Jitendra Kumar Gupta Moneycontrol Research

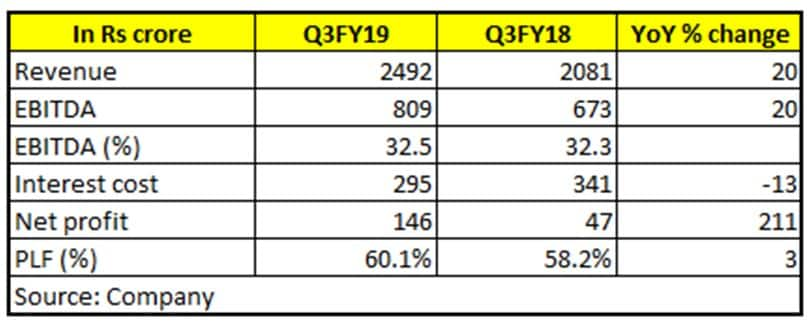

Despite cost pressures, JSW Energy continues to benefit from higher capacity utilisation and an improving revenue mix. During the quarter that ended on December 2018, the company reported a near three fold jump in net profit on a revenue growth of 20 percent to Rs 2492 crore.

Key positives

While it is getting more and more of its capacity tied to the long term power purchase agreements, a large part of this is still exposed to the merchant power rates or the spot market rates. During the quarter, it sold close to 1112 million units of power in the spot market or merchant sales taking the benefit of higher merchant power price, which were up by 21 percent on a year on year basis to Rs 4.28 per unit.

Moreover, during the quarter, it achieved 60.1 percent plant load factor (PLF) on a consolidated basis as against 58.2 percent in the corresponding quarter last year. These higher realisations and better volumes led to higher revenues.

Key negatives

Because of the non-integrated operations, JSW Energy has to depend on imported fuel, primarily thermal coal. International coal prices have spiked. Particularly in light of a depreciating rupee, the landed cost of coal is much higher. This led JSW Energy to witness close to a 24 percent increase in its fuel bill to Rs 1447 crore. This is precisely the reason that despite good traction in its volumes and realisations, the company’s EBITDA growth settled at about 20 percent during the quarter.

Key observations

Thankfully, the company has been constantly reducing its dependence on borrowed funds, with the net debt to equity now reaching to 0.90 times post the repayment of close to Rs 296 crore of debt during the quarter. This is one of the lowest debt to equity ratio in the industry. As a result of reduction in the debt, the company was also able to bring down its finance cost by Rs 45 crore to 295 crore. The savings during the quarter fuelled its profitability leading to near three fold jump in net profits to Rs 146 crore as against Rs 47 crore of profits in the quarter last year.

Outlook

Of late, over the last few months, the power demand has recovered and the market dynamics have become more favourable with the consolidation of generation capacities. During the quarter that ended on December 2018, the all India power demand grew at a healthy 6.8 percent. This is good for companies like JSW Energy, which is sitting on surplus capacity. And with high merchant power tariffs, there is even more incentive to produce power as well as ability to absorb cost of fuel inflation. At Rs 68 a share, the stock is currently trading at 14 times its FY19 estimated earnings, which is quite reasonable in the light of cash on its books, moderate financial leverage and strong expected earnings growth.

For more Research articles, visit our Moneycontrol Research Page.

(Disclaimer: Moneycontrol Research analysts do not hold positions in the companies discussed here)Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.