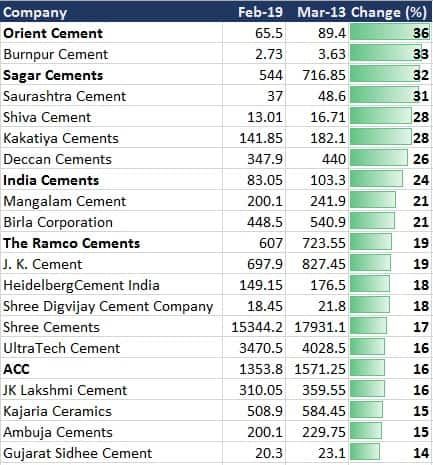

Along with the recent rally seen in benchmark indices, small and midcaps also saw a recovery after a long dull period. One of the sectors that made the most of this up move was cement. Most stocks gained in the range of 14-36 percent including biggies ACC, Ambuja Cements, UltraTech Cement and Shree Cements.

Another reason for this rally was rise in cement prices across India. Cement makers across India increased prices in February 2019 by as much as Rs 13-17 per bag.

While southern region witnessed the steepest hike of Rs 30-40 per bag followed by Rs 15-20 per bag hike in the West and Rs 12-15 per bag hike in the East, prices in North and Central region remained flattish during February.

To sweeten it further, power & fuel cost and diesel costs have softened by around 20 percent from their recent high in Q2FY19. Moreover, prices of petcoke, a key input, have come down from peak levels of $120-130 per tonne to $95 per tonne.

Stewart & Mackertich Research feels the recent price hike in cement prices would definitely improve the profitability margins in Q4FY19.

According to S&P Global Platts, petcoke prices in India are expected to further come down to $90-92 per tonne levels.

Hence, Stewart & Mackertich Research estimated that this price hike if sustained could improve realization by 5-7 percent and benefit to accrue directly to bottomline in Q4FY19.

"Though due to upcoming elections the cement demand could be slightly muted in Q1FY20 which could put pressure on the increased prices, but in the long term we expect the realization and return ratios to improve," the research house said.

As far as south-based companies are concerned, if cement prices were to remain high, then firms like Orient Cement, India Cements, Ramco Cement, ACC and Sagar Cement would see a sharp improvement in earnings, according to Elara Capital.

These stocks in last one month, especially after February 19, 2019, rallied 16-36 percent.

Elara Capital has estimated earnings of five south-based cement companies assuming a price hike of Rs 25-40 per bag for the next few quarters. Its analysis indicates that these companies' EBITDA could increase in the range of 65-145 percent YoY over next few quarters.

Given the near-term earnings visibility in South-based cement companies, they could outperform in the short run, according to the brokerage.

Disclaimer: The above report is compiled from information available on public platforms. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.