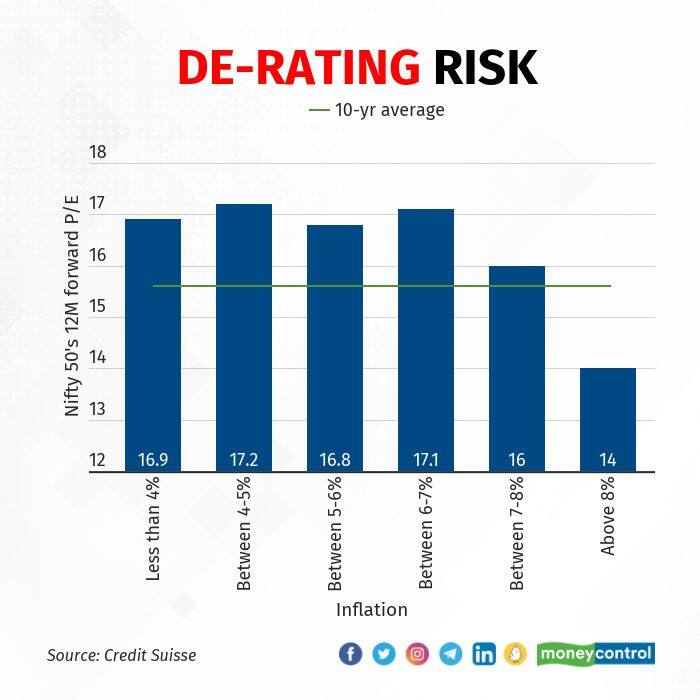

Indian markets can take inflation up to 8 percent, but above that it will start to de-rate fast, according to a Credit Suisse analysis.

Once it crosses that threshold, valuations can fall by as much as 200bps.

(Source: Credit Suisse)

(Source: Credit Suisse)

In April, CPI inflation did come close to 8 percent – at 7.79 percent. But then it fell back to 7.02 percent because of “the base effect and some cooling off in commodity prices”.

“Based on our analysis, the Indian economy and the equity market should be able to withstand inflation up to 7–8 percent. Should the rate of inflation move higher, we could see valuations of Indian equities deteriorate further. We note that the RBI and the government announced some measures to curb inflation when it reached near this threshold. We therefore expect strong policy response if the CPI starts moving closer to 8 percent levels again,” the analysis said.

India’s valuation continues to remain elevated when compared to other emerging markets (EM).

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.