The crisis at IL&FS perhaps went unnoticed before the first default, since it is not listed and was perceived as a quasi-government body because of the prominent shareholders being government entities.

However, it is neither a small problem nor one with a quick fix solution and the system has to be prepared for meaningful losses from this episode.

While a systemic intervention at the behest of the Reserve Bank of India (RBI) can douse the fire for now by pumping in the emergency liquidity (which nevertheless is of utmost importance to contain the contagion), the long-term problem is structural and the stakeholders will eventually end up paying the price.

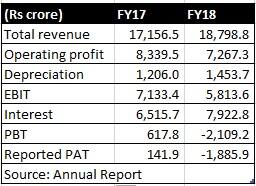

The FY18 financials suggest the consolidated entity reported a loss. Its interest coverage ratio was just a tad above one till FY17, indicating that it was barely able to service its interest obligations. This dropped to 0.73 in FY18. In effect, the earnings are now insufficient to cover the interest the group has to pay.

With a total borrowing in excess of Rs 91,000 crore, the leverage has risen to 16.8 times in FY18 from 10.6 times in FY17. Credit rating agencies, while aware of the balance sheet problems, were hoping for stake sale or monetisation of assets to salvage the grave situation and had to thereby, drastically downgrade the paper in the event of an actual default.

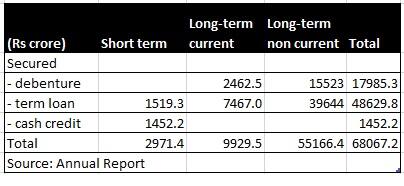

A peep into the massive borrowings of Rs 91,000 crore suggests that close to Rs 25,784 crore of shorter term loans will have to be immediately rolled over. The company doesn’t earn enough to service interest and hence the repayment of principal is a tall ask.

Technically, a large part of borrowings – close to 75 percent is secured. But how much of it can be recovered is the question.

According to media reports, post FY18 results, IL&FS’ short-term borrowings rose further, indicating their desperation to service long-term loans by borrowing short-term. IL&FS could borrow freely because their papers enjoyed a good credit rating before the default.

The group’s exposure to myriad banks and financial institutions by way of term loans is close to Rs 53,816 crore. This is not a significant number (0.6 percent) in the context of the total system’s credit. But given the long-term unsustainable business model of IL&FS, Indian banking sector may be also staring at a hair-cut from its exposure to IL&FS. It is premature to hazard a guess on the quantum, but conservatively a figure of close to Rs 27,000 crore shouldn’t be a surprise and it could actually turn out to be much higher.

A recent brokerage report has attempted to quantify the exposure of banking entities to IL&FS group and the list is clearly dominated by Public Sector Banks.

Source: Elara Capital

So while markets eagerly await a short-term solution, the magnitude of the problem is formidable. The crisis management may just be the beginning of a long road to unearth the mess in the behemoth that was ignored for a very long time.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.