Analysts have made a U turn on their view of Sun Pharmaceutical Industries in the past month, with brokerages downgrading the stock amid rising concerns over near-term earnings moderation. Consequently, Sun Pharma found itself topping the list of stocks that witnessed the maximum ratings downgrades during May.

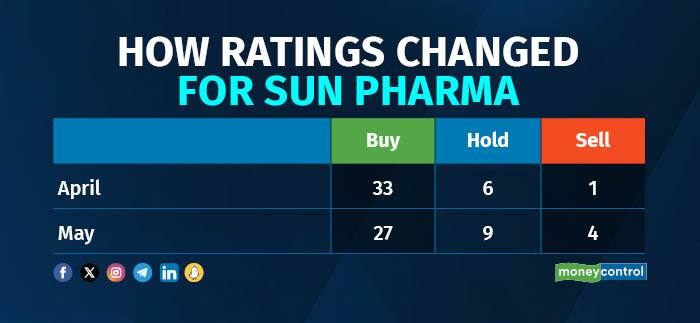

As per Moneycontrol's Analyst Call Tracker, the 'buy' call for the pharma stock slumped to 27 in May as compared to 33 in the month prior. In contrast, the 'hold' ratings rose to nine from the previous six and 'sell' recommendations spiked to four from just one in April.

The primary drivers behind these downgrades were concerns around earnings moderation following Sun Pharma's robust performance in FY24, which now sets a higher base for FY25. Aside from that, a spike in research and development (R&D) spends and guidance for high-single-digit revenue for FY25, further weighed on the sentiment.

R&D spends to riseThe drugmaker raised its R&D spend target for FY25 to around 8-10 percent of its total sales, higher than the near 7 percent spent in FY24. This increased investment, primarily directed towards expanding its high-margin specialty portfolio, is expected to impact the drugmaker's growth and margin profile over the upcoming years, according to Choice Broking, which maintains a 'sell' rating on Sun Pharma.

"Given that the company is in an investment phase, expenses are likely to remain elevated to ramp up specialty business," Prabhudas Lilladher also noted.

Additionally, Sun Pharma anticipates a slight increase in its tax rate in FY25 from the current 12 percent, further dampening earnings growth prospects, as per brokerages.

Even though Incred Equities remains optimistic over the prospects of Sun Pharma's specialty portfolio and margins in the medium term, the brokerage also believes that FY25 can be a moderate year for earnings. On that account, Incred downgraded the stock to 'hold' from its earlier 'add' call.

Sun Pharma outperformed the Indian pharma market in FY24, however, looking ahead, the company anticipates its growth trajectory to either align with or surpass the uptick expected in domestic pharma sales.

A faster pace of growth anticipated in the IPM along with higher expenses in hand for Sun Pharma are seen as factors behind the company's rather tepid growth guidance.

In addition, the projected moderation in revenue contribution from the blockbuster cancer drug Revlimid in FY25 poses another constraint on earnings growth.

Also Read | Analyst call tracker: Sun Pharma among analysts’ top picks on speciality, domestic sales boostDisclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.