In this edition of chemical stock picks from Q1FY19, we highlight a couple of stocks from the fluorochemicals space- Tanfac industries and Gujarat fluorochemicals.

Tanfac industries: One of the largest suppliers of fluorine-based chemicalsTanfac industries (Market cap: Rs 320 crore), a JV of Aditya Birla group and Tamil Nadu Industrial Development Corporation (TIDCO), is one of the largest suppliers of fluorine-based chemicals.

Key products include aluminium fluoride, anhydrous hydrofluoric acid, sodium silicofluoride, ammonium bifluoride and potassium fluoride. Inorganic chemical products have an application for various industries like aluminium, Oil, refrigerant gases, steel, glass, ceramics and fertilisers, while organic fluorine-based chemicals are used as intermediates for pharma and agrichemicals.

Quarterly results: a sharp increase in marginsOperating profit jumped three times aided by higher sales at 57 percent year-on-year (YoY) and a moderate increase in raw material costs. As a result, earnings before interest, tax, depreciation, and amortisation (EBITDA) margin surged to 27.5 percent versus 13.9 percent in Q1FY18. The company is witnessing strong growth with operating profit CAGR of 38 percent (FY15-18) on account of end market improvement, lower operating expenses and change in product mix.

Last fiscal, company’s sales increased by 19 percent YoY on account of higher sales and an increase in prices of products – hydrofluoric acid (HF), sulphuric acid & aluminium fluoride. The company reported that higher realisation in HF acid was on account of continuous penetration in photovoltaic (PV) & specialty grade HF markets and partial pass-through of increase in fluorspar prices. Further new applications helped in volume growth of 28 percent YoY for HF acid.

Factors favouring are increased product diversification with a higher share of speciality fluoride. Value-added products like photovoltaic hydrofluoric acid have an increasingly higher revenue share.

The key risk for the company is a dependency on imports for main raw material fluorspar which is majorly imported from China. To reduce the risk, it has expanded vendor base of Chinese origin. The company has also developed sources from other geographies and expanded the relationship to reduce dependency on Chinese origin. The company has a leveraged balance sheet, while the debt/equity ratio has reduced from 14x (FY15) to 1.9x in FY18, it is still elevated.

The stock has rebounded strongly from the recent lows and trading currently at 15x 12m trailing earnings. On account of improving end markets, investors can look at accumulating the stock on lower levels.

Gujarat fluorochemicals (Market cap: Rs 9,300 crore), is a diversified business group with key exposure to chemicals (52 percent), wind turbine (14 percent) and film exhibition (33 percent).

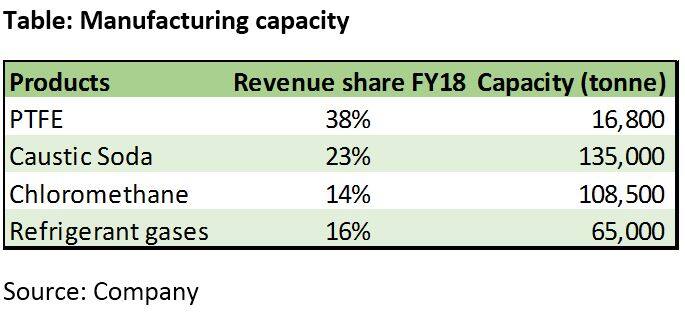

Within Chemicals, exposure is further diversified to PTFE (Polytetra flouro-ethylene, 38 percent), caustic soda (23 percent), Chloromethane (14 percent) and refrigerant gases (16 percent).

Company’s standalone business which mainly constitutes chemicals business reported sales jump of 38 percent YoY in Q1 FY19 backed by higher pricing growth in refrigerants (+21 percent), chloromethane (+32 percent), PTFE and value-added products. PTFE value-added grade, in particular, had a strong volume (18 percent) and pricing growth (28 percent).

Operating margins improved to 30.8 percent (from 20.8 percent in Q1 FY18) on account of better realizations and value-added share (14.6 percent vs. 9.2 percent in Q1 FY18).

Company’s chemical business contribution to operating profit has increased to 60 percent from 51 percent in Q1 FY18.

Vertically integrated chemical businessCompany’s chemical business is vertically integrated, with the output of one segment feeding the others. For instance, caustic soda production has chlorine as a byproduct which is used for making chloromethane. Chloromethane, in itself, is utilized to make refrigerant gases which are further used as an input for PTFE. Not only diversification helps in containing revenue volatility, but an integrated set is also supportive of margins.

Improving business prospects for caustic soda and PTFEPositive prospects for PTFE and caustic soda industry end markets are among the key drivers. In the case of the caustic soda industry, supply-demand imbalance (supply cut in China and Europe) has been favourable for product prices. In addition, end markets like paper industry, water treatment and alumina industries are also doing well.

PTFE has also witnessed improved prospects as it has applications for cookware (non-stick coating), electronics, pipes, automobile. Currently, GFL is the largest producer to PTFE in the country and fourth largest in the world (10 percent of world production). The company enjoys a high barrier to entry in this category on account of technology and raw material access. The company expects a double-digit growth in this segment on account of capacity addition (+30 percent), reduced supply in China and value added products.

The stock is trading at slightly expensive multiples (27x 12m trailing earnings) partially on account of a turnaround in earnings from a low base. Improved end-market prospects and integrated business model makes it a worthy business to have a close look at.

Follow @AnubhavSaysFor more research articles, visit our Moneycontrol Research pageDiscover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!