SUV major and one of India's largest EV players, Mahindra and Mahindra, is set to release its earnings report for the first quarter of FY26 on July 31. Analysts expect an uptick in revenue, driven by a strong product mix, better auto/farm volume growth and realisation. On the flipside, margins are likely to witness a slight decline during the quarter.

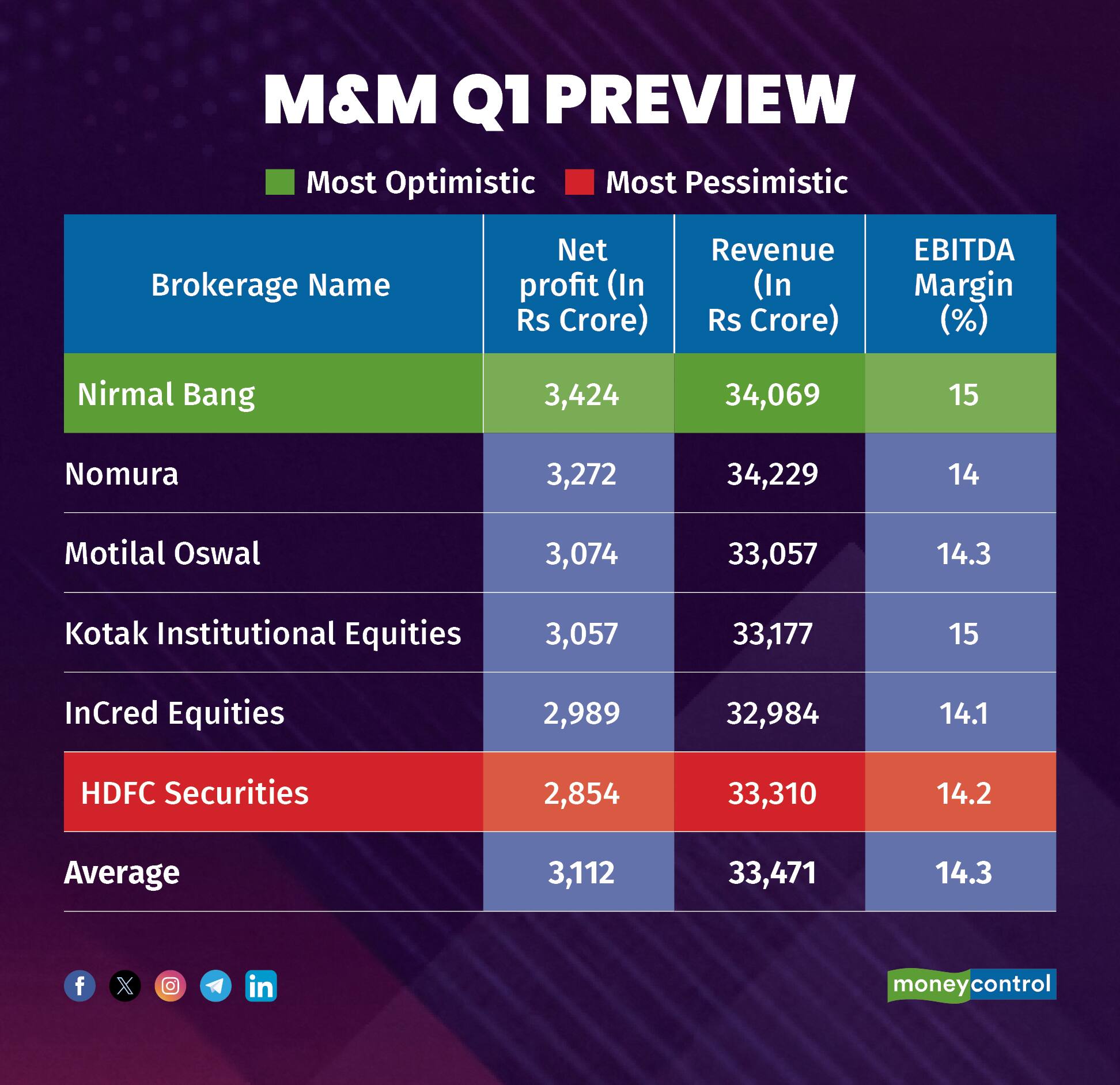

According to a Moneycontrol poll of six brokerage firms, the automaker’s revenue is likely to rise 24 percent year-on-year to Rs 33,471 crore. Net profit is projected to jump 19 percent to Rs 3,112 crore, up from Rs 2,613 crore in the year-ago period.

Earnings estimates from analysts polled by Moneycontrol are in a diverse range, indicating that any positive or negative surprises could trigger a sharp reaction in the stock price. Most optimistic brokerage -- Nirmal Bang -- has forecasted a 36 percent increase in net profit. On the flipside, HDFC Securities -- the most pessimistic brokerage -- projects a 9.2 percent rise in net profit.

What factors could aid Mahindra and Mahindra's earnings?Strong Volumes: Automotive revenues are projected to grow 27 percent, supported by a 17 percent rise in volumes, led by robust demand in the SUV and export segments. Tractor segment revenues are likely to increase 13 percent, aided by a 10 percent volume growth.

Rich Mix: The Thar maker is expected to witness a rise in average selling prices (ASPs) in the tractor segment by 2 percent, while ASPs in the automotive segment may rise 8.5 percent, reflecting a higher share of EVs and a lower contribution from LCVs.

Margin Pressure: Analysts across brokerages expect EBITDA margins to trim. The Moneycontrol poll forecasts a 60 basis points drop driven by an increasing share of electric vehicles in the mix and rising steel prices.

"In the passenger vehicle segment, M&M will likely be the only player to report strong double-digit growth in UVs at 22 percent year-on-year on the back of new launches," Motilal Oswal said in its preview note.

Key areas to watch include the volume ramp-up plans for the BE.06 and XUV.e9, guidance on tractor volumes, and insights into rural demand trends. Investors should also keep an eye on the company's margin trajectory and its strategy to navigate the rare-earth magnet supply crisis, which could impact both costs and production, given M&M's high focus on EVs.

M&M shares were trading at Rs 3,215, up 0.2 percent from the last close on the NSE. M&M shares are up 7 percent since the beginning of the year.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.