State-run power utility NTPC Limited is likely to report an 11 percent on-year growth in standalone net profit on October 29, when it will declare its results for the quarter ended September 2022. Revenue for the quarter is likely to jump more than 20 percent, driven by higher generation and commercialisation of 3 GW of additional capacity during the trailing twelve months (TTM).

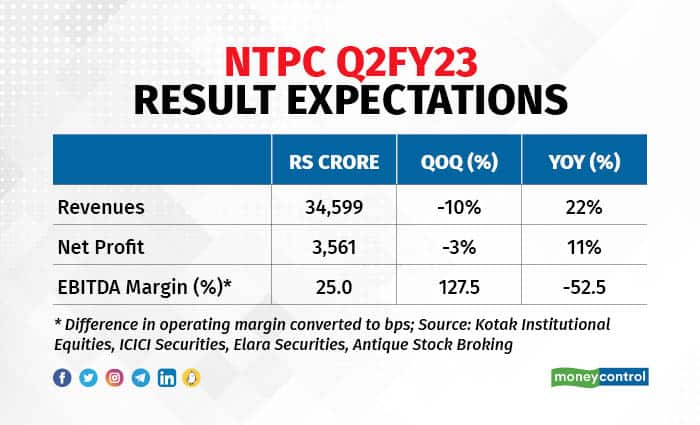

According to a poll of brokerages conducted by Moneycontrol, the standalone post-tax profit for India’s largest power generator is expected to be around Rs 3,560 crore. Experts hope that the company will report a standalone revenue of Rs 34,600 crore.

On a sequential basis, the profit is likely to decline 3 percent and revenues 10 percent because of slightly lower generation and lower sale of power after the peak months of April to June.

The state-owned utility had recorded a standalone PAT of Rs 3,212 crore during the same quarter last year on a revenue of Rs 28,329 crore.

During the April to June 2022, the standalone PAT for the company came in at Rs 3,676 crore, when it had achieved a revenue of Rs 38,350 crore.

Coal Production

NTPC continues to demonstrate an increasing trend in coal production from its captive mines and is expected to register a 62 percent year-on-year growth in ouput.

“The coal production in this fiscal till August 2022, was 7.36 million metric tonnes (MMT), posting a robust growth of 62 percent when compared to 4.55 MMT achieved in the same period of the last year,” Antique Stock Broking Ltd said in a report.

Power Generation

NTPC’s standalone generation increased 8.2 percent on-year to 80.5 billion units (BUs) in the second quarter this year, aided by higher coal plant load factor (PLF) and gross standalone commercialisation of 3GW capacity in TTM.

Sale and Realisations

During the quarter, NTPC sold 74.8 BUs, registering a growth of 8 percent on-year but, on a sequential basis, there was a decline of 7.8 percent in the total power sold by the company.

The company is likely to achieve an average realisation of Rs 4.4 per KWH (kilowatt hour) for the quarter, which was 7.5 percent higher than the average realisation of Rs 4.1 per KWH it achieved during the same period last year.

The average realisation, however, is lower by 7 percent from that of Rs 4.7 KWH achieved in the previous quarter.

Revenue and Profit

Regulated companies such as NTPC may post higher growth in their regulatory business on increased capacity.

“NTPC’s Q2FY23 revenues are estimated to increase on-year as it will likely benefit from high plant availability and gross generation (up 8.2 percent YoY) due to higher demand and incremental earnings from new capacity commissioned in TTM,” said a report from ICICI Securities.

It expects the company to report a revenue of Rs 32,886 crore. “Recurring PAT is likely to increase 10 percent YoY mainly due to higher commercial capacity and may come in at Rs 3,704 crore,” it said.

Factors to Watch

The investors would be keenly looking for the update on renewables, the progress of under-construction projects and their commissioning schedule. Outlook on fuel requirement and coal imports would also be a key monitorable.

NTPC was trading Rs 2.9 higher at Rs 173.55 at 12.42 pm on October 28 at The National Stock Exchange. The stock has generated returns of 26 percent over the past one year and has gained ~10 percent over the past one month.

Disclaimer: The views and investment tips of investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.