Mutual funds took a hit of Rs 4,300 crore on October 12 due to a 4.3 percent drop in stock prices, triggered by Infosys reducing revenue forecasts. This follows Tata Consultancy Services' (TCS) cautious outlook and raises worries about ongoing cuts in software spending by companies.

The stock dropped 4.3 percent in the opening and hit a low of Rs 1,402.10 a share. At 9.30am, the stock was trading at Rs 1,430 on the BSE, down 2.3 percent from its previous close.

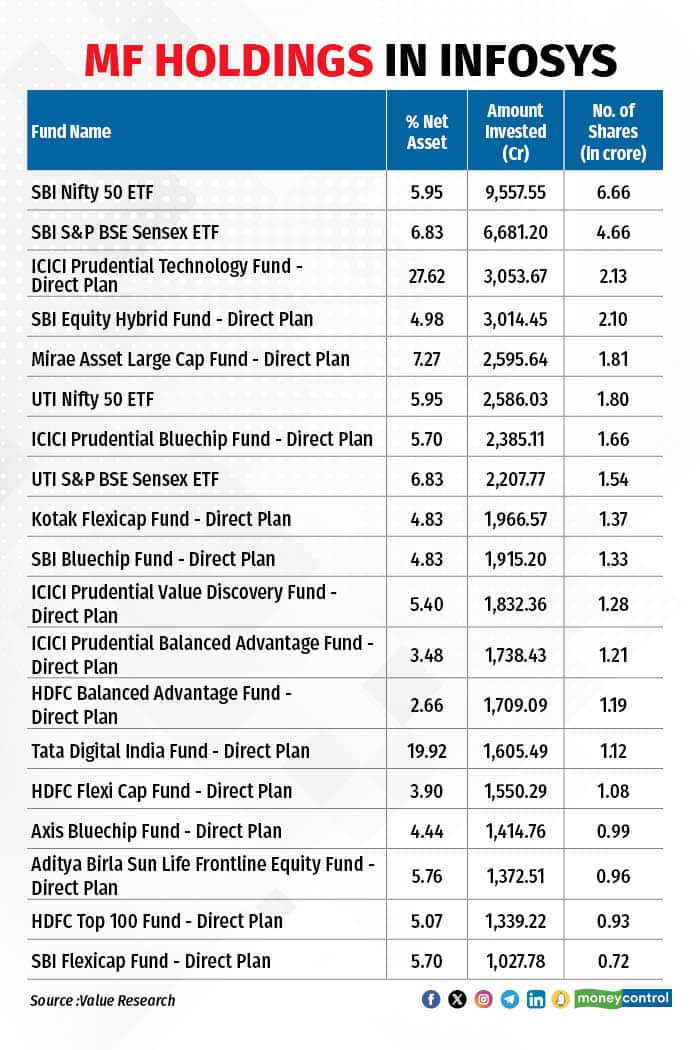

Around 460 mutual funds held cumulatively 688.12 million shares or 18.63 percent stake in the company as of June 2023 quarter. The aggregate value of these holdings stood at over Rs 96,480 lakh crore as of October 13 compared to over Rs 1 lakh crore on October 12. These mutual funds include, SBI Mutual Fund, UTI Mutual Fund, HDFC Mutual Fund, Aditya Birla Sun Life Trustee, ICICI Prudential Mutual Fund, among others.

Currently, Infosys has 21 buys, 15 holds and 9 sell calls according to Bloomberg.

Read: Infosys headcount shrinks by 7,530 in Q2, third consecutive quarter of decline

On October 12, Infosys Ltd, India's second-largest tech services provider, lowered its 2023-24 growth guidance for the second time. They now anticipate growth of 1-2.5 percent in constant currency terms, ignoring exchange rate fluctuations. Initially, they projected 4-7 percent growth in April, which was later revised to 1-3.5 percent in July. Despite achieving 3.7 percent growth in April-September with $336 million in incremental revenue, the management's 2023-24 expectation of at-best 2.5 percent growth implies a revenue decline in the third and fourth quarters.

"Infosys surprised on the downside for the third straight quarter by again moderating the guidance (now at 1-2.5 percent CC), unprecedented in its recent history. While we see this as negative from a sentiment perspective and expect near term pressure on share price, we were already anticipating muted FY24 revenue growth (MOFSLe at 2.6 percent YoY CC before results)", said Motilal Oswal Securities in its latest note.

The company's quarterly revenue reached $4.72 billion, surpassing analyst expectations with a 2.2 percent sequential increase and a 3.6 percent rise compared to the previous year. As a result, net profit improved by 3.7 percent sequentially and 0.3 percent year-on-year, reaching $751 million. Strong deal wins of $3.7 billion in 2QFY24 and a 44 percent year-on-year increase in trailing 12-month deal wins were notable, although many of these deals have longer durations and are expected to ramp up toward the end of FY24F, according to analysts.

Read: Infosys reels under pressure as stock down 4.5% after surprise guidance cut

"Guidance cut is a disappointment and captures the weak discretionary spending. Even as the outlook on discretionary spending is uncertain, Infosys has won a fair share of large deals to provide some visibility for FY2025E growth. We cut FY2024-26 revenue estimates by 1-2 percent and EPS estimates by 1-2 percent. We tweak FV to Rs1,700, valuing the stock at unchanged 22X multiple in September 2025E earnings", said Kotak Institutional Equities in its recent note.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.