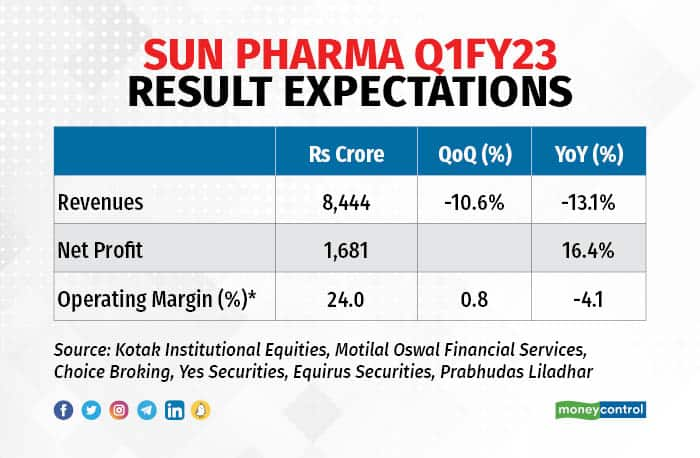

Sun Pharmaceutical Industries Limited (Sun Pharma) is expected to declare a growth of 16 percent year-on-year (YoY) in its consolidated profit after tax (PAT) for the quarter ended June 2022. The consolidated revenues however, are expected to skid 13 percent on-year.

On a sequential basis, the revenues are seen declining 10.6 percent.

The Mumbai-based drug maker will be declaring its quarterly results for the June quarter on July 29.

The company is expected to report a consolidated PAT of Rs 1,681 crore on consolidated revenues of Rs 8,444 crore for the quarter, according to an average of estimates of six brokerages polled by Moneycontrol.

The company had registered a consolidated PAT of Rs 1,444 crore during the corresponding quarter of last year on revenue of Rs 9,719 crore. The profit for the quarter had exceptional charges of Rs 631 crore towards settlement charges of a lawsuit related to its subsidiary in the US, and impairment charges. Adjusting for the exceptional items, PAT for the quarter would have been higher at Rs 2,075 crore.

During the January-March period, the company had reported a consolidated loss of Rs 2,277 crore and revenue of Rs 9,447 crore. However, the profit had an exceptional expense of Rs 3,936 crore towards settlement of a lawsuit in the US related to its subsidiary, Taro Pharmaceuticals, impairment of assets, one-time charge of restructuring of operations in certain countries, etc. Adjusting for this exceptional expense, the company was in a profit of Rs 1,659 crore.

The YoY growth is likely to be driven by growth in US business, strong performance from specialty product portfolio, and modest growth in domestic formulations (ex-COVID) on a high base of COVID last year. The margins are set to decline on-year due to rise in raw material costs, freight and other expenses.

Brokerage firm Motilal Oswal Financial Services, says, “Expect the US sales to grow 8 percent YoY to $410 million as strong execution in specialty sales offset to some extent by flat sales YoY at Taro.” It expects domestic formulation sales to decline 10 percent YoY due to reduced COVID-related offtake.

Kotak Institutional Equities, on the other hand, “builds in $391 million US sales (up 1 percent QoQ) in Q1FY23 as we expect Pentasa contribution and gradual specialty uptick to be largely offset by higher generic price erosion”. Ex-COVID, it builds 12 percent YoY domestic growth for the company in Q1FY23.

Experts expect the company to secure earnings before interest, tax, depreciation and amortisation (EBITDA) margins of 24 percent for the quarter, registering a YoY decline of 410 bps. On a sequential basis, the margins are seen improving by 80 bps.

“Owing to RM inflation, higher marketing expenses, freight costs and the Alchemee integration, we bake in 370 bps lower EBITDA margins YoY (up 144 bps QoQ) at 24.5 percent,” said a report from Kotak Institutional Equities. On a sequential basis, it expects Sun's Q1FY23 EBITDA to grow 14 percent on-quarter.

Experts would be keenly watching for an outlook on specialty portfolio scale-up across key markets and its update on progress of clinical trials for additional indication(s) of Ilumya. Commentary on margins will also be a key monitorable along with the outlook for tender-business.

Sun Pharma closed flat at Rs 894.85 on July 28 at the National Stock Exchange. The stock has generated returns of 30 percent over the past one year and is trading higher by 8 percent over the past one month.

Disclaimer: The views and investment tips of investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!