Reliance Industries Ltd (RIL) chairman and managing director Mukesh Ambani says that Jio Financial Services (JFS) will prove to be an invaluable addition to the Reliance ecosystem of customer-facing businesses – like Jio Telecom and Reliance Retail.

Ambani was speaking at the company’s Annual General Meeting (AGM) on August 28. He said that JFS will consolidate its payments infrastructure for both consumers and merchants, and also explore path-breaking features, such as blockchain-based platforms and the central bank digital currency (CBDC).

“The digital-first architecture of JFS will give it an unmatched head-start to reach millions of Indians. This is a highly capital-intensive business and has provided JFS with a strong capital foundation to build a best-in-class, trusted financial services enterprise and achieve rapid growth,” Ambani said.

With a net worth of Rs 1,20,000 crore, the company is one of the world’s highest capitalised financial service platforms at inception, he said.

Even though the JFS stock dropped 5 percent during the first four consecutive trading days after listing as an independent entity on August 21, the downside risks are limited as JFS derives a lot of its value from the 6.1 percent stake it holds in RIL.

At a listing valuation of Rs 1.66 lakh crore, it is the third-largest non-banking financial company (NBFC) in the country, after the Bajaj twins (Bajaj Finance and Bajaj Finserv), and even bigger than mid-size banks such as IndusInd Bank.

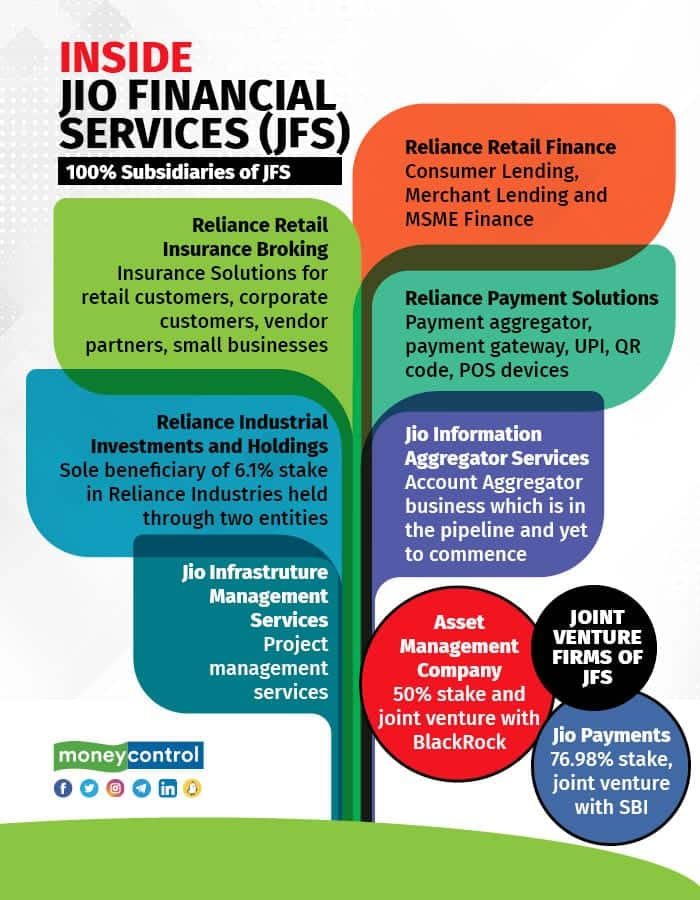

According to a Morgan Stanley report on JFS’ business plan, the company is expected to compete with fintech startups in areas like payment gateways, UPI payments, Point of Sale (PoS) devices, consumer durable lending, insurance broking, payments banking and investment products. Each of these segments has independently created fintechs valued at multi-billion dollars in the private market.

JFS’s ambition in the wide gamut of financial services does seem like a serious threat, given the heft and deep pockets the group has, along with RIL’s ability to execute new businesses at scale, like it did in the retail and telecom sectors.

Fintechs have adopted a wait-and-watch approach towards new entrants as they feel that JFS opens new doors for them even as competition is likely to intensify. While little is known about JFS’ existing revenue, its potential is not in question.

JFS is likely to leverage Reliance Group’s long tentacles in the retail and telecommunication space to enter the financial services, including consumer lending, merchant lending for its various suppliers and vendors as well as other products such as investments and insurance.

According to analysts, it is primarily going to target consumers with credit options at checkout counters at its offline and online stores. Reliance Retail reported a turnover of Rs 2,60,364 crore for financial year 2022-23. Even offering 20 percent of this on credit could create a Rs 50,000-crore loan book.

This segment is currently dominated by Bajaj Finance and credit card EMI offers from banks facilitated through PoS devices. JFS will not be restricted only to group outlets, but will be available at other large retail chains as well, if it offers competitive rates. This is one of the reasons why the Bajaj Finance stock has been under pressure despite robust earnings results.

“JFS’ businesses will likely leverage the strengths of the group – technology-first approach underpinned by group tech capabilities, Jio’s reach, relationships with vendors and individual customers. Among others, it will focus on tapping borrowers who access high-interest informal channels,” says a report by Kotak Institutional Equities.

According to the report, the merchant lending business will likely leverage the ecosystem of Reliance Retail and Jio Mart. “The focus seems to be funding kirana stores that have limited access to low-cost bank loans, ” the report adds.

“The group will use its strength to build businesses that scale well and use economies of scale to provide better value to customers than their competitors,” says a senior executive at a fintech company that could compete with JFS in the medium term.

Investment, insurance and digital lendingEvolved financial services products, such as investments (equity or mutual funds) and insurance, are probably going to be tougher markets for JFS to crack as most customers with high disposable incomes already have logged on to several platforms servicing their needs.

The senior executive feels that JFS will have to create a new market for expanding its business in these products.

JFS had partnered with US-based investment management firm BlackRock to provide investment services, such as mutual funds -- apparently, a digital-first offering to provide affordable investment solutions to all segments of society.

“We have seen the speed of change and the unique combination of talent, innovation, and digital infrastructure transforming entire industries in India, and we see enormous potential for growth in the country’s asset management industry,” says Larry Fink, CEO of Blackrock.

According to Fink, the convergence of rising affluence, favourable demographics, and digital transformation across industries is reshaping the market. He adds that the growing financialisation and a shift from unmanaged and physical assets to savings and investment will accelerate as India’s per- capita GDP increases.

Along with insurance broking services, these are areas where fintechs have created a large enough market among the urban audiences with high disposable incomes.

“Most active traders and investors would want to stick with differentiated platforms and JFS would likely target passive investors from smaller towns,” says the cofounder of a digital stock broking firm.

However, small-ticket consumer loans and personal loans could be distributed through Jio’s telecom customers and this could threaten the advantage Paytm and PhonePe is likely to have. Paytm disburses around Rs 15,000 crore worth of credit every quarter through its lending marketplace.

“While the jury on fintech is out, traditionally, NBFC lending to less-banked businesses have leveraged strong collection infrastructure over appraisal. NBFCs have typically followed collection-based models in such (less-banked) segments. As such, while JFS may have a head-start in origination, the company will need to get collection mechanisms in place, if it wants to grow beyond the fintech marketplace,” says Kotak in its report.

JFS will enter the insurance segment, potentially in partnership with global players to offer simple products in life, general, and health insurance products, Ambani said in his AGM speech.

“Through a seamless digital interface, it will use predictive data analytics to co-create contextual products with partners and cater to customer requirements,” he added, giving an idea about the company’s wide-ranging ambitions in the space. However, it is not clear how differentiated the platforms and products will be.

Jio Financial ServicesValidation of fintech market

Jio Financial ServicesValidation of fintech marketMost startups hope that JFS, being a separate entity with large cash reserves, proves the potential that the country’s largest business house sees in the fintech space.

“Given how India has led the world with financial infrastructure, it is only a natural progression, now the rails are in place, and it is time to scale up. I am sure more big industrial houses will follow. This will also create more exit opportunities for venture capital-backed startups in the near future,” says Nischay Ag, founder of Jar, an investment platform.

The existing large fintech players could also seek funding support from venture capital and private equity to take on the competition from JFS. It is also expected to fast-track consumer adoption in Tier 2 and 3 towns as large and trustworthy brands could enhance the profile of such products, adds Nischay.

“Whenever Reliance enters a space, they will ensure they make it big and attract the entire spectrum of demographics to consume their products. The lending landscape will become even more competitive, and with Jio's reach throughout the length and breadth of the country, distribution and collection is expected to be quite deep. This will pave the way for a lot more action in the fintech landscape,” says a co-founder with a fintech startup.

Credit solutions at competitive rates can be a strong areaJFS is likely to succeed in consumption-based credit in the beginning. After all, Reliance Retail recorded over 25 crore customers and 78 crore footfalls in the last fiscal.

The group also has over 18,000 retail outlets as well as several e-commerce channels, including JioMart, Urban Ladder, Zivame, Ajio, and Reliance Digital. For its payment gateway and PoS business, it could see group companies moving to JFS platforms. And during checkout, it could easily offer credit solutions at competitive rates.

Jio Telecom, with over 44 crore customers, has the potential to help JFS make huge strides in mobile payments. But success won’t be easy, feel fintech executives. Tata Group’s attempt at ecommerce and payments through Tata Neu has not seen much success. Reliance itself has seen mixed results with its digital endeavours and has proved to be a tough market to crack in the short term.

“They will get the best talent and buy the best technology to execute well enough. The deep pockets mean that they are in for the long haul,” says the senior executive quoted above.

Disclosure: Moneycontrol is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.