Kotak Mahindra Bank is expected to report a modest performance for the January–March quarter (Q4FY25), supported by stable asset quality, although margins are likely to shrink, according to analysts. The private bank is scheduled to release its Q4 results on May 3, 2025.

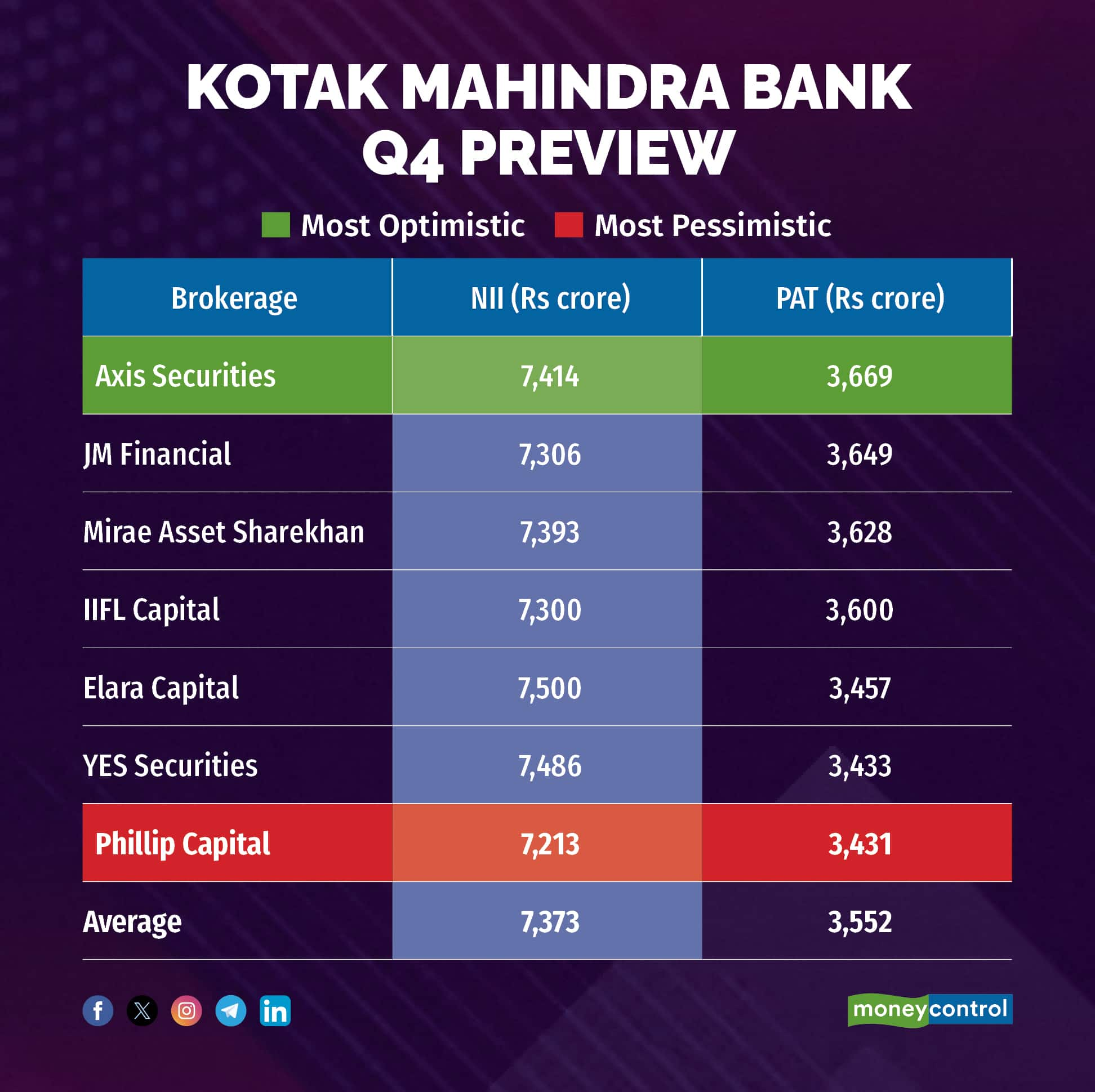

According to Moneycontrol's poll, Kotak Bank’s net interest income (NII) is likely to grow by 7 percent year-on-year (YoY) to Rs 7,313 crore, compared to Rs 6,909 crore in the same quarter last year. The bank’s profit is expected to increase by 2 percent YoY to Rs 3,552 crore in Q4FY25, as against Rs 3,484 crore in Q4FY24.

Estimates of analysts polled by Moneycontrol are shown to be in a narrow range, meaning any positive or negative surprises may elicit a sharp reaction in the stock price. Among the brokerages polled, Axis Securities rolled out the most bullish projections while Phillip Capital forecasted the slowest growth for Kotak Mahindra Bank.

What factors are driving the earnings?Margin contraction: Analysts at Phillip Capital believe that a drop in the repo rate will hurt margins, since a large part of Kotak Bank’s loan book is linked to floating interest rates. They expect net interest margins (NIMs) to fall by 44 basis points, from 5.28 percent in Q4FY24 to 4.84 percent in Q4FY25.

Healthy loan growth: According to Mirae Asset Sharekhan, the bank is expected to post a healthy 15 percent YoY loan growth in Q4FY25, which should support overall earnings.

Stable asset quality: Most brokerages expect the bank’s asset quality to remain steady in Q4FY25. The net non-performing asset (NNPA) ratio is expected to stay firm at 0.42 percent, compared to 0.41 percent in Q3FY25.

What to look out for in the quarterly show?Investors will closely watch the management’s commentary on net interest margins, along with the bank’s growth outlook—particularly in the unsecured loan segment, now that the regulatory ban on its digital business has been lifted.

During the January–March period, shares of Kotak Mahindra Bank soared by 21 percent, significantly outperforming the Nifty 50 index, which rose by 3 percent during the same timeframe.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.