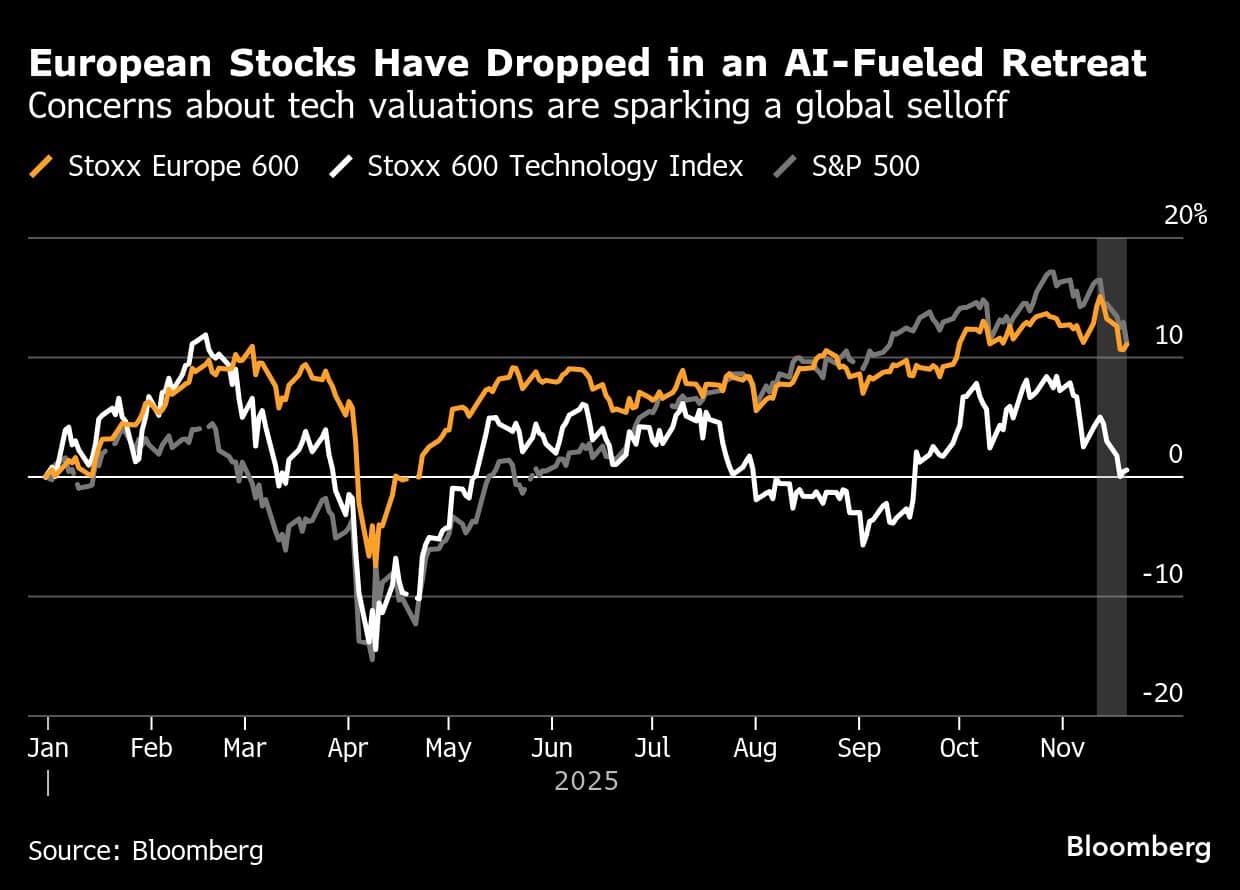

European stocks posted their worst week since August as a risk-off mood hit some of this year’s biggest winners on concerns about lofty technology valuations and an uncertain US monetary policy outlook.

The Stoxx Europe 600 Index was down 0.3% by the close, extending losses since Monday to 2.2%. The index came off session lows after Federal Reserve Bank of New York President John Williams said he sees room for the US central bank to cut interest rates again in the near term.

Energy and technology stocks tumbled the most on Friday, while defensive sectors including food and beverage as well as personal care outperformed. Media and travel were also among the biggest gainers. The defensive Swiss Market Index rose 0.7%, benefitting from demand for havens.

Siemens Energy AG dropped 10% even after the company announced its largest share buyback, as investors booked profits in some of this year’s strongest winners. ASML Holding NA, the biggest gainer on the index by points this year, fell 6.3%.

The Stoxx 600 is in retreat as investor sentiment turns cautious into the year-end. Investors are awaiting further evidence that hefty spending on artificial intelligence is paying off, while there are growing doubts about the Fed’s next rate cut.

Investors are also monitoring negotiations to end the war in Ukraine. Kyiv’s key European allies lined up with President Volodymyr Zelenskiy to reject key elements of a plan drafted by the US and Russia.

“I’m wondering how much of it is really healthy de-risking rather than, ‘we’re in an AI bubble and it’s going to implode,’” said Sophie Huynh, a portfolio manager at BNP Paribas Asset Management. “Heading into year-end, you’re wondering how much new economic data you’re going to receive. After a spectacular year, do you really want to risk your year-end performance? So you take chips off the table.”

On Thursday, the S&P 500 logged its sharpest intraday reversal since the height of the tariff turmoil in April following a mixed jobs report. Still, the benchmark was up 1% in early trading on Friday, suggesting appetite for dip-buying.

Some market participants said the pullback was expected after a strong rally in both European and US stocks this year. Last week, the Stoxx 600 was approaching overbought levels — a precursor for potential declines. The benchmark is now about 3.8% below an all-time peak.

“This is a healthy correction which could continue into the beginning of next week as many systematic funds have to de-risk,” said Ulrich Urbahn, head of multi-asset strategy and research at Berenberg. “However, we also believe that markets will rebound into year-end.”

For Guillermo Hernandez Sampere, head of trading at asset manager MPPM, the market reaction showed that skepticism about the US labor market stems from insufficient data after a government shutdown delayed publication.

“The expectation of a swift response from the Federal Reserve could further fuel volatility,” he said.

Meanwhile, latest data added to confidence in the health of the regional economy as private-sector activity in the euro area stayed strong in November. However, in the UK, businesses recorded hardly any growth in the weeks ahead of the Labour government’s upcoming budget.

Ubisoft Entertainment SA advanced 3.9%, reversing initial declines, as news that the company was found by auditors to be in breach of a loan agreement was outweighed by better-than-expected net bookings.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.