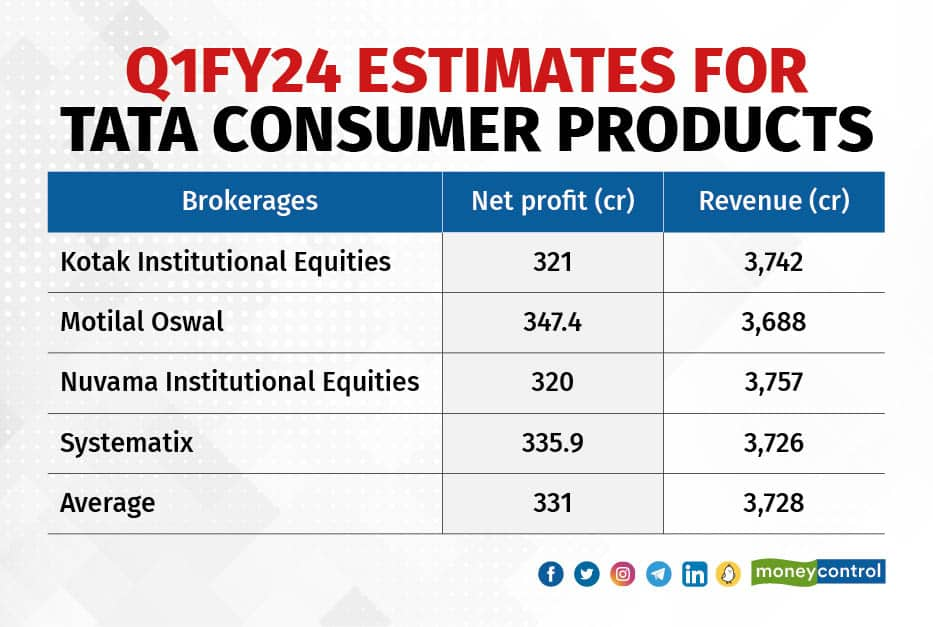

Tata Consumer Products is expected to report a consolidated net profit of Rs 331 crore in Q1FY24, up 11.7 percent year-on-year (YoY) and 13.5 percent sequentially, according to average estimates of four brokerage firms. Tata Consumer Products will announce its results for the April to June quarter on July 26.

Consolidate revenue is expected to be at Rs 3,728 crore in the April to June quarter, which is a 12 percent increase YoY and a 3 percent increase sequentially. Operating margins or Earnings Before Income Tax Depreciation and Amortisation margins (EBITDA) is forecasted to be 14.7 percent. This is a 58 basis points increase YoY and 19 bps increase on a quarter-on-quarter (QoQ) basis.

A 5 percent volume growth is expected in tea business in Q1FY24.

Kotak Institutional Equities estimates a 60 bps decline sequentially in gross margins partly due to rising tea prices during the quarter. Leaf tea prices in South India has increased 10 percent YoY in Q1FY24, according to Incred Research. Leaf tea prices in North India however, fell 6.1 percent YoY in the same period.

Also Read: Cash Market | Tata Consumer shows a break out of a "flag" trend continuation patternAnalysts expect Nourishco and Sampann business to do well in the April to June quarter. Nourishco brand has products like Himalayan water and Tata Gluco Plus. “We expect the Nourishco and Sampann businesses to register strong growth. For Sampann, we expect pricing-led growth on the back of increased prices for pulses and poha,” said Nuvama Institutional Equities in its Q1FY24 preview. The brokerage firm further said that for Nourishco, Tata Copper and Himalayan water is expected to clock high sales whereas Gluco and Fruski sales will be a bit muted due to unseasonal rainfall during the quarter.

International businessGross margins for Tata Consumer Products’ international business will remain under pressure on account of high coffee costs, said Nuvama Institutional Equities. However, EBITDA is expected to be better due to a cut in advertisement spends and other costs, said the brokerage firm.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.