Jitendra Kumar Gupta Moneycontrol Research

No one would be looking at a 10-12% return by buying a lottery ticket for the simple reasons that they are highly risky. A lottery ticket will probably find itself at the extreme end of the risk and return curve and thus demand a very high return. On a relative basis, equity investors would have lower expectations, but still higher than the return expectation of a bond investor.

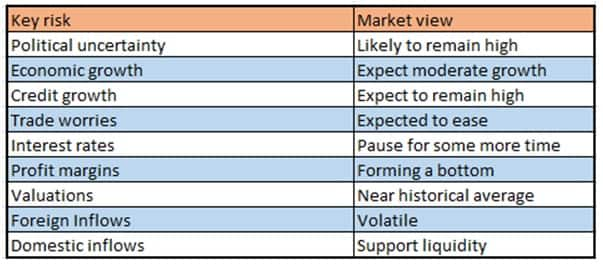

This simple demarcation in return expectations keeps on fluctuating based on the perception of risk including country risk. Indian and foreign equity investors have started weighing many such risks including elections next year, interest rates, commodity prices, fiscal situation and country risk, which are now getting reflected in the equity risk premium (excess return expectations).

“If the money gets dearer, the desire to invest in equity is less because the bonds are giving you better yields, that effectively suggests that equities should command a lower PE multiple. Moreover, given the weak earnings growth of the last five years, it makes little sense to give the Nifty a higher multiple at this juncture. This year too, the earnings outlook is subdued. I do not see a major recovery in earnings in the medium term,” said Saurabh Mukherjea, Founder, Marcellus Investment Managers.

Equity risk premium: taking a note

India’s equity risk premium has gone up from 2.9% in November this year to 3.4% in the first week of December. While the latest data post the state election results are not available, it is expected that the premium has only gone up post the state elections.

Bond vs equity: a risk worth noting

The other important data point that investor can gauge the increase in risk is narrowing of the spread between the bond yield and earnings yield of Nifty. In August 2018 at the peak of the market, this difference was 3.3% (refer below illustration), which has narrowed to 2.4%.

Increase in earnings yield compared to bond yield indicate that stocks become cheaper as investors look for higher risk-adjusted returns. Factoring in the elections next year, particularly in the light of the adverse outcome of the state elections recently, investors are weighing risks differently.

To further illustrate the point, at the peak of the market in January 2008, Sensex was trading at 24.6 times one year forward earning thus providing an earnings yield of 4% compared to bond yield of 7.74%. But as the market started to weigh the global risks, equity started becoming cheap thus the Sensex earnings yield rose to 8% in March 2009 far higher than the bond yield of 7.1% in that period. As the risk increases the difference narrows down.

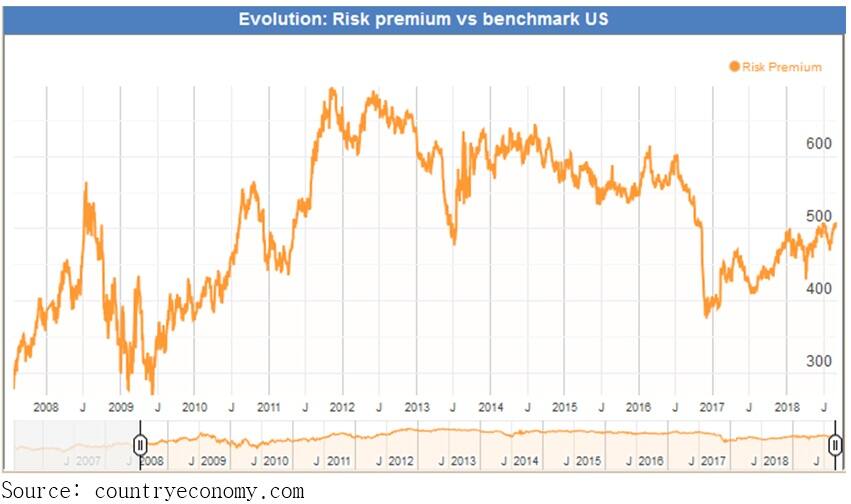

Impact on inflow

There is very little doubt that the perceived risk has increased as far as the Indian stock markets are concerned. Foreign investors would weigh in all these risks and add to their overall expectations. India’s risk premium benchmarked against the US calculated by one of the websites countryeconomy.com suggest that the risk premium has increased from a low of about 390 points in December 2016 to currently at about 449 points.

When premiums increase a foreign investor would evaluate India along with other markets. With the corresponding increase in risk, his or her expectations would increase in terms of the returns and thus would expect equities to be a lot cheaper for generating those additional return.

One direct fallout of this would be on foreign portfolio allocation to India and thus foreign inflows. And this possibly could be one reason why FIIs are selling in the Indian equity market. Post the state elections, FIIs have sold close to Rs 3700 crore in Indian equity markets and Rs 4469 crore so far in the month of December 2018.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.