Kalyan Jewellers is scheduled to open its initial public offering for subscription on March 16.

Axis Capital, Citigroup Global Markets India, ICICI Securities and SBI Capital Markets are the global co-ordinators and book running lead managers, while BOB Capital Markets is the book running lead manager to the issue.

Here are 10 key things you should know about the public issue and the company:

1) IPO DatesThe bidding for the initial public offering (IPO) will begin on March 16 and the last for subscribing to the issue will be March 18. The anchor book, if any, will open for a day on March 15.

2) Price BandThe price band for its public issue was fixed at Rs 86-87 per equity share.

3) Public IssueThe Rs 1,175-crore IPO consists of a fresh issue of Rs 800 crore and an offer for sale of Rs 375 crore by existing shareholders.

Promoter, TS Kalyanaraman will sell shares worth Rs 125 crore, and investor, Highdell Investment will offload Rs 250 crore worth of shares via offer for sale. The company has reserved Rs 2 crore worth of shares for its employees.

Investors can bid for a minimum of 172 equity shares and in multiples of 172 equity shares thereafter. Hence, the minimum application size is Rs 14,964 at the higher end of the price band.

Half of the issue size has been reserved for qualified institutional buyers, 15 percent is for non-institutional investors and the rest 35 percent is for retail investors.

4) Objectives of the issueThe company plans to utilise the proceeds from the fresh issue for its working capital requirements and general corporate purposes.

5) Company ProfileKalyan Jewellers started its jewellery business in 1993 with a single showroom in Thrissur, Kerala. Since then, it has expanded to become a pan-India jewellery company with 107 showrooms across 21 states and union territories in India.

The company also has an international presence with 30 showrooms in the Middle East as of December 2020. All of its showrooms are operated and managed by the company itself.

Indian jewellery business contributed 78.19 percent to the company's revenues in FY20, and exports accounted for 21.81 percent. For the nine months ended December 2020, contribution of domestic business to revenue stood at 86.21 percent and exports at 13.79 percent.

The company also sells jewellery through its online platform candere.com.

6) Strengthsa) Kalyan Jewellers is an established brand.

b) It is one of India's largest jewellery companies (with a pan-India presence) on the basis of revenue for the year ended March 2020.

c) The company's hyperlocal strategy enabled it to cater to a wide range of geographies and customer segments.

d) Its grassroots 'My Kalyan' customer outreach network is a key element of its hyperlocal strategy enabling it to be a neighbourhood jeweller and is focused on marketing and customer engagement across urban, semi-urban and rural areas in India.

e) It has visionary promoters with strong leadership and a demonstrated track record supported by a highly experienced and accomplished senior management team and board of directors.

f) It has a wide range of product offerings targeted at diverse set of customers.

g) The company has established a robust set of operational and control processes to manage the business operations and to support the future growth at both the showroom and corporate level.

7) Strategiesa) Kalyan Jewellers intends to leverage its scalable business model to expand showroom network and diversify channels of distribution.

b) It intends to widen product offerings to further increase consumer reach.

c) It intends to leverage its 'My Kalyan' network to deepen customer outreach and strengthen the distribution network in core markets.

d) The company intends to continue to invest in customer relationship management (CRM), strategies, campaigns and technologies to analyse and manage customer interactions and related data throughout the customer lifecycle, with the goal of creating a long-term relationship with customers, building customer retention and driving sales.

8) FinancialsKalyan Jewellers reported a profit of Rs 142.27 crore for the year ended March 2020 against a loss of Rs 4.86 crore in the previous financial year; and a profit of Rs 141 crore in FY18.

Revenue in FY20 grew by 3.4 percent (year-on-year) to Rs 10,100.9 crore. In FY19, the revenue fell by 7.4 percent (year-on-year) to Rs 9,770.76 crore.

In the nine months period ended December 2020, the company posted a loss of Rs 79.95 crore against profit of Rs 94.3 crore in the corresponding period. In same period, revenue declined sharply by 30.7 percent to Rs 5,516.70 crore due to the COVID-19 impact.

As of December 2020, 72 out of its total 137 showrooms were located outside of South India.

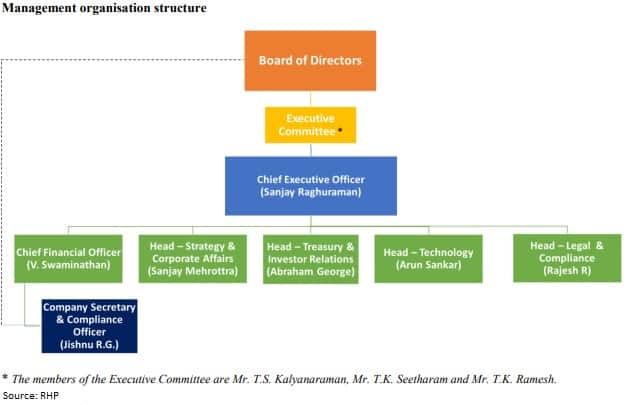

9) Promoters, Shareholding and ManagementFounder and promoter TS Kalyanaraman is the Chairman and Managing Director of the company. He has over 45 years of retail experience, of which over 25 years is in the jewellery industry.

Promoters and promoter group held 67.99 percent in the company as of March 9, 2021.

TK Seetharam and TK Ramesh are also promoters of the company and both currently are Whole-time Directors of the company.

Salil Nair is the Non-Executive Director on the board and Anish Kumar Saraf is the Non-Executive, Nominee Director.

Agnihotra Dakshina Murty Chavali, Mahalingam Ramaswamy, TS Anantharaman, Kishori Jayendra Udeshi and Anil Sadasivan Nair are Independent Directors.

Sanjay Raghuraman is the Chief Executive Officer of the company. He is a qualified cost and works accountant and a qualified chartered accountant. He has approximately 14 years of experience in retail financial services and operations. Prior to joining the company, he had worked in HDB Financial Services, Wipro and Clix Capital Services.

V Swaminathan is the Chief Financial Officer of the company. He has approximately 26 years of experience in finance and corporate planning and control. Prior to joining the company, he had worked with UltraTech Cement, Eaton Fluid Power, Carraro India and Reva Electric Car Company.

10) Allotment, Refunds and Listing DatesThe company and the shareholders participating in offer for sale, in consultation with merchant bankers, will finalise the share allotment around March 23. The refund of money (to anchor investors, if any) and unblocking of funds from ASBA account will take place around March 24.

The allotted shares will be credited to the demat accounts of eligible investors around March 25, and the shares will get listed on bourses with effect from March 26, as per the tentative schedule in the company's prospectus.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!