Benchmark indices recorded gains for the fifth straight week during the one that ended on July 5, surging around 8 percent during the period. Going ahead, analysts expect the trend to largely remain positive, however, bouts of volatility can be seen with the onset of the Q1 earnings season and the release of US and India inflation numbers.

Key factors to watch include expectations around the Union Budget and the Q1 FY25 earnings season. Individual stocks will also be under scrutiny based on their Q1 FY25 earnings and management commentary in the upcoming weeks. Investors will also keep a close eye on FII and DII fund flows, as well as crude oil prices, to gauge overall sentiment.

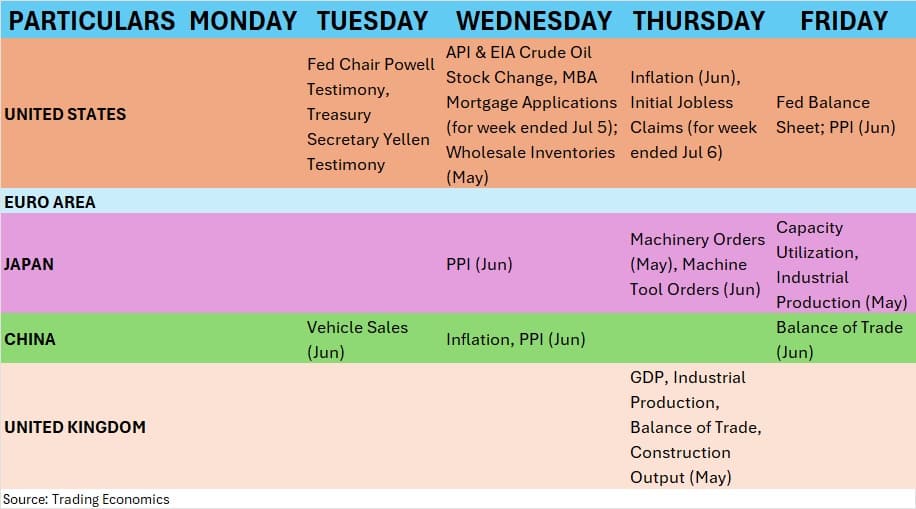

On the global front, investors will remain eyed on the release of the US inflation print for June as well as Federal Reserve Chair Jerome Powell's testimony.

Sector-specific movements are anticipated amid budget-related buzz. While the underlying sentiment remains bullish, bouts of profit booking may also be seen, said experts.

In the previous session, the Sensex closed 0.1 percent lower and the Nifty, ended up 0.1 percent. During intraday trading, Sensex saw a decline of over 550 points, while Nifty dropped by 130 points.

"We anticipate the index to continue consolidating, with a generally positive outlook. Traders should concentrate on stock selection and trade management, keeping in mind the potential for increased volatility," said Ajit Mishra – SVPo f Research, Religare Broking.

Here are 10 key factors to watchCorporate EarningsThe Q1 FY25 earnings season is back, with companies slated to release their quarterly numbers this week onwards. Information technology giant, TCS will kickstart the season and release its Q1 numbers on July 11 followed by HCL Technologies which will detail its results on July 12. Avenue Supermarts will also follow the cue, with earnings slated to be released on July 13.

The Q1 earnings season will also trigger a bout of stock-specific action.

Market participants will keep a watch on the inflation data, due to be released on July 12. India's retail inflation eased to a 12-month low of 4.75 percent in May 2024. Core inflation also eased slightly, dropping to 3.1 percent in May from 3.2 percent in April. However, food inflation remains sticky at 8.69 percent.

Domestic Economic DataAside from the domestic consumer inflation numbers, the focus will also be on industrial production, and manufacturing production, along with bank loan and deposit loan growth, all slated to be released on July 12. In addition, the Reserve Bank of India will also release foreign exchange reserves data on July 12.

US Inflation and Powell TestimonyFederal Reserve Chairman Jerome Powell is set to deliver crucial testimony on Tuesday, July 9, 2024, followed by a significant speech on July 10. Investors keenly await insights from Powell as these events coincide with the release of US inflation data on July 11, shaping market sentiment and strategy for the upcoming week.

Global Economic DataInvestors will also focus on China's inflation and Producer Price Index (PPI) data, which provide insights into economic conditions in the world's second-largest economy. Additionally, attention will turn to South Korea's interest rate decision, influencing regional monetary policy. From the United States, significant data releases include MBA Mortgage Applications and API & EIA crude oil stocks change for the week ended July 5, Wholesale Inventories for May, Initial Jobless Claims for the week ended July 6, and the Producer Price Index (PPI) for June.

Foreign institutional investors' (FII) activity will also be watched next week as they returned to Indian equities and bought shares worth Rs 6,874.66 crore in the previous week, as per provisional data. Buzz around the Union Budget and India's inclusion in JP Morgan's bond index are some factors that garnered FII interest in local equities.

On the other hand, domestic institutional investors (DIIs) booked some profit in the equity markets over the previous week as they net sold equities worth Rs 385.29 crore, according to provisional data.

though FII outflow has been more than compensated by consistent, robust buying by domestic institutional investors (DIIs) in the equity markets over the previous week where FIIs net sold Rs 14,704 crore worth of shares in the cash segment, while DIIs net bought stocks worth Rs 20,796 crore, per

“FII buying can sustain provided there is no sharp up move in US bond yields,” said VK Vijayakumar, Chief Investment Strategist, Geojit Financial Services.

IPOThe primary market is set for another buzzing week as two companies are slated to make their market debut this week. In the SME segment, one initial public offering (IPO) will open for subscription while the other three will close their subscriptions.

In the coming week, Shark Tank fame Namita Thapar-led Emcure Pharmaceuticals and Bansal Wire will make their market debut on July 10. Both the IPOs had garnered strong investor responses and were subscribed nearly 70 times their respective offer sizes.

Additionally, Ambey Laboratories, Ganesh Green Bharat, and Effwa Infra & Research will also have their SME listing next week.

Technical ViewAfter showing minor weakness from the highs in the last couple of sessions, the Nifty 50 witnessed buy-on-dips action on July 5, closing on a flattish note. "Following this, a reasonable bullish candle has been formed on the daily chart after opening lower and with minor upper and lower shadows. Technically, this market action signals the formation of a bullish counterattack type candle pattern, which signals possible comeback of bulls after a small dip," said Nagaraj Shetti, Senior Technical Research Analyst at HDFC Securities.

"Previously, a similar type of formation on 24th June has resulted in a sustainable up move for the subsequent week. This is a positive indication. The underlying trend of Nifty continues to be positive. There is a possibility of an upside breakout hurdle around 24,400-24,500 levels in the next few sessions. Immediate support is at 24,170 levels," he further said.

F&O CuesThe weekly options data indicated that the Nifty is likely to achieve 24,500 in coming sessions, followed by 24,800, provided it holds 24,000.

On the Call side, the 25,000 strike holds the maximum open interest, followed by the 25,500 and 24,500 strikes, with maximum writing at the 24,800 strike, and then the 25,000 and 25,500 strikes.

On the Put side, the maximum open interest was seen at the 24,000 strike, followed by the 23,500 and 24,200 strikes, with maximum writing at the 24,200 strike, and then the 23,500 and 24,000 strikes.

India VIXThe volatility has consistently been declining in the last couple of weeks, making the trend more favourable for bulls. The India VIX, the fear index, dropped 8.02 percent to 12.70, from 13.8 levels during the week.

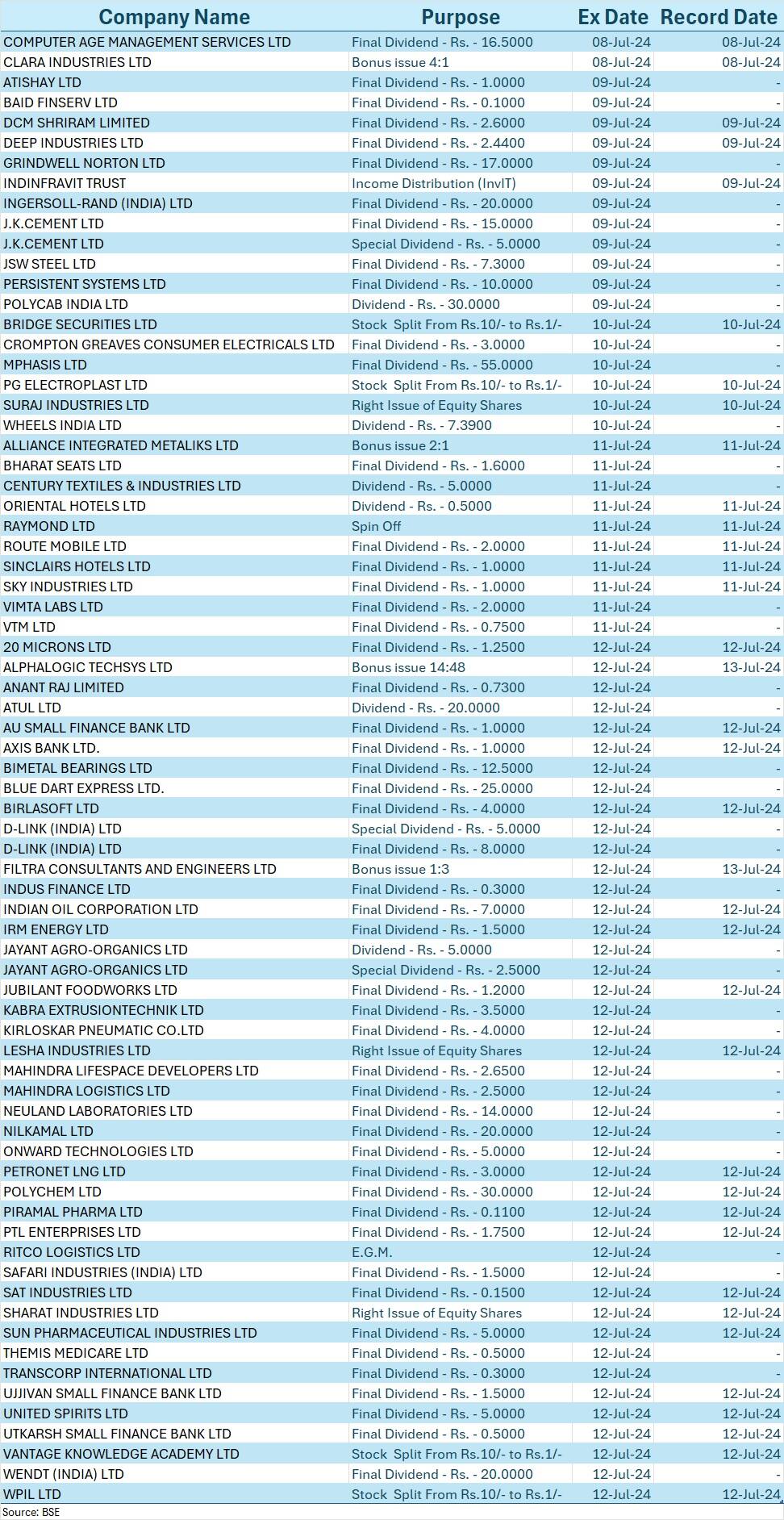

Corporate ActionHere are key corporate actions taking place next week:

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.