JSW Steel Ltd is expected to report a drop in net profit for the June quarter due to weak revenue, despite lower raw material costs providing some relief. Earnings will be announced on July 19.

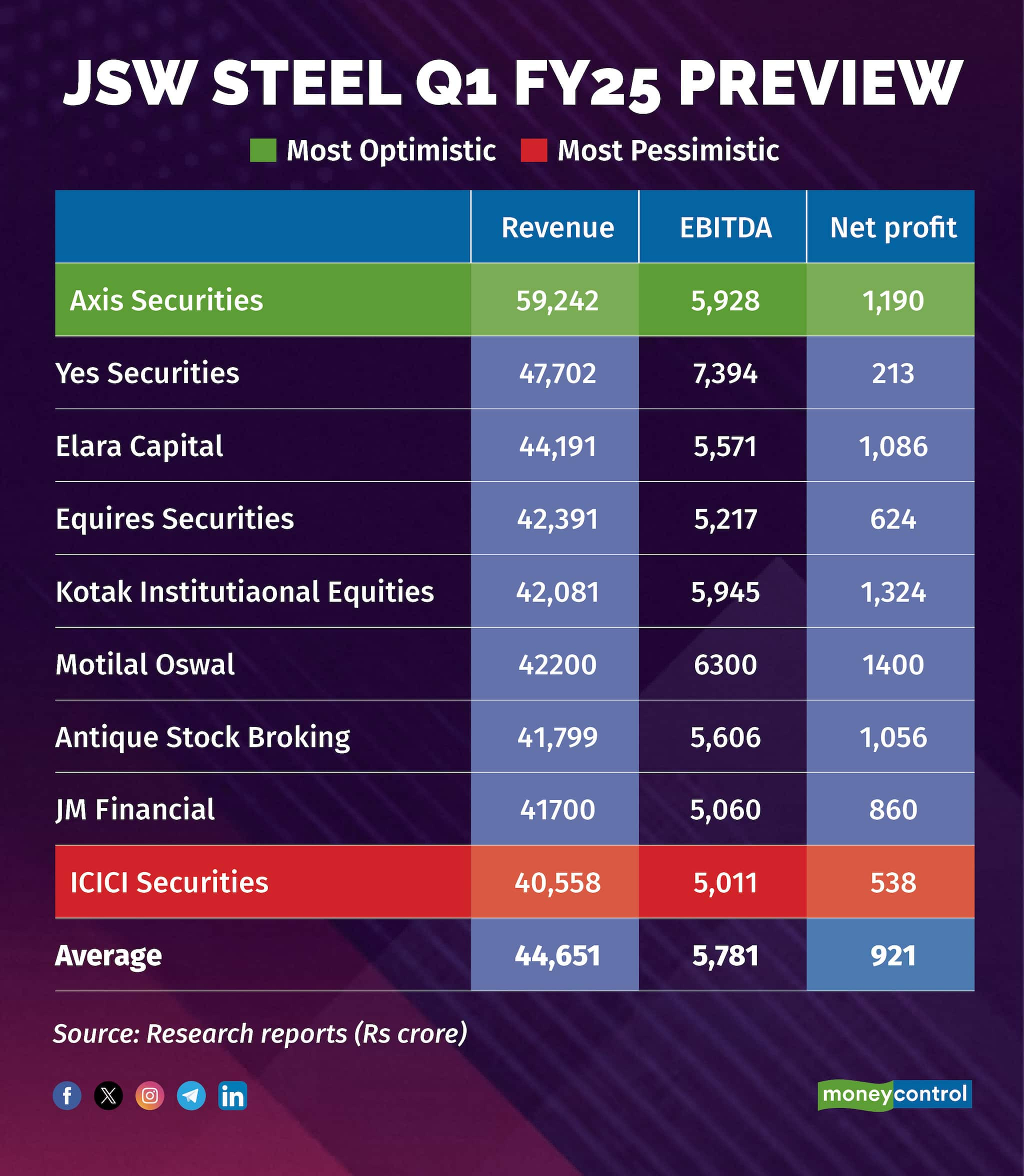

JSW Steel's consolidated net profit for the June quarter is expected to be Rs 921 crore, down 29 percent sequentially and 61 percent year-on-year, based on nine brokerage estimates polled by Moneycontrol.

Consolidated revenue is projected at Rs 44,651 crore, down 3.5 percent QoQ but up 5.77 percent YoY. EBITDA is likely to be Rs 5,781 crore, down 5.6 percent QoQ and 18 percent YoY.

What factors are driving the earnings?Mixed forecasts: Some brokerages expect sales realisation to have been high enough for sequential revenue growth, while others believe realisation couldn't offset the volume decline.

Antique Stock Broking expects consolidated revenue is expected to remain largely stable YoY with higher volumes offsetting lower realisation.

Consolidated EBITDA at Rs 5,610 crore is expected to decline 20 percent YoY and 8.5 percent QoQ impacted by higher iron ore costs partially offset by lower coking coal costs coming in with a lag.

Volume expectations: Kotak Institutional Equities expect the firm to report standalone volume of 5.1 mn tons (up 4 percent YoY, down 10 percent qoq).

The brokerage house estimates steel realisations to increase by 0.3 percent qoq ( down 6.3 percent YoY) on account of product mix. It estimates standalone EBITDA/ton to increase sequentially to Rs8,556/ton ( down 13 percent YoY, up 9.6 percent QoQ), led mainly by lower raw material costs during the quarter.

"We expect standalone realisations to decline by 0.8 percent qoq as price increase in longs were offset by weakness in other products coupled with lower realisation in export markets. However, lower coking coal costs sequentially should lead to cost savings and expect standalone EBITDA/t to increase by 3.1 percent qoq to Rs 8,051/t in 1QFY25E. We expect lower profitability sequentially in subsidiaries mainly on account of lower prices", Equires Research said in its note.

What to look out for in the quarterly show?Key points to watch include JSW Steel's outlook on the domestic and international steel markets, the impact of increased Chinese steel exports, raw material cost guidance for Q2, and expectations for volumes and ramp-up timelines. Additionally, the performance of domestic and overseas subsidiaries and management's comments on capex and timelines will be crucial.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.