UltraTech Cement, the crown jewel of the Kumar Mangalam Birla group, plans to acquire 23 percent in India Cements for up to Rs 1,890 crore. The deal involves purchasing 70.6 million shares of India Cements at Rs 267 each. This transaction, described by UltraTech as a "non-controlling financial investment," is expected to be finalised within a month, according to a stock exchange filing.

Read: Potential hostile takeover by UltraTech brewing in India Cements?

Here’s a snapshot of how the two cement companies fared in terms of key financial metrics and stock performance.

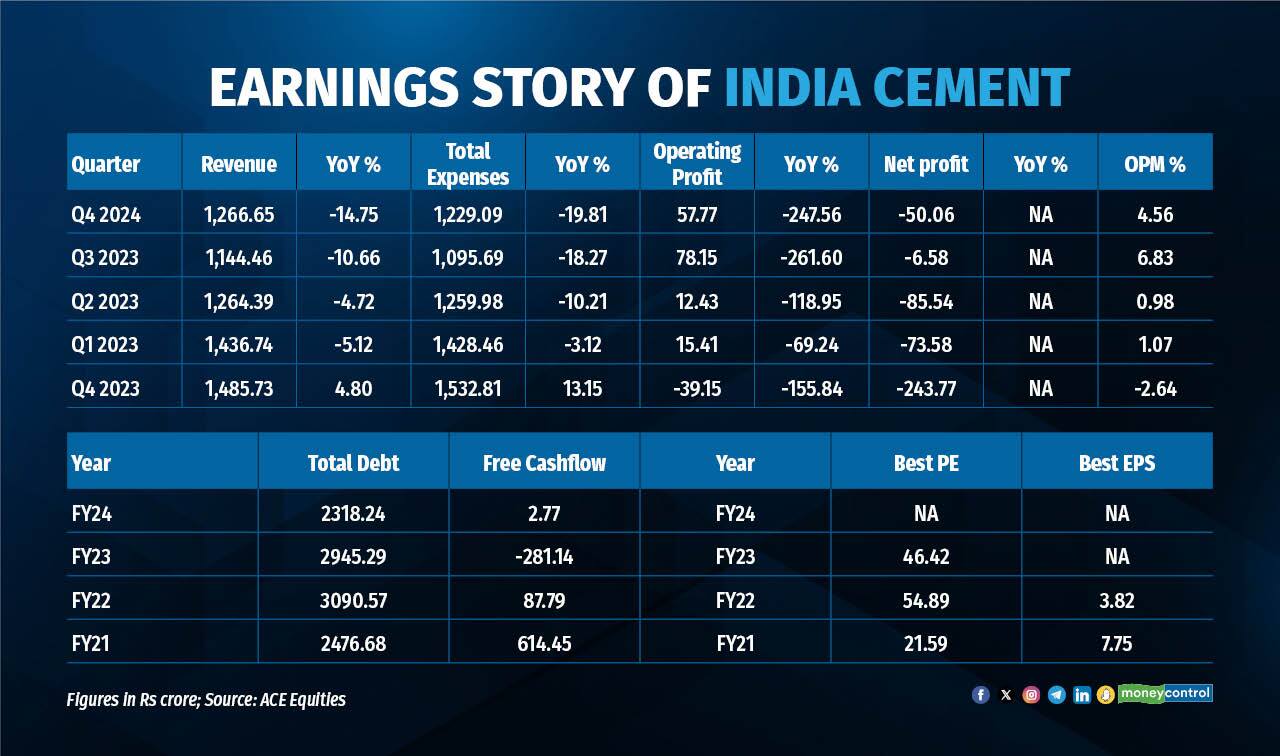

India Cements earnings

The company reported its fifth consecutive quarterly loss in the March 2024 quarter, with revenue continuing to decline year-on-year for the fourth straight quarter. The company, ranked tenth largest in the cement sector, is grappling with working capital shortages. This has been exacerbated by intense price competition following the Adani Group's entry into the industry through the acquisition of Ambuja Cements Ltd and ACC Ltd in 2022.

As of March 2024, all shares held by promoters, led by managing director N Srinivasan, were pledged with banks, up from 45 percent at the end of December 2023. In response to these challenges, India Cements has been actively taking steps to alleviate its working capital constraints, including asset sales. The company's Q4 performance reflects these efforts, showing some improvement according to experts.

The management anticipates significant relief in working capital following the recent sale of non-core and core assets such as land and a grinding plant. They have expressed cautious optimism regarding demand and pricing trends and clarified their intention not to sell further core assets for business funding, focusing instead on operational efficiencies. The management has sounded confident about resolving working capital issues and improving business operations in the coming quarters. But analysts remain watchful given the company's historical performance relative to peers.

ultra vs india cement

ultra vs india cement

UltraTech Cement earnings

India’s largest cement manufacturer reported a strong revenue growth in Q4, driven by robust demand across key markets. Improved operating leverage, favorable fuel prices, and effective cost controls contributed to margin expansion.

UltraTech Cement is aggressively pursuing acquisitions to achieve its ambitious target of increasing capacity from 147 million tonnes per annum (mtpa) to 200 mtpa. In December 2023, the company announced the acquisition of Kesoram Industries' cement assets for Rs 7,600 crore. This transaction, awaiting regulatory approvals in 2-3 quarters, includes two integrated cement units in Karnataka and Telangana with a total grinding capacity of 10.75 million tonnes (MT). Additionally, UltraTech expanded into Jharkhand through the acquisition of Burnpur Cement, adding 0.5 MT grinding capacity.

In FY24, UltraTech invested around Rs 9,200 crore in capital expenditures, increasing its domestic manufacturing capacity to about 141 MT (excluding Kesoram). The company plans to maintain a similar capex run-rate next year and aims to achieve a total capacity of around 157 MT by March 2025.

Analysts expected strong demand for cement from from rural and infrastructure sectors, alongside increasing orders from urban real estate. The management is optimistic about a prolonged favorable demand environment in the cement sector.

UltraTech's expansion plans for phases 2 (22.6 mtpa) and 3 (21.9 mtpa) are progressing as scheduled, aiming for completion by FY2027. Coupled with the acquisition of Kesoram (10.75 mtpa), this will elevate its total cement capacity to 195.4 mtpa (including overseas capacities). UltraTech is well-positioned to capitalise on the expanding cement demand expected over the next 4-5 years, with a positive outlook on profitability and balance sheet strength.

ultra vs india cement

ultra vs india cement

Stock price performance

In 2023, UltraTech Cement significantly outperformed India Cement in terms of stock performance. However, this year both stocks are closely aligned, with each gaining around 11 percent.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.