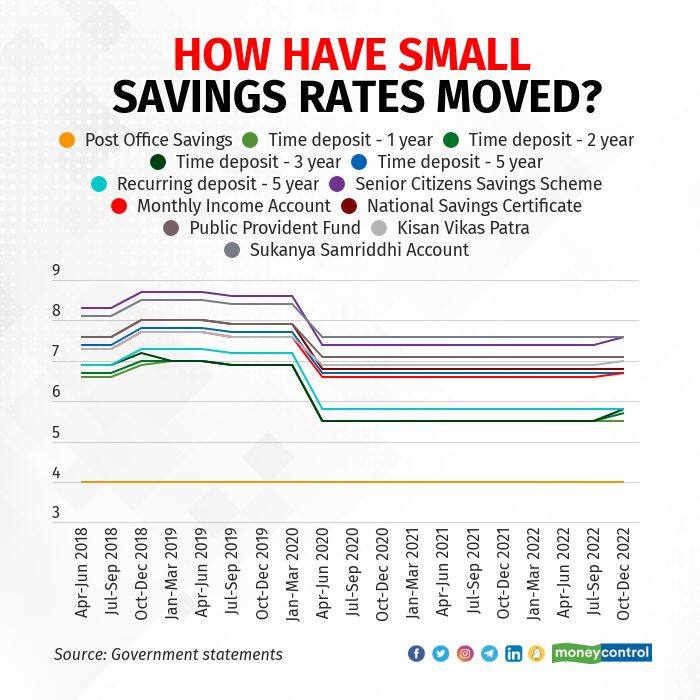

India raised interest rates on a few of the dozen small-savings schemes for October-December after keeping the rates unchanged for nine quarters in a row.

While this gives some reason for cheer to the common man during the festive season, one should not expect sharp rises over the coming months.

Interest rates on small savings were not lowered at all over the last two years when the policy and government bond interest rates had fallen sharply in the wake of the unprecedented monetary easing during the coronavirus pandemic.

The need to ensure effective monetary transmission (bank deposits compete with small savings instruments) and the limited fiscal space (the government pays more on small savings than on bonds) are also likely to drag returns on the popular small savings instruments.

These schemes include the Public Provident Fund, Post Office Deposits as well as National Savings Certificates.

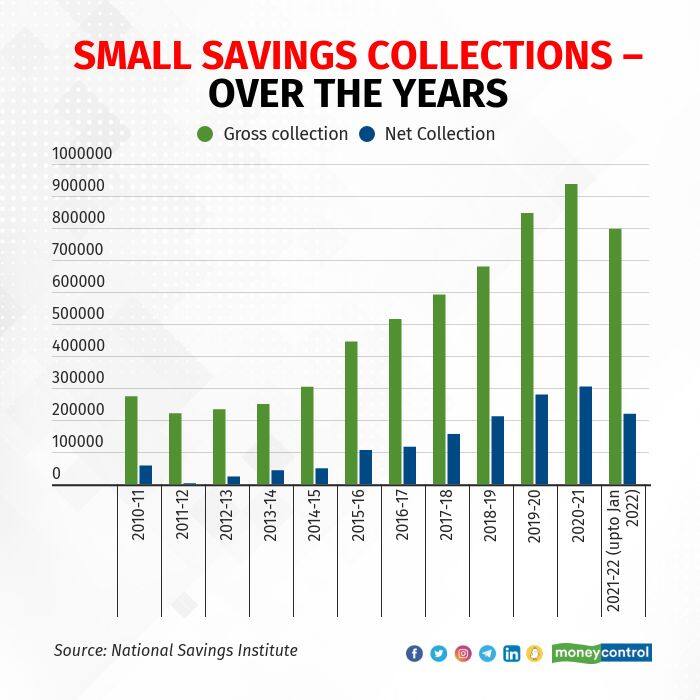

The twin purposes of small savingsIn India, small savings schemes serve as social security and as tools for resource mobilisation for the government.

In fact, flows into small savings schemes have cushioned government finances over the last few years as the budget came under pressure due to the pandemic.

Funds coming in through the small-savings route helped the government keep its market borrowings and cost of borrowings under check.

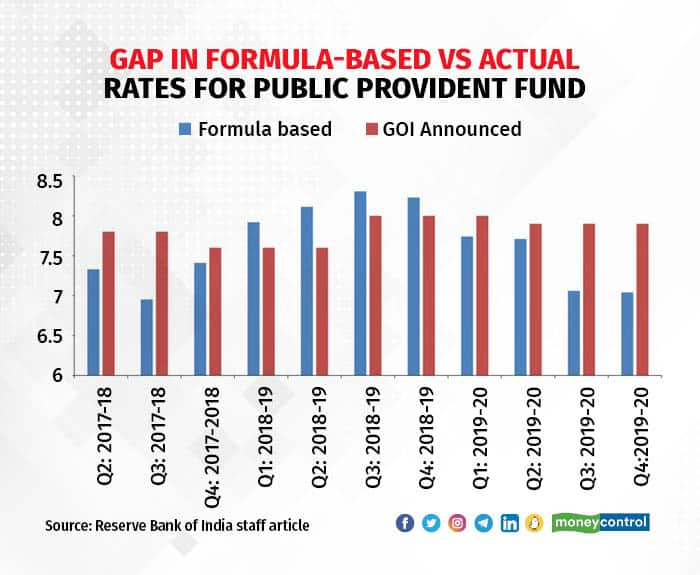

In principle, small savings interest rates are linked to market yields on government bonds at a spread of 0-100 basis points over the yield of bonds of comparable maturities.

In reality, such administered rates can be rigid, especially on the downside, which distorts the overall interest rate structure in the economy.

There are signs that the government wants to reduce its reliance on high-cost small savings instruments, Pankaj Pathak, Fund Manager, Fixed Income, at Quantum Asset Management Co, said.

“Ideally, small savings rates should be linked to government bond rates. Over the last many years, we have seen that the government has kept the rates much higher than at least bank fixed deposits. There was some relation to government bond rates but when yields fell sharply in the last 2-3 years, it was not revised down that much,” Pathak said.

As bond market yields rise amid policy rate increases, there will be some motivation for the government to increase small savings rates as there is a broader participation in small savings instruments across all kinds of demographic profiles, the fund manager said.

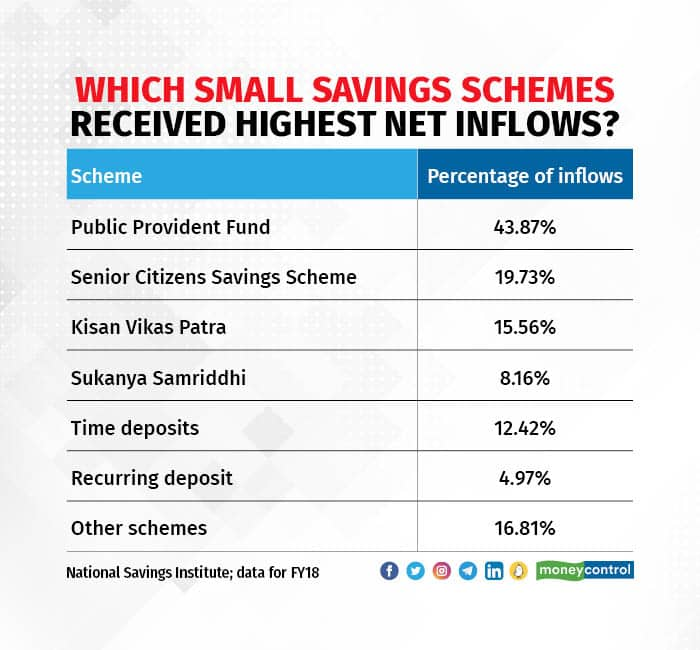

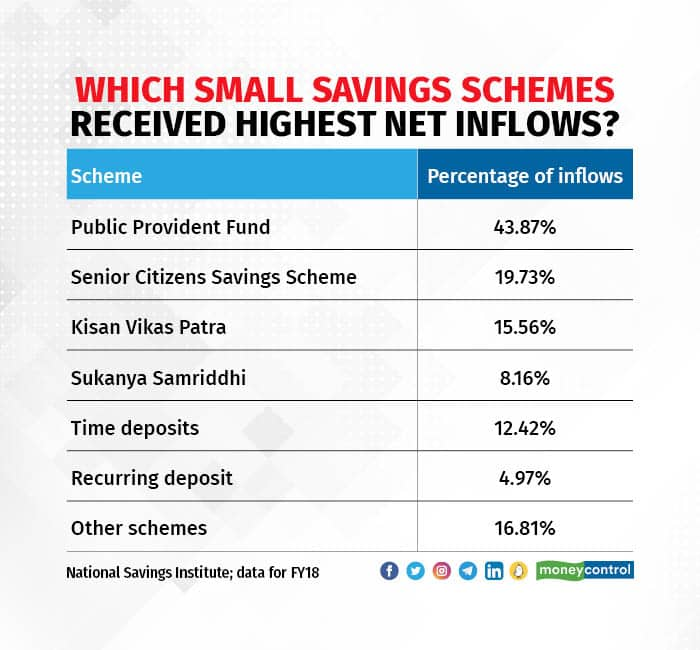

These schemes attract investors due to the sovereign guarantee they carry as well as due to the tax-exemption schemes like PPF, five-year schemes and Sukanya Samriddhi scheme, meant for girls, carry. According to the latest data, this makes such schemes attract most net inflows.

India’s central bank has, since early May, raised the key policy repo rate by a total of 190 basis points as it seeks to curb red-hot inflation. More rate hikes are likely in the months ahead.

Still, even if small savings rates were to be raised further, the quantum may not be steep as the government won’t want to compete with the banking system’s credit expansion.

“If banks are not able to raise deposits, at some point, that is going to discourage them from expanding credit. So, I think short-term rates will move up but maybe not at a pace which people will desire,” Pathak said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.