The Reserve Bank of India’s fifth increase in interest rates since May 2022, which now brings the home loan rates at pre-Covid levels, will push up mortgage rates, impact monthly instalments payable by homebuyers, and reduce home affordability, real estate experts said.

Other experts said the trajectory of rising interest rates may give the rental market a fillip if potential homebuyers find that purchasing a house is beyond their budget.

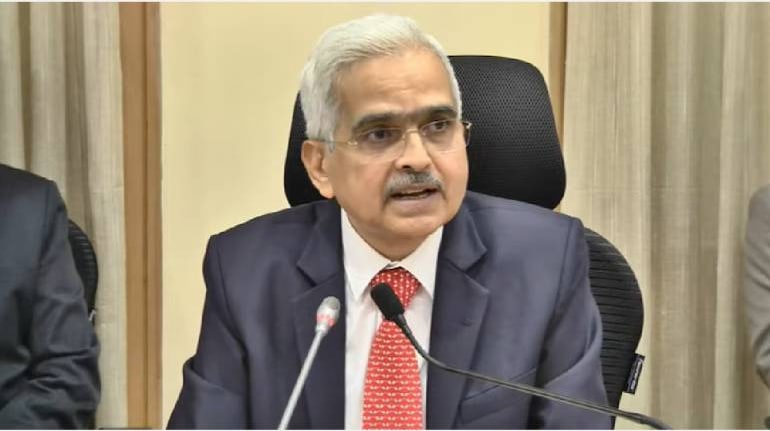

The RBI increased the benchmark lending rate by 35 basis points to 6.25 per cent on December 7 in a bid to tame inflation, which has remained above its tolerance level for 11 months.

The benchmark rate has gone up 225 basis points since May. This latest hike comes after a 40 bps increase in May and a 50 bps hike each in June, August and September.

“The RBI has been extremely judicious in their decision to raise the repo rate by 35 bps as against the previous revisions, which were much sharper,” said Shishir Baijal, chairman of Knight Frank India, a property consultant. “Since the rate hike cycle in May 2022, home loan products have become more expensive by around 150 bps, before today’s hike.”

Reduced affordability

Lending rates have risen significantly, especially for loans linked to the external benchmark-based lending rate (EBLR), where the entire increase has been passed on to borrowers. Loans linked to the marginal cost of funds based lending rate (MCLR) have risen by about 108 bps during this period.

This hike will further impact EMIs and reduce home affordability, Baijal said.

Based on the interest rate impact in this cycle, the Knight Frank Affordability Index has recorded a cumulative deterioration of an average of 3 percent across the country. The index tracks the EMI (equated monthly instalment) to total income ratio for the average household.

“The RBI’s decision… was quite expected. The relatively lower hike of 35 bps as compared to earlier ones was also anticipated in the backdrop of more headroom available to the central bank amid a visible cooling off in inflationary pressures and indications of a moderation in Fed rate hikes,” said Samantak Das, chief economist at Jones Lang LaSalle, a global firm that manages commercial property and investment.

The policy rate hike leads to higher lending rates, which impact the sentiment of stakeholders. However, the moderation in the repo rate hike augurs well for the real estate sector as its pace has slowed down even as bank delay or moderate passing on the additional costs to borrowers. This should continue to support the momentum in the residential markets, with India’s new apartment sales in the top seven metros expected to cross the 200,000 mark in 2022, for the first time in over a decade, he said.

The gradual easing of inflation is also expected to partially mitigate input cost pressures and provide legroom for developers to offer competitive-value homes and keep home purchase affordability within range, he added.

Moderate impact

Anuj Puri, chairman of ANAROCK Group, a property consultant, is of the view that as long as interest rates remain in single digits (within 9.5 percent), the impact on housing will be moderate, at best. If the rates breach this point, “we will see some real pressure on residential sales volumes in the months to come – especially in the affordable and lower mid-range housing segments,” he said.

India’s housing market remains largely user driven. Unlike investors, users do not look for the lowest entry point but for inherent value and the benefits of home ownership. As long as users continue to significantly outnumber investors, the interest rate-driven impact on housing sales will not be very pronounced, Puri said.

Still, borrowing costs for both individuals and companies will go up, which will impact economic activity, said Dhruv Agarwala, Group CEO of Housing.com. Proptiger.com and Makaan.com.

“We feel that there should not be any concern on the demand front while mortgage rates remain under 10 percent,” he said.

“Home loan interest rates going above 9 percent may have some impact on residential sales. However, we are confident that the impact will not be significant as demand for new properties remains buoyant,” said Abhishek Kapoor, CEO of Puravankara, a developer. “We believe the rate hike will not deter genuine homebuyers from buying new properties.”

Rental market

With home loans getting dearer, prospective homebuyers may opt for rentals.

“The repo rate now is near a 4.5 year high and is likely to stay higher for an extended period of time. Mortgage rates are now again at or even higher than they were prior to Covid,” said Amarendra Sahu, founder of NestAway Technologies. “This will probably give the rental market more traction. Renting will become significantly more affordable due to increasing home-buying costs and interest rates. Home rentals have little correlation to home loan rates. We expect the central bank to stay on a long pause before they start cutting rates, likely in the later part of CY23.”

According to Niranjan Hiranandani, vice chairman of the National Real Estate Development Council (NAREDCO), loan costs remain in the low-regime interest rate zone and while floating home loan interest rates may hurt EMI payments temporarily, they will average out positively in the long run.

“Though the property market may experience lag in sales to accommodate rising EMI pay-outs and simultaneously evaluate postponement options for a stipulated period of time, the home ownership sentiment rides high amidst geo-political turbulence, spiralling uncertainties, and an escalated inflation crisis on the back of stability and social security that this asset offers,” he added.

“Any increase in repo rate has a direct impact on the end consumers, including home buyers, as banks will ultimately pass on this increase to customers and this may impact the current momentum in the short term,” said Harsh Vardhan Patodia, president of CREDAI National (Confederation of Real Estate Developers' Associations of India). “However, owing to high sales during 2022 and robust consumer sentiment, real estate continues to have an edge over other investments. Nonetheless, with the Union Budget for FY24 around the corner, the impact could be subdued through policy changes that positively impact consumers.”

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.