2020 has been an exceptional year, with a new set of challenges and learnings. Amid the COVID-19 pandemic, US presidential elections, India-China skirmishes, sharp GDP cuts and the pursuant upgrades— global capital markets have gyrated from down-circuits to record highs.

The only constant in 2020 has been the volatility in markets and one of the key learnings of 2020 has been the importance of portfolio diversification.

Innovative investment options like Alternate Investment Funds (AIF), Municipal Bonds, Real Estate Investment Trusts (REITs), and Infrastructure Investment Trusts (InvITs) have emerged as compelling investment alternatives for today’s uncertain times beset with high volatility given their steady yields and favourable risk-reward.

Portfolio diversification is a strategy that has held wise investors in good stead in uncertain times, by not putting all eggs in one basket—be it pure debt, pure equity, gold or other risky assets.

Diversification is important not only from a risk perspective but also from a return and growth perspective. In a scenario where fixed deposit and savings deposit rates have plummeted to 4-6 percent, investors need to look away from conventional portfolio to alternatives like InvITs, REITs (expected yield 7-11 percent) to consistently beat inflation and grow their portfolio.

InvITs having annuity-like business models have managed to weather the market uncertainty better. InvITs are designed to mitigate the under-construction risks in the infrastructure sector (at least 80 percent investment in operational projects) and provide steady predictable cash flows as 90 percent of the net distributable cash flows gets distributed to the investors.

In addition to the stable cash flows, such platforms also provide an opportunity to grow by adding more operating projects and increase the yield.

These InvITs are listed on stock exchanges in India (minimum investment Rs 1 lakh) and thereby provide flexibility to sell these units without any lock-in unlike traditional stable products like fixed deposits or close-ended funds. Hence, InvITs while no different from its pure-play corporate peers, stand out due to:

1. Limited execution risk: 80 percent of the investment has to be in operational, revenue-generating projects 2. Stronger corporate governance framework: 50 percent of the Board to be independent, assets to be held by an independent trustee, etc. 3. Tighter regulations on leverage: Unitholders approval and AAA credit rating necessary to increase leverage beyond 25 percent 4. Better protection of minority rights: Unitholders approval required on matters related to sponsor change, change in investment strategy, material related party transactions, etc. 5. Steady risk-adjusted returns: At least 90 percent of the net distributable cash flow to be distributed to unitholders

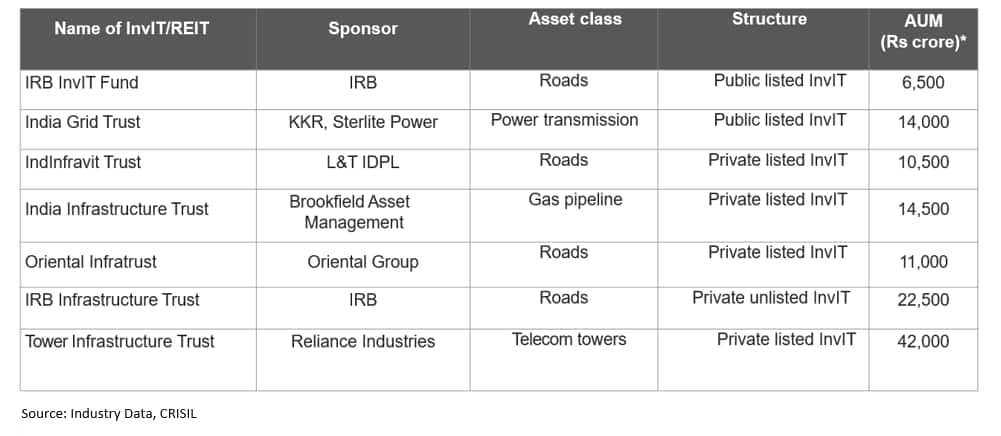

1. Limited execution risk: 80 percent of the investment has to be in operational, revenue-generating projects 2. Stronger corporate governance framework: 50 percent of the Board to be independent, assets to be held by an independent trustee, etc. 3. Tighter regulations on leverage: Unitholders approval and AAA credit rating necessary to increase leverage beyond 25 percent 4. Better protection of minority rights: Unitholders approval required on matters related to sponsor change, change in investment strategy, material related party transactions, etc. 5. Steady risk-adjusted returns: At least 90 percent of the net distributable cash flow to be distributed to unitholders  Although one can say that InvITs have taken off better than expectations, there is still a significant market upside for Indian InvITs, as they form just 0.7 percent of the market cap/GDP ratio as compared to 20 percent in Singapore and 7 percent in HK. Global rating agency CRISIL believes that InvITs-REITs have enormous potential of around Rs 8 lakh crore in India over the next 4-6 years. Experts see InvITs as the preferred route of infrastructure investment for long-term investors going forward, given the stable regulations but say that a supportive taxation regime and a conducive macro environment will be required to support investors' appetite. While there are several InvITs (Power Grid, NHAI, Tata Power, etc) already in the pipeline, the future trajectory of InvITs in India would depend on the underlying quality of management and business, accessibility to investors and stability of the policy framework. (The author is a CEO, IndiGrid Trust)

Although one can say that InvITs have taken off better than expectations, there is still a significant market upside for Indian InvITs, as they form just 0.7 percent of the market cap/GDP ratio as compared to 20 percent in Singapore and 7 percent in HK. Global rating agency CRISIL believes that InvITs-REITs have enormous potential of around Rs 8 lakh crore in India over the next 4-6 years. Experts see InvITs as the preferred route of infrastructure investment for long-term investors going forward, given the stable regulations but say that a supportive taxation regime and a conducive macro environment will be required to support investors' appetite. While there are several InvITs (Power Grid, NHAI, Tata Power, etc) already in the pipeline, the future trajectory of InvITs in India would depend on the underlying quality of management and business, accessibility to investors and stability of the policy framework. (The author is a CEO, IndiGrid Trust)Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.