The record rally in the market continued this week as well. The Nifty50 closed above 13,700 levels while the S&P BSE Sensex had a touch-and-go-moment with 47,000.

The S&P BSE Sensex rallied 861 points or 1.87 percent while the Nifty50 was up 1.83 percent for the week ended December 18 compared to 1.6 percent gain seen in the S&P BSE Midcap index and 1.2 percent rise in the BSE Smallcap index in the same period.

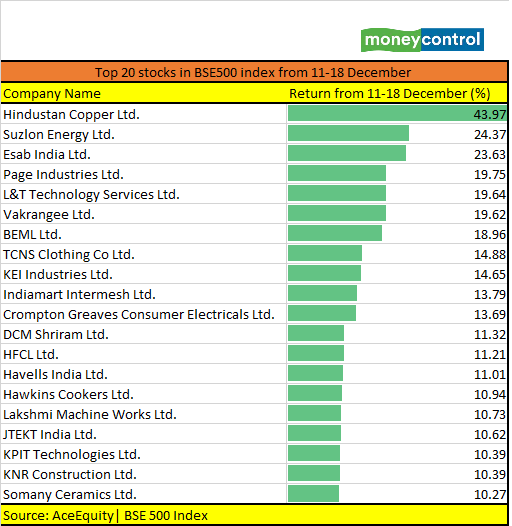

Even though the broader market underperformed, there was plenty of action seen in individual stocks. There are about 20 stocks in the BSE500 index that rose 10-40 percent in just 5 trading sessions.

Stocks that registered double-digit returns include names like Somany Ceramics, KNR Construction, Hawkins Cookers, Havells India, KEI Industries, and Hindustan Copper.

Tracking gains in global markets, news on the vaccine front, fall in COVID cases in India, US Fed’s dovish stance, strong domestic macro cues, and flow of liquidity helped bulls to push benchmark indices into unchartered territory for yet another week.

During the week, the domestic indices have been following the global peers on expectations of US stimulus measures and developments in Brexit talks.

“The market was inching to fresh highs, each day, supported by improvement in Indian industrial data and US Federal Open Market Committee’s reaffirmation to continue its support through stimulus measures until the economy reaches maximum employment and the inflation target,” Vinod Nair, Head of Research at Geojit Financial Services told Moneycontrol.

“Fed’s decision to keep rates unchanged will help FII’s to maintain a positive view on emerging markets like India. Although small and mid-cap stocks had outperformed the benchmark indices, a reverse trend was witnessed by the end of the week,” he said.

The coming week will be a truncated one as the market will remain shut on Friday, 25 December on account of Christmas.

The decision on the US stimulus package and Brexit deal will be eyed. RBI will be releasing deposit and borrowing data of the Indian banking system for the month of November.

Technical Outlook:The Nifty50 managed to close above the 13700 levels in the week gone by despite some profit taking which is a positive sign. The index closed flat on Friday with a positive bias at 13760, but for the week it is up 1.83 percent.

It was the seventh consecutive week when the market managed to close above the closing of the previous thanks to robust inflows from FIIs in the Indian markets. FIIs have bought nearly Rs 36,000 crores in the current month.

Technically, the index still maintains higher bottom series which is broadly positive for the market. However, for bulls to remain in control, Nifty50 has to hold on t 13650.

“For the next few trading session, 13650 should be the sacrosanct level for the trend following traders. Above the same, we can expect uptrend continuation wave up to 139935-14000,” Shrikant Chouhan, Executive Vice President, Equity Technical Research at Kotak Securities told Moneycontrol.

“On the flip side, dismissal of 13650 could possibly trigger one quick correction leg till 13500. The larger texture of the market is still into the bullish side, so any short term corrections should be used to add quality IT, Pharma and FMCG stocks with the medium-term time horizon,” he said.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.