State-owned Bharat Dynamics has opened its initial public offer for subscription on Tuesday, with a price band of Rs 413-428 per share.

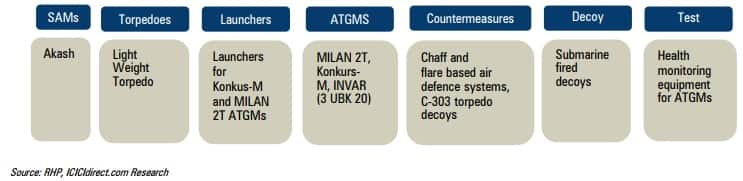

Here are 10 things you should know before subscribing the issue:-Company ProfileHyderabad-headquartered Bharat Dynamics is one of the leading defence PSUs in India engaged in the manufacture of surface to air missiles (SAMs), anti-tank guided missiles (ATGMs), underwater weapons, launchers, countermeasures and test equipment.

It is the sole manufacturer in India for SAMs, torpedoes, ATGMs; and it is also the sole supplier of SAMs and ATGMs to the Indian armed forces, according to F&S Report.

Additionally, it is also engaged in the business of refurbishment and life extension of missiles manufactured.

The defence company currently has three manufacturing facilities located in Hyderabad, Bhanur and Vishakhapatnam.

About the Public IssueThe initial public offering of 2,24,51,953 equity shares is an an offer for sale by the promoter, The President of India, acting through the Ministry of Defence.

The company has reserved a portion of 4,58,203 equity shares for allotment to eligible employees. The issue will close on March 15.

The price band for the offer is at Rs 413-428 per share. Employees and retail investors will get shares at a discount of Rs 10 per share on offer price.

Bids can be made for a minimum lot of 35 equity Shares and in multiples of 35 shares thereafter.

Equity shares are proposed to be listed on BSE and NSE. The book running lead managers to the offer are SBI Capital Markets, IDBI Capital Markets & Securities and YES Securities (India).

Fund RaisingBharat Dynamics aims to raise Rs 927.27 crore at lower end of price band and Rs 960.94 crore at higher band, through the issue.

Objects of the IssueIt is an offer for sale; hence the company will not receive any proceeds from the offer and all the proceeds will go to the selling shareholder.

Main objects of the Offer are to carry out the disinvestment of 22,451,953 equity shares by the selling shareholder and to achieve the benefits of listing the equity shares on the stock exchanges.

It is a part of divestment programme for which the government revised its target to Rs 80,000 crore (from Rs 72,500 crore earlier) in the recent Union Budget.

Strengths> The infrastructure at manufacturing facilities combined with vast expertise enable the company to cater to the needs of the Indian armed forces in a timely manner.

> The implementation of 'Make in India' policy has enabled it to improve supply chain management in order to meet long term commitments to primary customer, the MoD and ensured transparency in identifying and developing new vendors. Increase in indigenisation will enable the company to reduce reliance on imports and the cost of products.

> In order to ensure that products qualify the trials by the Indian armed forces, it has set up various quality control processes such as multi-level inspection at vendor’s plants, inspection of outsourced materials / components, subassembly checks and final checks of our products in order to ensure highest success rates of products.

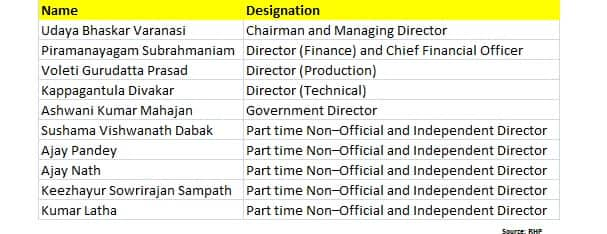

> It has a diversified Board with directors and each of key management team having several years of experience in the defence industry.

> As of January 31, 2018, its outstanding order book was Rs 10,543 crore. It has delivered consistent growth over the last five financial years both in terms of financial and operational metrics.

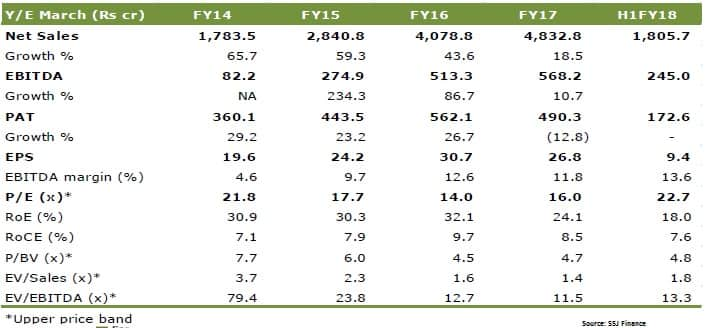

FinancialsThe state-owned defence company has posted profits continuously in the last five fiscals. It has reported a CAGR of 39.4 percent and 10.8 percent on revenue and net profit fronts respectively over FY14-FY17.

Its promoter is the President of India acting through the Ministry of Defence.

Udaya Bhaskar has been associated with the company in the capacity of a Chairman and Managing Director since January 30, 2015. He holds a bachelors degree in plastics technology and chemical engineering from H B Technological Institute, Kanpur University and holds masters degree in technology from Indian Institute of Technology, Delhi. He joined the company in the year 1990.

The promoter currently holds 100 percent of the pre-Offer equity share capital of the company.

The government will dilute 12.25 percent stake through the issue.

Post completion of the offer, promoter's shareholding will be reduced to 87.75 percent of the post offer paid-up equity share capital.

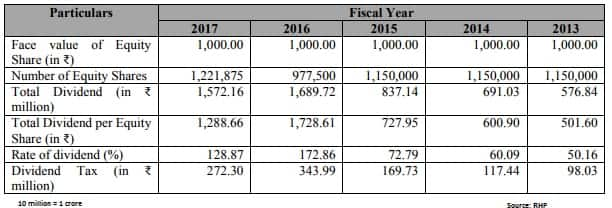

Dividend PolicyBharat Dynamics has consistently declared dividends for the last five fiscals.

> BDL is primarily dependent on a single customer, the Indian armed forces through the Ministry of Defence. A decline or reprioritisation of the Indian defence budget, the reduction in their orders, termination of contracts or failure to succeed in tendering projects and deviations in the short term and long term policies of the Ministry of Defence or the Indian armed forces in the future will have a material adverse impact on company's business, financial condition, and results of operations, growth prospects and cash flows.

> The company operates in a highly regulated environment and interference from the government is quite high as it involves national security concerns.

> It is dependent on its information technology infrastructure to conduct its business activities, manage risks, implement its internal control systems and manage and monitor its business operations.

> Government of India intention to open FDI in the defence sector is expected to increase the competition intensity among players operating in the sector.

> Cost overruns/delays in delivery may lead to loss under fixed-price contracts.

> The company is dependent on key original equipment manufacturers for sub-assemblies/ component, single source supplier and sub contractors.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.