The broader indices erased previous week gains, underperforming the main indices with a loss between 0.7-2.5 percent in the volatile week amid mixed India corporate earnings, uncertainties over US-India, continued outflow of FII, above average rainfall, and the UK-India trade deal.

BSE Mid and Smallcap indices erased the previous week's gains, falling 1.7 percent and 2.5 percent, respectively, while the BSE Largecap index extended the fall in its fourth consecutive week as it ended lower by 0.7 percent.

For the week, the BSE Sensex index fell 294.64 points or 0.36 percent to finish at 81463.09, and Nifty50 declined 131.4 points or 0.52 percent to close at 24837. However, in this month till now Sensex and Nifty shed 2.5 percent each.

The Foreign Institutional Investors (FIIs) remained net sellers throughout the week, while Domestic Institutional Investors (DII) compensated with buying the equities. FIIs extended their selling in fourth week, as they sold equities worth Rs 13,552.91 crore, however, DII bought equities worth Rs 17,932.45 crore, extending buying in 14th week.

In this month till now, FII sold equities worth Rs 30,508.66 crore, while DII bought equities worth Rs 39,825.97crore.

On the sectoral, Nifty Media index shed 5.7 percent, Nifty Realty index declined nearly 5 percent, Nifty IT index plunged 4 percent, Nifty oil & gas and FMCG shed 3.5 percent each. However, Nifty Bank, Pharma and Private Bank indices ended with marginal gains.

"The Indian equity market ended lower for the fourth consecutive week, as weak Q1 earnings and cautious global sentiment weighed on investor confidence. The Nifty 50 breached the key level of 24,900, along with the significant FII’s net short positions reflect broad-based selling pressure," said Vinod Nair, Head of Research, Geojit Investments.

"Mid- & small-cap indices saw steeper corrections, underperforming the benchmark. The sectoral laggards, including IT and financials, were adversely impacted by subdued guidance and emerging concerns around asset quality. Subpar aggregate earnings performance is likely to challenge the sustainability of current premium valuations across benchmark indices, and we expect a consolidation in the near term."

"The finalization of the US-Japan and India-UK trade agreements marks a key step in easing global trade barriers. A resolution of the US–India mini trade deal by 1 August could further allay investor concerns. Domestically, the expectation for further rate cuts is also rising on the back of a benign inflationary trend, which will stimulate growth."

"The ECB has paused monetary policy easing cycles amid concerns over global inflationary pressures from potential tariff implementations. Going forward, the market will be keeping a close eye on key US data such as GDP and jobs data next week, which will influence the Fed's interest rate decision, with the market expecting the Fed to maintain the status quo," Nair added further.

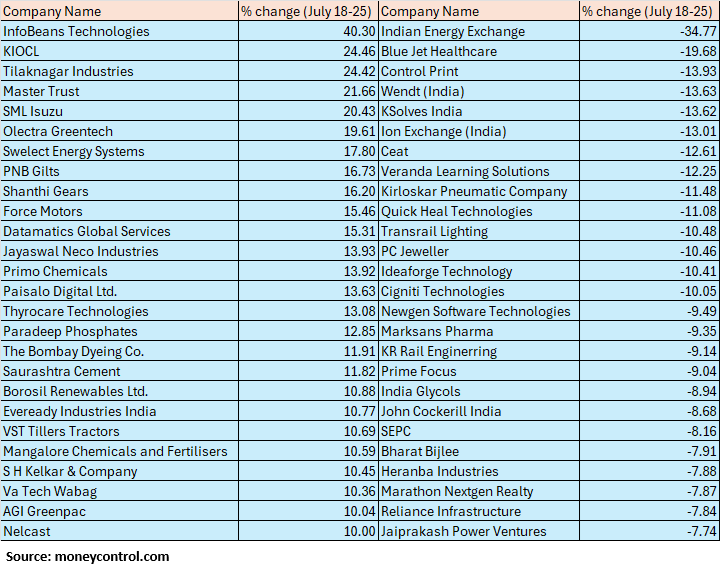

The BSE Small-cap index plunged 2.5 percent with Indian Energy Exchange, Blue Jet Healthcare, Control Print, Wendt (India), KSolves India, Ion Exchange (India), Ceat, Veranda Learning Solutions, Kirloskar Pneumatic Company, Quick Heal Technologies, Transrail Lighting, PC Jeweller, Ideaforge Technology, Cigniti Technologies falling between 10-34 percent.

On the other hand, InfoBeans Technologies, KIOCL, Tilaknagar Industries, Master Trust, SML Isuzu added between 20-40 percent.

We expect market to remain in consolidation mode amid continued uncertainty around India-US trade deal, a mixed Q1FY26 earnings season so far and intensifying FII outflows. Key results over the weekend include Kotak Mahindra bank, Macrotech Developers, CDSL amongst others.

Rupak De, Senior Technical Analyst at LKP SecuritiesNifty remained under sustained selling pressure as the index slipped below the crucial support level of 24,900. Moreover, it has closed below the 50-day Exponential Moving Average (50EMA) for the first time in several sessions, signaling a meaningful weakening of the ongoing trend.

Additionally, the index has now fallen back into the zone of the previous swing high on the daily timeframe, which further highlights a potential trend reversal. The current setup appears notably weak and suggests the possibility of a deeper correction.

If the Nifty fails to reclaim levels above 24,900 in the next session or two, bulls could face significant short-term challenges. On the downside, immediate support is seen at 24,700, followed by 24,500. On the upside, resistance is now placed around 25,000.

Shrikant Chouhan, Head Equity Research, Kotak SecuritiesThe equity markets in India and globally focused on earnings and management commentary during the Q1FY26 earnings season. While aggregate earnings were broadly in line with estimates, the muted outlook provided by a number of companies across sectors dented the market mood. Crude oil price remains range-bound and continues to provide comfort.

Further, a good monsoon so far and low inflation numbers are further positive for India. However, uncertainty with trade tariffs continues to impact global and domestic equity market sentiments. Over the next couple of weeks, stock-specific action will continue, led by the Q1FY26 result outcome and management commentary.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.