Centrum Research expects Asian Paints, Bajaj Consumer, Britannia Industries, Colgate Palmolive, Dabur India and Hindustan Unilever to register 11.4 percent YoY revenue growth in Q4, despite a higher base last year. It feels that new rural off-take could continue to outpace the all-India average, with total rural growth still remaining ahead of urban.

Outlook:

Centrum believes concerns about a slowdown are likely to be short-lived. Volume growth could even surprise positively, driven by PM-Kisan cash transfers and focus on rural development. Moreover, consumption in the top 12 metros could continue to outpace all semi-urban towns, largely driven by an uptick in demand through modern trade.

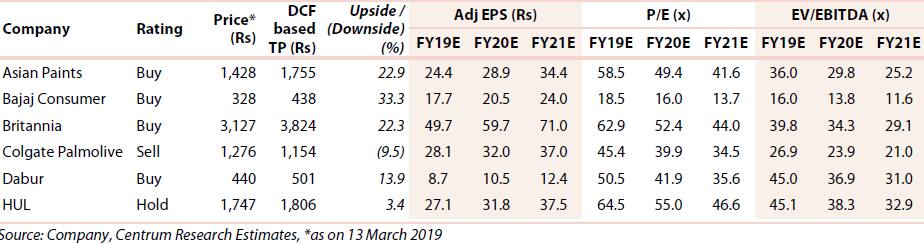

The research firm prefers companies with improving distribution networks, innovative products meeting rural demand and those gaining market share. The top picks among the six are Britannia, Asian Paints and Bajaj Consumer Care, it said.

Volume growth is key:

Centrum believes that prevailing product prices are still lower than pre-GST, which could be supporting volume growth. The lower prices could be attributed to (1) benign raw material prices including lower crude oil, (2) focus on internal cost efficiencies and (3) due to competition from regional players.

According to the research firm, Q4 domestic volume growth assumptions are: HUL (7.5 percent), Dabur (9.5 percent), Britannia (9.5 percent), Colgate (7 percent), Asian Paints (12 percent) and Bajaj Consumer Care (10.2 percent), despite a high base last year. There are, however, concerns about subdued demand conditions due to macro headwinds. A few companies have reported that trade funding issues impacted demand, especially in the wholesale channel.

The research firm suggests an uptick in 'new rural' and does not rule out volumes surprising on the upside due to high promotional intensity across modern trade and e-commerce channels in highly penetrated categories such as laundry, soaps, hair oil and toothpaste.

EBITDA margin likely to inch up:

On margins, Centrum expects stable-to-slightly higher gross margins YoY. EBITDA margin trend is likely to be a mixed bag. It estimates an average 12.2 percent EBITDA growth.

It estimates EBITDA margins of 19.2 percent for Asian Paints, 15.2 percent for Britannia, 22 percent for Dabur and 29.1 percent for Colgate, 22.9 percent for HUL and 30 percent for Bajaj Consumer Care.

What to watch for:

According to the research firm, the sector may witness a few positive and some negative surprises including

1) Change in royalty rates – although SEBI has extended the deadline by three months, note that companies charging a royalty rate above 2 percent would require minority shareholders’ approval.

2) Lower inflation may result in an uptick in volume growth in rural regions owing to rising household incomes.

3) Product innovation and renovation may arrest slowing demand.

4) The launch of new product/categories may contribute to revenues.

5) Escalating competition may impact margins given higher A&P spends.

6) There could be staggered price increases due to input cost pressure.

Top picks:

Centrum Equity Research prefers Britannia Industries, Asian Paints and Bajaj Consumer Care.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.