India’s banks reported one of their best quarterly performances for the third quarter of FY23 and the final three months of the fiscal year are also looking up in terms of profitability. The system’s loan growth is at a healthy 16 percent and is likely to finish FY23 in the high teens. The aggregate net profit of 31 listed lenders was up 46 percent for the October-December period. Bad loans have been slashed, provisions have been beefed up and capital ratios are at their best in years.

So, why are bank shares getting hammered?

The sectoral index Nifty Bank has lost more than 6 percent since January while the broader Nifty is down 4.5 percent. Bank shares are dragging the market down from being the driver of market optimism in 2022. Part of this gloom emanates from the tension surrounding lenders’ exposure to Adani group companies.

What also seems to trouble investors is that the outlook for fiscal year 2023-24 is unclear when it comes to sustainability of credit growth. Numerically, a high base would result in more subdued loan growth of 11-12 percent in FY24, analysts point out. The country’s largest lender, State Bank of India (SBI), too is hoping for 10-12 percent growth next year. The exuberance of loan growth and beefed-up return ratios has been baked into valuations and investor attention is now turning to differentiating parameters.

At such a time, a key parameter that could set banks apart is their operating expense. When income growth moderates, tightening the belt on expenses is a logical way to sustain operating profits and banks would need to make this choice in the coming quarters.

Thrifty or spendthrift?

On aggregate, 31 listed banks reported a 16 percent increase in operating expenses (opex) for the December quarter. For the first nine months of FY23, the year-on-year increase in opex was 14 percent. Opex has been on the rise for most lenders given the need to strengthen technology, expand their footprint and hire personnel.

In a report, analysts at Jefferies India Pvt Ltd point out that private sector banks have led the increase in opex over the past two years. Opex has grown by more than 20 percent in FY22 for private sector banks. “Indian banks, esp. private ones, are pushing opex growth to multi-year highs (23% for 9MFY23) to utilise benefits of strong NIMs (net interest margin) & low credit costs to expand branches, staff and investment in digital platforms,” the report said.

Indeed, large private sector lenders such as ICICI Bank, HDFC Bank and Axis Bank have increased their spending to boost technological capabilities. Others, such as Kotak Mahindra Bank and IndusInd Bank, also increased spending to ramp up their branch network and tech footprint. Whether it is building a new stack for small businesses or strengthening existing tech platforms, large lenders have been spending big.

It has been the opposite in the case of public sector banks. Operating expenses have moderated, partly due to the mergers in 2020. For instance, SBI’s opex growth has averaged around 8 percent after it swallowed all its subsidiaries by FY17. To be sure, expenses increased post pandemic as the bank consciously built an in-house technological platform and the Yono application unlike many other peer banks, which started off by partnering with fintechs. The bank’s opex growth has largely been driven by the gyrations of staff costs. On the other hand, branch network and employee strength has undergone a massive change owing to mergers, keeping costs under control.

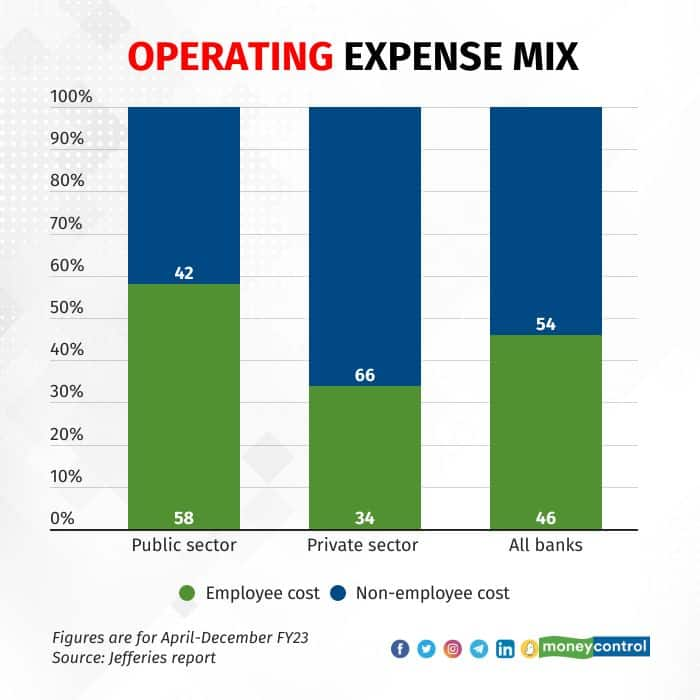

Public sector lenders have begun to spend on technology in earnest post-pandemic, but their spends have not matched those of their private sector peers. Moreover, employee benefits and wages form more than half of the expense for PSBs, unlike for private sector lenders.

No nip and tuck

For the banking sector as a whole, operating expenses are expected to stay elevated as constant tech updates and expansion plans would maintain upward pressure. “Opex is expected to remain elevated due to branch expansion, tech spends & DSA/DMA payouts, while for PSBs – adhoc provision for the new bipartite agreement and PLI-related provisions could keep cost elevated,” wrote analysts at Emkay Global Financial Services Ltd, in a note.

That said, public sector banks are more likely to be the drivers of an opex increase than private sector lenders. Private sector banks are ahead of their public sector counterparts in tech investments, having used the surge in margins and interest income wisely in the previous quarters. Government-owned banks are still in the process of building digital capacity. Further, wage revisions will trigger provisioning in the coming quarters. “Some provisions have already been made but a lot will be coming in the following months,” said an executive at a public sector bank.

The last wage revision was done in July 2020, costing banks roughly Rs 7,900 crore and the lenders had begun provisions for the same. The hike in salaries was agreed by banks and unions to be 15 percent. Expectations are that the current round may see a 10 percent hike. Jefferies expects the growth in expenses of public sector lenders to remain unchanged or even rise as they begin to provide for the upcoming wage revision of staff.

In essence, large banks with scale and heft in branch network and a tech footprint stand a better chance of maintaining operating profit growth. ICICI Bank and HDFC Bank remain preferable bets across brokerages. Analysts at Kotak believe that there is a compelling case for further rerating of bank shares over the medium term while those at Emkay note that current fall in shares presents opportunities to buy.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.