As we approach Interim Budget, the big worry for Indian market is persistent selling by foreign investors. Foreign portfolio investors (FPIs) made a net withdrawal of about Rs 83,146 crore from the Indian markets (equit + debt) in 2018, and are net sellers of over Rs 5,000 crore (equit + debt) so far in January.

Most experts feel that flows are expected to be rangebound in 2019 as FPIs may continue with a cautious stance until there are concrete signs of economic recovery and a stable government after the general elections.

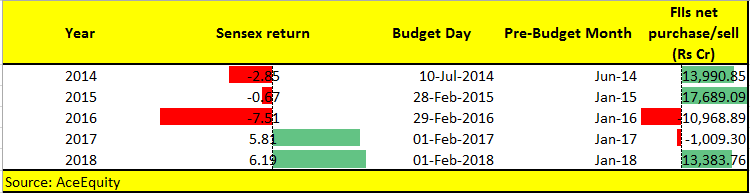

In the last 2 out of 5 years, FPIs were net sellers a month ahead of the Budget, according to data the historical data. Data suggests that FPIs pulled out nearly Rs 11,000 crore in 2016 and a little over Rs 1,000 crore in 2017.

However, they were net buyers in 3 out of last 5 years of the Modi government, pouring in more than Rs 10,000 crore each in 2014, 2015 as well as 2018.

Going by investor expectations, if US Fed pauses or reduces rates in 2019, analysts expect dollar index to weaken and flows to return to emerging markets (EMs), including India.

Stability on the political front is likely to add more confidence. Continuity of policy, even if NDA comes to power with a reduced majority in Lok Sabha, will add to confidence.

“Given the challenging global growth outlook, export-oriented EMs will be at a disadvantage to India, whose macroeconomic fundamentals are relatively strong and earnings recovery is on the bend,” Elara Capital said in a report.

“However, given the general election overhang till May, we can expect robust FPI flows only in H2FY19. India, will be a hot favourite for FPI flows in CY19 as the earnings downgrade cycle is behind us and expect ~14 percent earnings CAGR (ex-financial) in FY18-21E,” it said.

Weakening of the US dollar and domestic-focused emerging market economies will also contribute towards higher inflows into the country. EMs like India will be attractive for equity flows in the backdrop of slowing global growth.

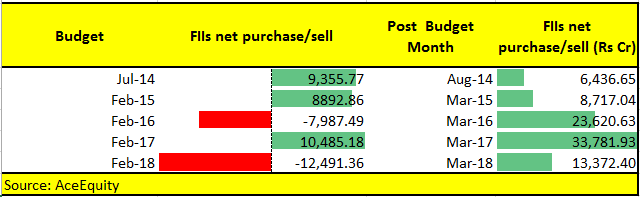

Last five years' data suggests that FPIs were uncertain in the Budget month in the last 2 out of 5 years but have remained net buyers in the month following the Budget announcement.

FPIs were net sellers in 2016 and 2018 in the Budget month, while they were net buyers of over Rs 10,000 crore in 2017. In 2015, they poured nearly Rs 9,000 crore; and in 2014, when the Modi government came to power, they had invested over Rs 9,000 crore.

If we analyse the data for the month following the Budget month, FPIs were mostly net buyers. In fact, they were net buyers in August 2014 of about Rs 6,400 crore, followed by March 2015 when they poured in Rs 8,717 crore, and in March 2016, FPIs were net buyers to the tune of Rs 23,000 crore.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.