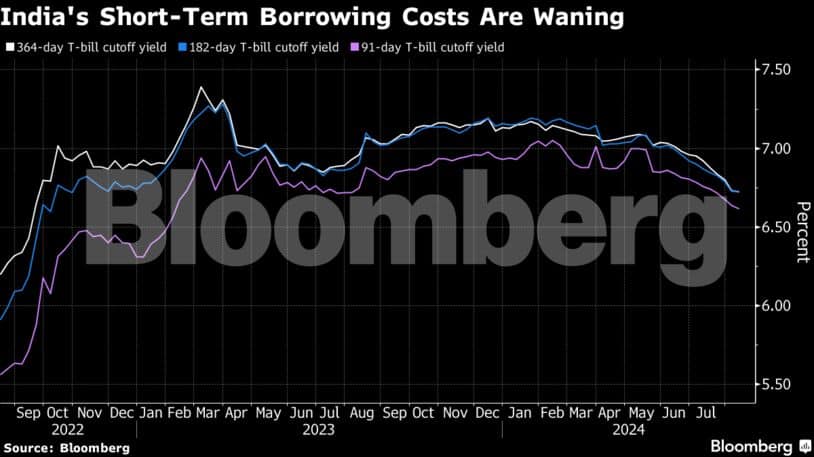

Short-term borrowing costs in India declined to the lowest in nearly two years, reflecting a buildup of liquidity in the banking system just as calls for central bank policy pivot mount.

The yield on the 364-day treasury bill dipped to 6.7240% in an auction on Wednesday, the least since September 2022. The yield on other very short-dated papers also dipped.

Lower government borrowing via treasury bills has helped push borrowing costs lower, with government spending after elections fueling a liquidity surplus. An additional driver are the RBI’s currency interventions in the face of overseas capital inflows liked to India’s inclusion in JPMorgan Chase & Co.’s emerging market bond index.

“Cyclically during this time we don’t see much of a cash withdrawal,” which would be a big drain on liquidity, said Pankaj Pathak, a senior fixed income fund manager at Quantum Asset Management Co. Short-term rates are likely to stay low for a few more months as the system remains in excess ahead of the festive season, he added.

The RBI began a series of aggressive interest rate increases in 2022. But slowing consumer demand and concerns about the health of the global economy are now fueling calls for cuts.

Inter-system liquidity stood at 1.5 trillion rupees ($17.9 billion) on Aug. 13, according to a Bloomberg Economics gauge. Nomura Holdings, Inc. strategist Nathan Sribalasundaram expects it to stay in surplus until late September.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.