Bakery products manufacturer Mrs Bectors Food Specialties will open its initial public offering during December 15-17 period.

This is the fifteenth IPO in 2020 after SBI Card, Rossari Biotech, Mindspace Business Parks REIT, Route Mobile, Happiest Minds Technologies, Chemcon Speciality Chemicals, Angel Broking, UTI AMC, Mazagon Dock Shipbuilders, Likhitha Infrastructure, Computer Age Management Services, Equitas Small Finance Bank, Gland Pharma and Burger King India.

The anchor book will open for subscription for a day on December 14.

SBI Capital Markets, ICICI Securities and IIFL Securities are acting as the book running lead managers to the offer. Equity shares are proposed to be listed on BSE and NSE.

Here are 10 key things you should know about the company and the issue:

1) About IPO

The bakery products maker plans to raise Rs 540.54 crore via its public issue. The IPO consists of a fresh issue of Rs 40.54 crore and an offer for sale of Rs 500 crore by selling shareholders.

Linus Private Limited will sell equity shares worth Rs 245 crore via offer for sale, Mabel Private Limited - Rs 38.5 crore, GW Crown PTE Ltd - Rs 186 crore and GW Confectionary PTE Ltd - Rs 30.5 crore.

The offer includes a reservation of Rs 50 lakh worth of shares for eligible employees. Employees will receive shares at a discount of Rs 15 per share.

Investors can bid for a minimum lot of 50 equity shares and in multiples of 50 thereafter.

2) Price Band

The company, in consultation with merchant bankers, has fixed a price band of Rs 286-288 per share for its public issue.

3) Objectives of the Issue

Mrs Bectors Food Specialties will utilise funds from the fresh issue for expansion of the Rajpura manufacturing facility by establishing a new production line for biscuits.

However, the company will not receive any proceeds from the offer for sale. Exiting shareholders will receive the proceeds from the offer for sale.

4) Company Profile

Mrs Bectors Food Specialties is one of the leading companies in the premium and mid-premium biscuits segment and the premium bakery segment in North India, according to the Technopak Report. It manufactures and markets a range of biscuits such as cookies, creams, crackers, digestives and glucose - under flagship brand 'Mrs Bector's Cremica'.

The company also manufactures bakery products in savoury and sweet categories which include breads, buns, pizza base and cakes under brand 'English Oven'.

Mrs Bectors Food Specialties supplies bakery products to retail consumers in 26 states within India, as well as to reputed institutional customers with pan-India presence, and to 64 countries across six continents during FY20.

Mrs Bector's Cremica is one of the leading biscuit brands in the premium and mid-premium segment in Punjab, Himachal Pradesh, Jammu and Kashmir and Ladakh while its English Oven is the one of the largest selling brands in the premium bakery segment in Delhi NCR, Mumbai and Bengaluru.

It is also the largest supplier of buns in India to reputed QSR chains such as Burger King India, Connaught Plaza Restaurants, Hardcastle Restaurants, and Yum! Restaurants (India), the Technopak report says.

5) Company's Strengths

Mrs Bectors believes that it has following competitive strengths:

a) It is one of the leading brands in biscuits and bakery businesses in North India with an ability to establish brands;

b) A leading exporter of biscuits;

c) Established presence in retail and institutional bakery business;

d) It has modern and automated production processes with a focus on quality control;

e) It has widespread and established sales and distribution network;

f) It has experienced promoter and management team

6) Strategies

a) Focusing on growth in premium biscuits and bakery segment to improve margin;

b) Focus on product development in biscuits and bakery segments;

c) Expand product reach in India and globally;

d) Expansion of distribution network through diversification;

e) Focus on increasing brand awareness.

7) Financials

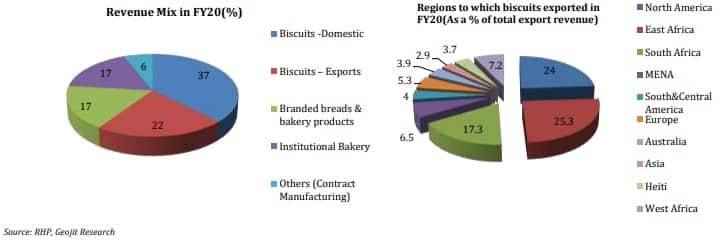

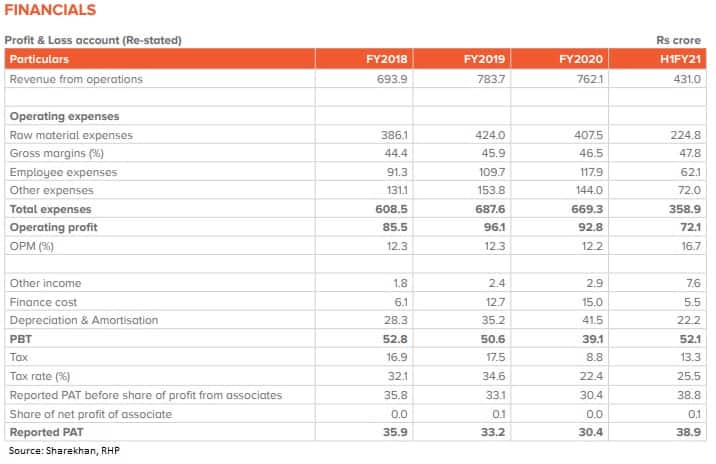

In the financial year FY18 to FY20, company registered a revenue growth at a CAGR of 5 percent, but profit declined at a CAGR of 8 percent in same period. However, its financial performance started improving in FY21 with profit at Rs 39 crore on revenue of Rs 431 crore in first half of FY21.

Company has maintained a high average gross margins of 44 percent for biscuits which is higher compared to peers owing to its in-house manufacturing and 51 percent for bakery segment, in the past three and half years.

Its diversified product portfolio can be classified under two key categories - biscuits and bakery products. The following table sets forth the performance of product segments in the last three financial years, April 1-September 30, 2020 and April 1-September 30, 2019:

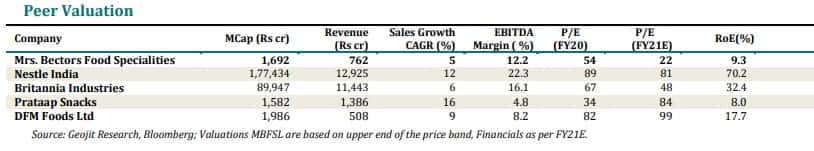

8) Peer Comparison and Market Share

The Indian biscuit market is dominated by lead brands like Britannia, Parle and ITC which has 65 percent market share.

9) Promoter and Shareholding

Anoop Bector is the promoter of the company. Promoter held an aggregate of 1,25,50,800 equity shares, comprising 21.89 percent of the pre-offer paid-up equity share capital, as of December 8, 2020. Promoter and the promoter group together held 52.40 percent stake in the company.

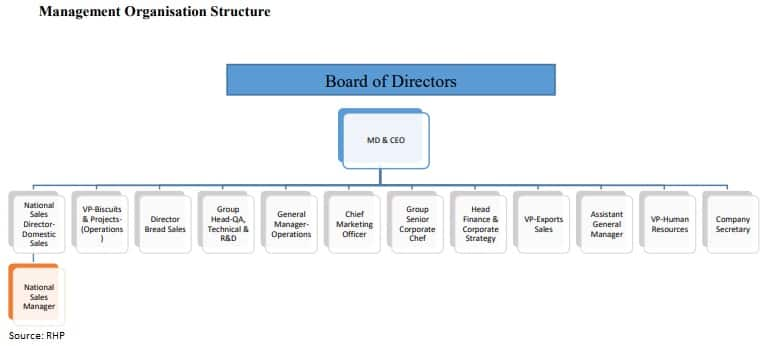

10) Management

Subhash Agarwal is the Chairman and Independent Director of the company. He is a practising advocate with an experience of 60 years. He has been a member of the District Taxation Bar Association, Ludhiana since 1995. He was appointed as the Chairman on board on July 10, 2018. He has been on our Board since February 10, 2017.

Anoop Bector is the Managing Director of the company. He has been on the board since the incorporation of company and has an experience of 25 years with the company.

Ishaan Bector and Parveen Kumar Goel are whole-time directors on the board, while Rajni Bector is the non-executive director, and Rahul Goswamy and Tarun Khanna are the non-executive nominee directors.

Nem Chand Jain, Rajiv Dewan and Pooja Luthra are independent directors on the board.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.