Industry bodies and major players in the Indian palm oil processing sector have welcomed the government’s new National Mission on Edible Oils – Oil Palm (NMEO-OP) and say it will reduce the country’s dependence on expensive palm oil imports.

However, since palm is a long gestation crop, it could take half a decade or more before the new policy starts showing results, and the states also have to play their part, industry representatives say.

“In terms of imports, India imports more than 90 percent of its total palm oil consumption. This means that on an annual basis, there is a foreign exchange outflow to the tune of Rs 70,000 crore plus and this number will increase as the consumption goes up,” Sanjay Goenka, Managing Director and Chief Executive Officer of 3F Oil Palm Agrotech told Moneycontrol.

Goenka is also the president of the Oil Palm Developers and Processors Association (OPDPA), an industry body representing companies like 3F Oil Palm, Godrej Agrovet Ltd and Ruchi Soya Industries Ltd.

Almost 75 percent of the oil palm produced in India is processed by these three companies, Goenka said.

“This is a long-awaited policy, and will lead to India producing more palm oil and reduce import dependency. However, all this cannot happen overnight as oil palm is a long gestation crop,” Goenka said.

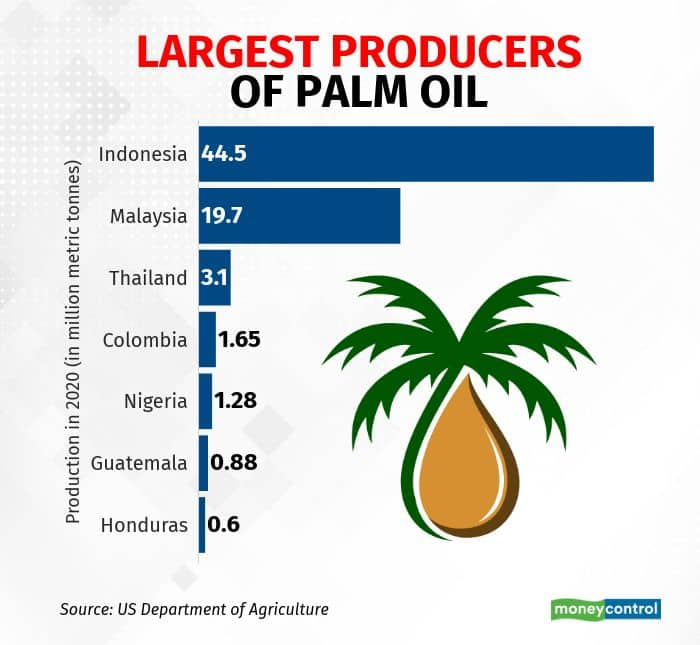

In 2020-21, India consumed 8.76 million tonnes of palm oil, while domestic production was only around 200,000 tonnes. India is one of the largest consumers of edible oil owing to its population. What sets it apart from the West and China is the fact that while those nations also use a lot of animal-derived oil and fats for cooking, India almost wholly depends on plant-based oils.

Results will show only after 2025-26

“Even if we start expanding rapidly and we add 1 lakh hectares per annum, there is a long gestation period for this crop. The results will come only after 4-5 years. All this will make a difference only after 2025-26,” said Balram Yadav, Managing Director of Godrej Agrovet.

Yadav expects the percentage of exports in India’s palm oil consumption to start reducing by 2027-28.

On August 18, the Union Cabinet approved the Rs 11,040 crore National Mission on Edible Oils-Oil Palm to boost palm oil production in India.

Out of the total outlay, spread out over five years to begin with, Rs 8,844 crore is the central share and Rs 2,196 crore is the share of states and this includes a viability gap funding component. The focus of the scheme will be on North East India and Andamans, the regions with climate most conducive for palm oil plantations.

"The Centre will come up with a mechanism to fix and regulate palm oil prices. If the market is volatile, the difference will also be paid by the centre through direct benefit transfer," Agriculture Minister Narendra Singh Tomar had said.

The aim of the scheme is to raise the domestic production of palm oil by three times to 11.20 lakh tonnes by 2025-26 and to 28 lakh tonnes by 2029-30.

This will involve raising the area under oil palm cultivation to 10 lakh hectares by 2025-26 and 16.7 lakh hectares by 2029-30. The special emphasis of the scheme will be on India’s north-eastern states and the Andaman and Nicobar Islands due to the conducive weather conditions in the regions.

Price assurance will boost industry

Yadav of Godrej Agrovet said that one of the biggest reasons the palm oil processing industry was not growing in India was because the price of fruits has been linked to global crude palm oil (CPO) prices.

“This policy tries to solve the problem of price fluctuations. We are assured of what we are going to get, the farmer is assured of what he is going to get, and the difference government will pay,” he said.

Agriculture Minister Tomar had said that the Centre will give a price assurance to oil palm farmers. This will be known as the viability price and will protect the farmers from the fluctuations of the international market. The viability price shall be the annual average price of the last 5 years adjusted with the wholesale price index to be multiplied by 14.3 per cent.

"This will be fixed yearly for the oil palm year from November 1 to October 31. A formula price will also be fixed which will be 14.3 percent of crude palm oil price and will be fixed on a monthly basis," the government’s official statement had said.

The viability gap funding will be the difference between the viability price and formula price and if the need arises, it would be paid directly to the farmers' accounts in the form of DBT. The industry will be mandated to pay 14.3 percent of the crude palm oil price which will eventually go up to 15.3 percent. The sunset clause of the scheme is 1st November 2037.

"To give impetus to the North-East and Andaman, the Centre will additionally bear a cost of 2 percent of the CPO price to ensure that the farmers are paid at par with the rest of India. The states who adopt the mechanism would benefit from the viability gap payment proposed in the scheme and for this, they will enter into MoUs with the Centre," the statement said.

States will have to do their bit

Another issue, as per Yadav was the long gestation period. “So the farmer does not have cash flow for four-five years. For a processor like us, when the farmer used to put pressure that he is not making money, the state governments in their myopic view will increase the payout from processors to farmers by changing the formula thereby making the business unviable,” he said.

Yadav said that the processors import the seed links, harvest them for one year and sell them at a subsidised rate to farmers. That subsidy is then owed to the processors by the state governments, which have not been paid for years. Yadav said Godrej Agrovet has more than Rs 10 crore pending in such subsidy payments from state governments.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!