Shares of Kotak Mahindra Bank have surged 13 percent in the last 25 trading sessions—outpacing its cumulative gains over the past four years. This rally follows multiple brokerage upgrades and revised target prices, spurred by the bank’s stronger-than-expected third-quarter performance compared to other private lenders. Additionally, the Reserve Bank of India (RBI) lifting curbs on its digital banking operations has set the stage for further growth.

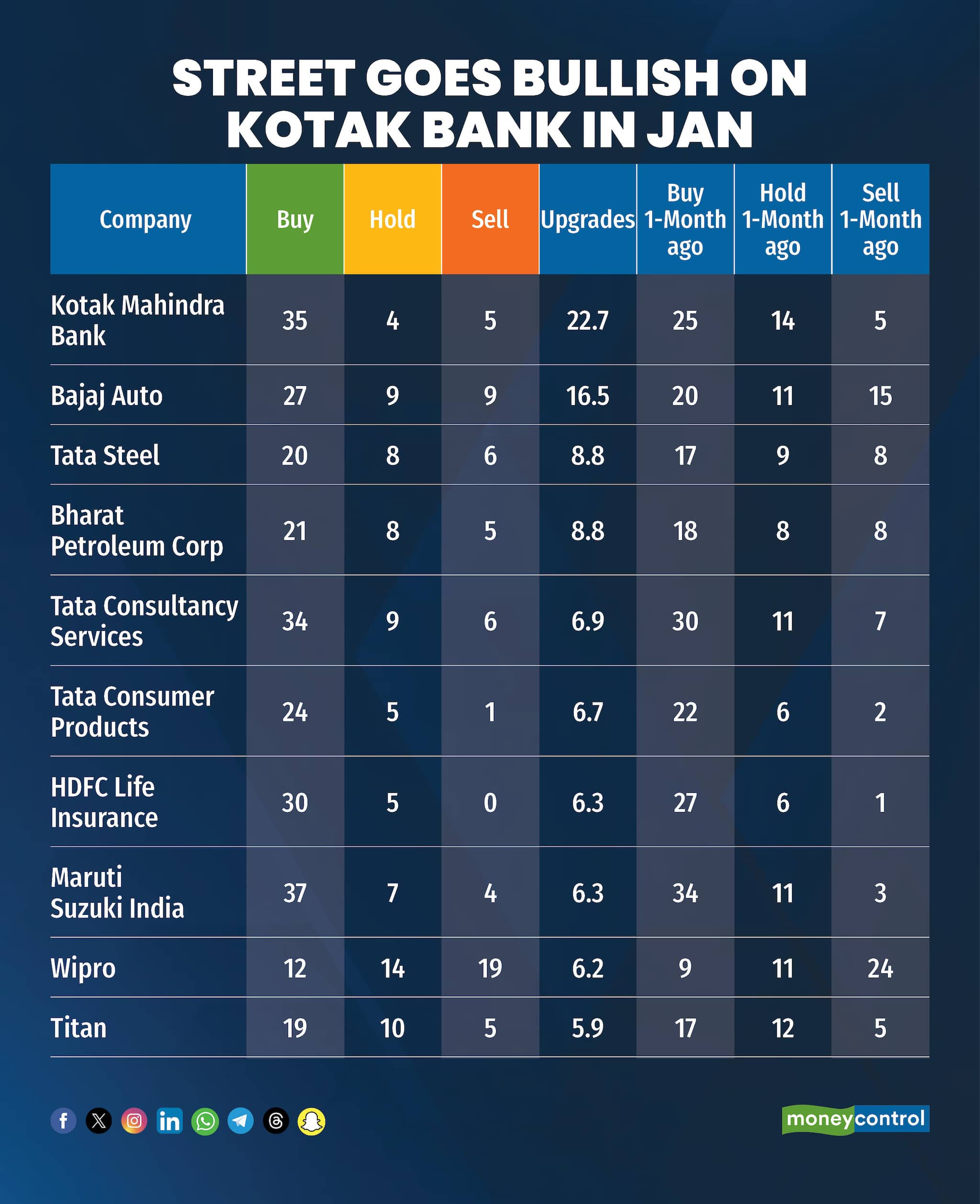

According to Moneycontrol's analyst call tracker for January, Kotak Mahindra Bank emerged as the Street’s favorite pick. The counter received 35 "buy" calls, up from 25 the previous month, while "hold" ratings dropped from 14 to 4, and "sell" ratings stood at 5.

Kotak Mahindra Bank delivered a stellar third-quarter performance, surpassing Street estimates with robust loan growth and solid asset quality. This achievement came despite the RBI’s restrictions on its digital banking operations since April last year.

The private lender’s deposit growth was on par with HDFC Bank at 16 percent, while its margins, the highest among peers at 4.87 percent, underscored superior profitability and operational efficiency.

Domestic brokerage Nuvama Institutional Equities remarked, "Kotak Mahindra Bank’s earnings offer both growth and quality, positioning it among the sector’s best. A marginal uptick in net interest margin (NIM), healthy loan growth, strong deposit growth, and a quarter-on-quarter decline in slippage with a higher provision coverage ratio (PCR) are key positives."

Reflecting this confidence, Nuvama issued a double upgrade, shifting its rating from "sell" to "buy," with a fresh target price of Rs 2,040 per share. DAM Capital also raised its rating from "neutral" to "buy," setting a target price of Rs 2,020 per share. Similarly, Jefferies revised its target price upward to Rs 2,200 from Rs 2,120 per share.

RBI lifts digital embargo: a fresh catalyst?Following a strong Q3 performance, Kotak Mahindra Bank received a further boost as the RBI lifted restrictions on digital customer onboarding and credit card issuance. Brokerages now see no major overhang preventing the stock from reversing its underperformance.

Morgan Stanley reiterated its "overweight" rating and issued the highest target price of Rs 2,290 per share, citing the lifted restrictions as a key factor enabling Kotak to manage margins more effectively than its peers.

HSBC also welcomed the move, emphasizing its impact on strengthening the bank’s customer franchise and boosting earnings potential. "This development will allow the bank to resume digital customer acquisition, eliminating the need for an extensive physical distribution network," HSBC noted. The brokerage maintained its "buy" rating and increased its target price from Rs 2,100 to Rs 2,210 per share.

The lender’s credit card volumes had declined 2 percent quarter-on-quarter (QoQ) to Rs 14,117 crore. However, brokerages believe the RBI’s decision will spur new acquisitions, strengthen volumes, and support margin expansion.

Historically, Kotak Mahindra Bank has seen single-digit annual returns in either direction since 2020. It gained 18.5 percent that year but fell 10 percent in 2021, edged up 1.8 percent in 2022, rose 4.4 percent in 2023, and declined 6.4 percent last year.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.