India is testing the waters of a sluggish global green bond market with its debut sale this month that aims to raise $2 billion for sustainable projects.

Indian officials have been clear they want a significant “greenium” for the sale to lower the nation’s borrowing costs, and that will require attracting enough foreign investors to the rupee-denominated debt.

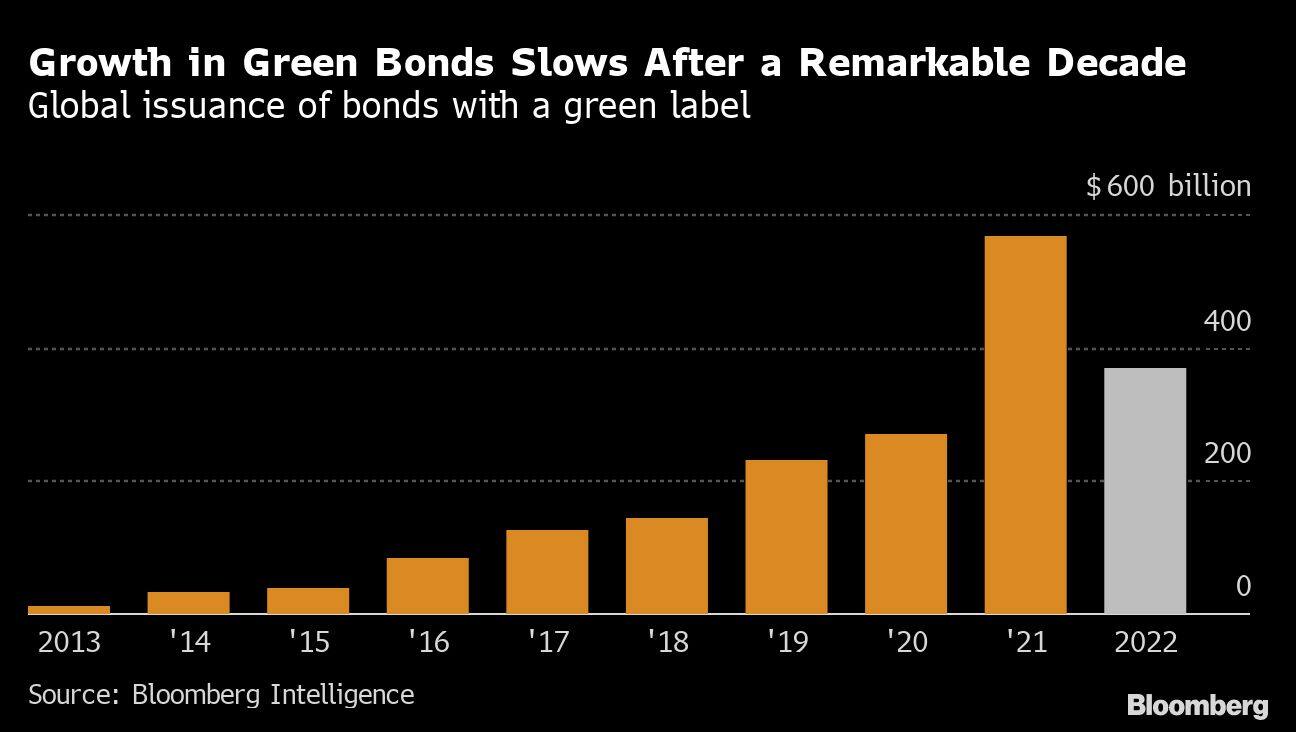

Green bond sales dropped for the first time in a decade last year, as monetary policy tightening hit issuance, and as asset managers came under fire for alleged greenwashing. Companies and governments worldwide raised a total of $863 billion in green, social and sustainability-linked bonds in 2022, a 19% drop from the record $1.1 trillion in 2021, according to data compiled by Bloomberg.

So far this year, at least two governments have tapped the green bond market, led by Hong Kong, which sold the equivalent of $5.8 billion of debt across three currencies. Ireland pulled in €35 billion ($37 billion) of orders for a €3.5 billion sale of 20-year bonds.

India is putting its first sovereign green bond on the radar of some of its biggest domestic asset managers, including state-run insurers and pension funds as well as foreign investors from Japan to the UK to drum up demand, according to people familiar with the matter.

“We could possibly see quite a healthy level of interest, especially from the domestic investors,” given the broader macro environment, with rates and inflation peaking, said Nicole Lim, fixed income ESG analyst at abrdn plc in Singapore.

Below are some charts that put context around India’s green bond and how it fits into the nation’s climate goals. India plans to sell the debt in two auctions on Jan. 25 and Feb. 9.

Market Slowing

Green bond issuance fell in 2022 for the first time since the nascent market became of interest to major asset managers.

Green Mandates

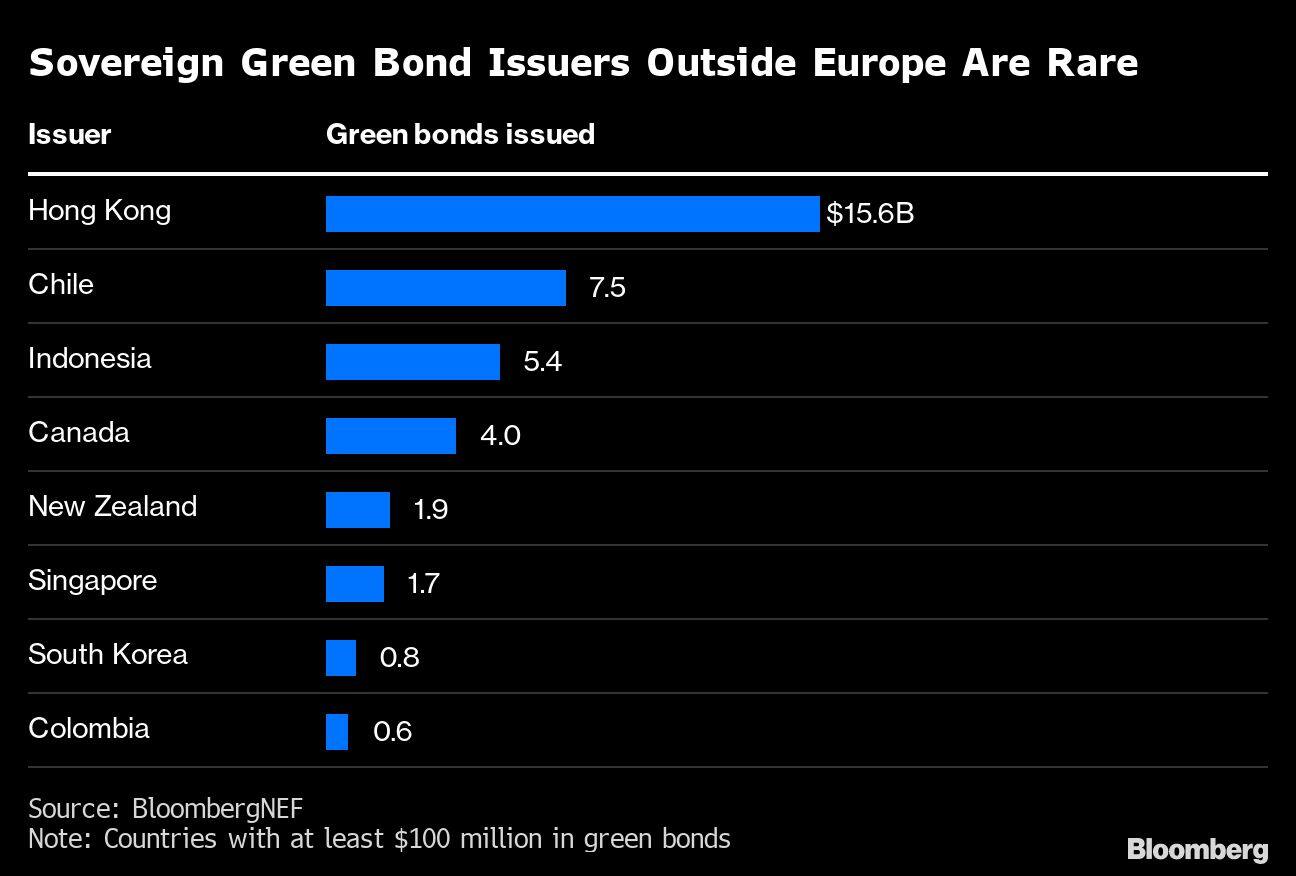

India may be a late comer to the green bond market in Asia, but sovereign issuers are still a select club outside Europe. That could burnish the appeal of its sale for foreign investors with a green mandate, despite the exchange rate risks that come with a rupee-denominated bond.

Renewable Targets

Raising sufficient funding at a low cost will be crucial for meeting the renewable energy goals set by India, which relies on fossil fuels for more that half its energy needs.

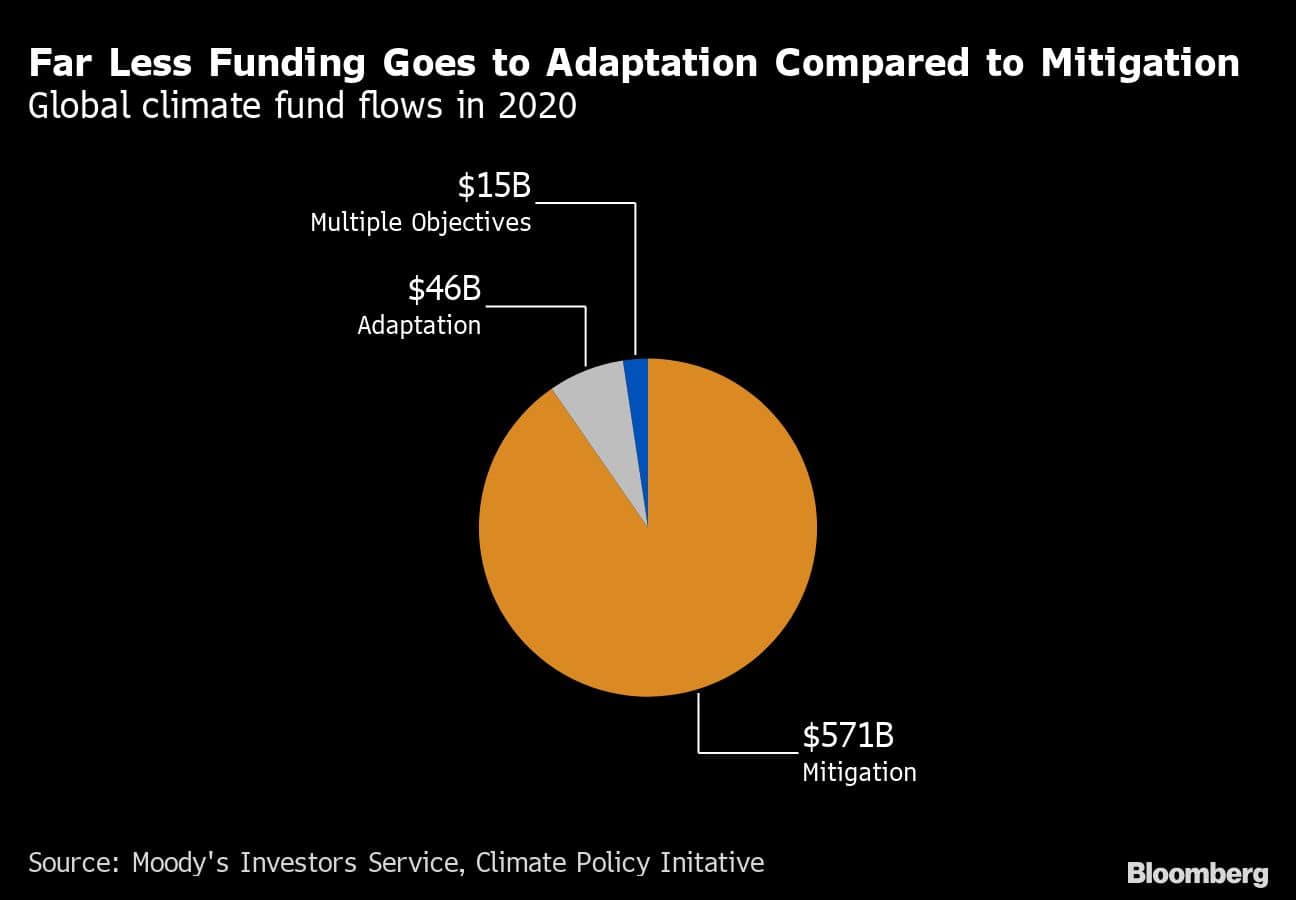

Adaptation Gap

Besides building out renewable power capacity, money raised from the sale may be used to build infrastructure that boosts its resilience to rising temperatures and extreme weather. Globally, funding for climate adaptation has fallen far short of a 50-50 split with mitigation — which aims to reduce emissions — which was part of the 2015 Paris agreement.

Understated Market

Indian corporate issuers have not always found it worth the cost and effort to get a green tag on their debt, given the absence of domestic ESG debt funds. The establishment of a clear benchmark with a sovereign bond and the potentially greater investor interest it may bring could change that.

Companies in India have issued more than $26 billion of this debt, mostly for renewable energy projects.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.