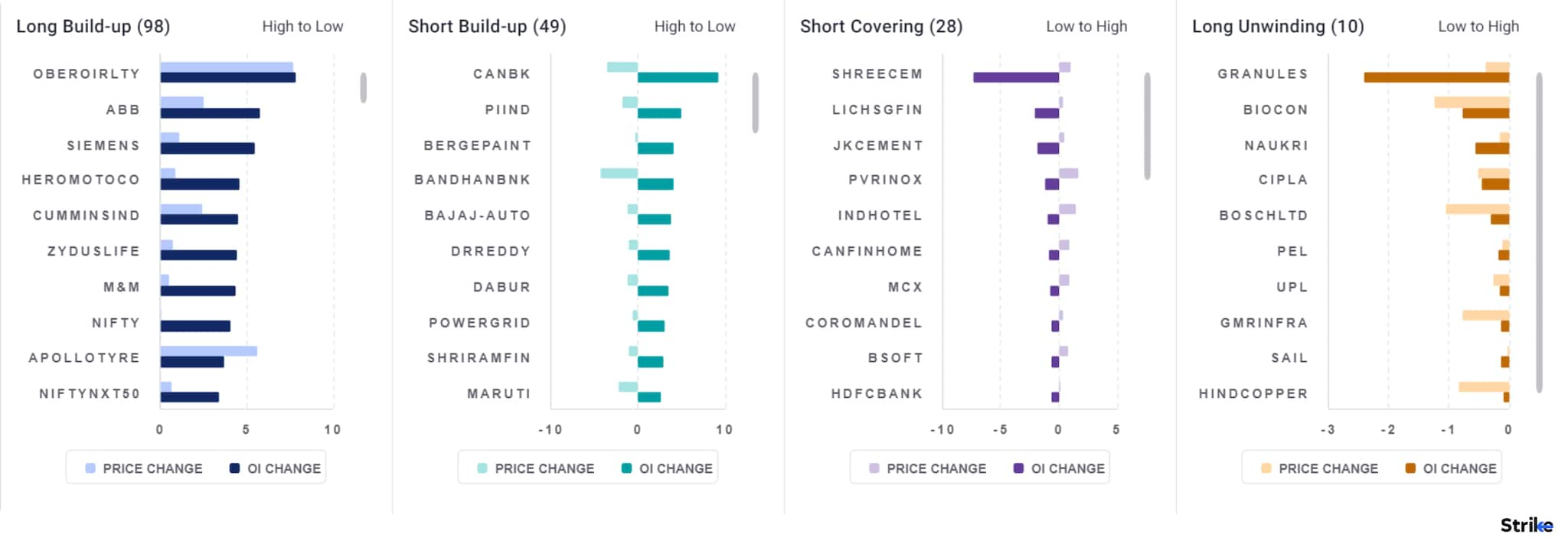

Among individual stocks, long build-up is observed in ABB, Nifty, and Heromotoco, while short build-up is seen in Berger Paints, PI Industries, and Bandhan Bank.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.