Hindustan Petroleum Corporation limited (HPCL) reported a weak performance over a sharp sequential decline in its operating and net profits.

Gross refining margins (GRMs) saw a dip that was much in line with the global contraction, with substantial inventory losses also having impacted the company's profits.

-GRMs for the 9M from April to December were at $5.17 per barrel , as compared to $7.51 per barrel in 9M FY18. The calculated GRM for the quarter comes to around $3.5-4 per barrel. There has been an expected weakness in GRMs globally with the Singapore benchmark at $4.5 per barrel, as compared to $6.1 in Q2.

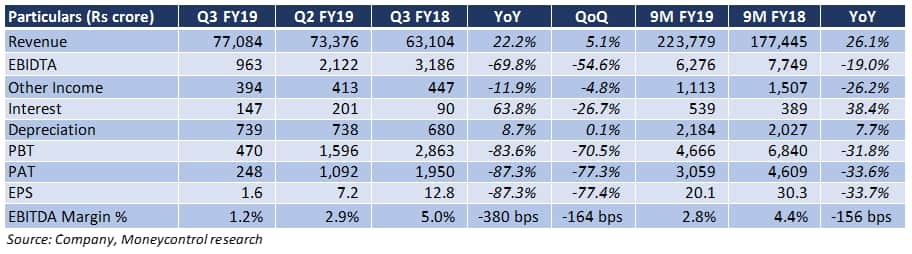

-Earnings before interest tax depreciation and amortisation (EBITDA) saw a sharp 70 percent year-on-year (YoY) decline, in comparison to a drop of 54 percent sequentially over high inventory losses, an increase in input costs, employee expenses and finance costs.

-A sharp correction in global crude prices since October 2018 has led to a substantial inventory loss for the company which ate away at the quarters' profitability. This compares to an inventory gain in the same quarter last year.

-Other expenses saw a noticeable cut, which worked a bit in favour of margins. The company has highlighted that Other Expenses for 9M FY19 include Rs 827 crore towards losses on account of foreign currency transactions and translations. This is in comparison to a Rs 406 crore gain during 9M FY18 period.

-While volumes in the domestic business saw a 7 percent QoQ uptick, as compared to a 2.3 percent rise YoY, export volumes dipped 6.3 percent QoQ in comparison to 42.9 percent YoY rise.

-Crude throughput remained largely flat YoY , as against a drop of 4.2 percent QoQ.

-Pipeline throughput remained flat both YoY and sequentially

-Finance costs went up 63 percent YoY, however there was a 26 percent decrease in the costs QoQ.

-The overall performance of the company appears weak, much in line with expectations. With volatile crude prices, upcoming central elections and tweaking of marketing margins around elections, we remain cautious on the company’s performance.

Follow @RuchiagrawalFor more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.