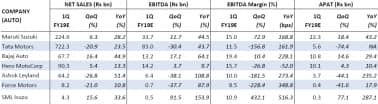

Automobiles sector will report a stellar quarter in Q1 led by strong recovery in rural demand, government spending on infrastructure, new launches and low base (led by BSIV and GST transitions). Most OEMs are likely to report high double-digit revenue growth, with Ashok Leyland (+51 percent YoY) Bajaj Auto (+45 percent) and Maruti Suzuki (+28 percent) being the stand out performers.

Excluding Tata Motors, auto OEM universe is expected to post 30 percent revenue and 43 percent YoY EBITDA growth. Even auto ancillaries would also mirror this strong revenue performance(+28 percent YoY).

During the quarter PVs/2Ws segment posted 16/15 percent YoY volume growth driven by healthy rural sales momentum. CV volume jumped 50 percent YoY on low base driven by pick-up in construction/mining activities and cyclical recovery in LCVs.

EBITDA margin for our auto OEM universe (ex-Tata Motors) expected to expand 146bps YoY to 15 percent. RM cost inflation was offset through price increase and strong volume growth. On RM front, increase in CR Steel sheet (+7 percent QoQ in rupee term) and Aluminum (6 percent QoQ) was offset by fall in Lead (-3 percent QoQ) and rubber prices (-3 percent QoQ).

In the PV segment, healthy volume growth coupled with favorable mix will lead to 44 percent YoY EBITDA growth for Maruti Suzuki.

In two-wheeler space, Bajaj Auto will report a 64 percent YoY improvement in EBITDA led by 38 percent YoY increase in volumes while Hero MotoCorp, likely to see 50 bps YoY contraction in in EBITDA margin due to input cost pressures.

In CV segment, Ashok Leyland is likely to report strong EBITDA growth (+109 percent YoY) led by operating leverage benefit and better tonnage mix (M&HCV volumes up 54 percent YoY). Tata Motors is likely to report 157bps margin contraction sequentially owing to lower scale in JLR and commodity inflation. We expect JLR EBITDA margin contract 214bps QoQ to 10 percent while standalone margin to improve by 122bps to 8 percent.

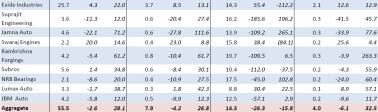

Most auto ancillary companies are expected to show strong numbers led by sturdy industry volume growth and ability pass on the impact of higher RM costs. In our auto ancillary companies’ coverage, we expect significant growth in net profit of Ramkrishna Forgings (+263 percent YoY), Jamna Auto (78 percent YoY), NRB Bearings (+60 percent YoY), Lumax Autotech (+57 percent YoY) and Subros (+52 percent YoY).

FY18 domestic tractor industry has delivered a volume growth of 22 percent to 711k units. The strong growth had been led by government's subsidy support and normal monsoons. For FY19, we estimate the domestic industry volumes to grow at 8 percent in line with historic/long term average. Nevertheless, government support owing to elections and good monsoons may act as catalyst. Swaraj Engines, a pure play tractor engine supplier is our top pick (upside of 31percent).

Outlook

Demand outlook for FY19 is positive across segments, driven by healthy rural sales momentum, expectation of normal monsoon for the third year in a row, and a pick-up in economic activities. Key threats to demand are posed by inflationary fuel prices and higher interest rates.

Our top picks are Ashok Leyland, Bajaj Auto and Hero MotoCorp among the large caps, and Lumax Auto, JBM Auto and Jamna Auto among the mid/small caps space. We continue to like Maruti Suzuki's unique moats, although valuation leaves little room for an upside.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!