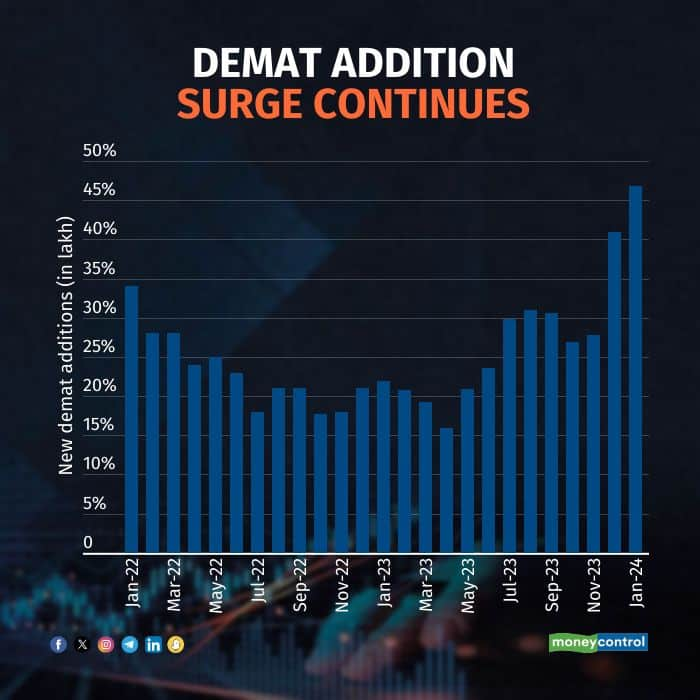

Despite wild volatility after a major bull run, investors refused to shy away from the market and the number of fresh demat accounts opened in January beat the previous high set in December.

According to data from the Central Depository Service and National Securities Depository, the number of demat accounts opened in January totalled over 46.84 lakh, compared to 40.94 lakh a month ago and 21.90 lakh a year ago. The total demat tally crossed 14.39 crore, up 3.4 percent from a month ago and 30.3 percent from a year ago.

Analysts said that though the markets were volatile in January ahead of events such as Budget, monetary policy decisions by the US Federal Reserve and the Reserve Bank of India, especially after a sharp run-up seen since November, the overall long-term view remains positive.

"India is on a structural growth path which is reflecting well in macro data points and this is quiet resilient despite hiccups being faced by global economy. India is fastest growing economy worldwide and hopes of government continuity has further propelled the confidence. Thus, demat accounts continue seeing record additions," said Sneha Poddar, an analyst at Motilal Oswal Securities.

Analysts further said that rising demat accounts are driven by FOMO in new investors attracted to India's promising long-term prospects and heightened financial literacy after Covid. Increased capital market investments, especially from tier ll and lll cities, are boosting growth in demat and trading accounts, along with a surge in mutual fund investments through the demat route. The vibrant primary market is further motivating investors to open demat accounts to take part into the IPO boom, they added.

"Overall, we believe the rising trend (in demat) to continue in the same phase looking at markets touching lifetime highs after every dip, giving investors decent returns and opportunities," said Prashanth Tapse, senior VP (Research), Mehta Equities.

Analysts also anticipate a pre-election rally, potentially sparking increased investor interest and demat account openings. ICICI Direct's recent report suggests a pre-election rally could propel Nifty to 23,400 levels by June 2024. Despite the Nifty 50 reaching all-time highs recently, heightened volatility is expected leading up to the general elections. The anticipation is fuelled by positive returns from the Nifty over the past eight years, and market participants are optimistic about another year of strong returns as macroeconomic indicators in India strengthen, supported by a steady increase in aggregate demand, the report added.

The US Fed has recently left rates unchanged with Fed chair Jerome Powell saying that policymakers will likely wait beyond March to cut interest rates reiterating that officials want to see more economic data to assure that inflation is on suitable path to their 2 percent goal. Investors are also eagerly awaiting the Reserve Bank of India's bi-monthly policy decision on February 8. Economists predict the central bank will likely keep key interest rates unchanged, with a possibility of maintaining the current policy stance of withdrawal from accommodation.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.