Diversified FMCG-to-cigarettes conglomerate ITC will report its earnings for the third quarter of the current fiscal year on February 6, 2025. The FMCG player is likely to report the highest revenue among all its listed peers.

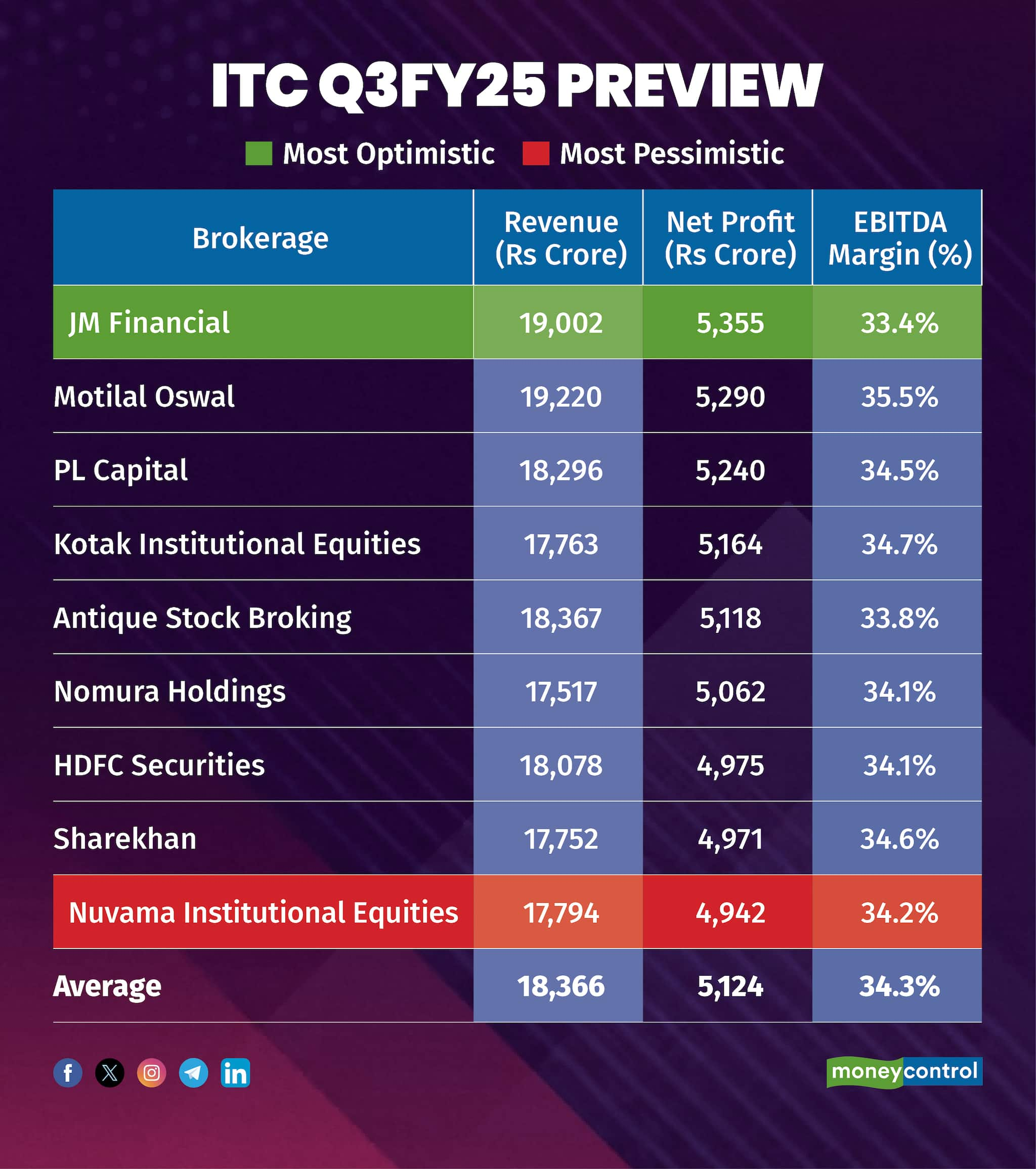

According to a Moneycontrol poll of nine brokerages, ITC is likely to report revenue of Rs 18,366 crore, rising 11.4 percent year-on-year compared to Rs 16,483 crore in the October to December quarter of FY24.

Net profit is likely to come in at Rs 5,124 crore in Q3FY25 as against Rs 5,578 crore in the year-ago period, a degrowth of 8.1 percent.

Earnings estimates of analysts polled by Moneycontrol are in a narrow range, so any positive or negative surprises may elicit a sharp reaction in the stock. Even the most optimistic estimate sees ITC’s net profit slipping 4 percent year-on-year, while the most negative projection sees a fall of 11.4 percent in net profit for the quarter.

What factors are impacting the earnings?ITC’s FMCG and cigarettes segments are expected to perform well, but agri and paper arms could be a drag, noted brokerages.

Profit hit by high base, tax credit: As a result of a low effective tax rate in Q3FY24, where ITC saw a tax reversal of around Rs 470 crore, the profit is likely to see a fall on a high base.

Cigarettes: For the quarter ended December, cigarette volumes are likely to rise around 3.5 percent, according to most brokerages. The revenue for tobacco segment might see a seven percent jump on-year. ITC is also seeing fierce competition from peers in this sector.

Segments: The FMCG business is likely to report 5 percent growth, while hotels should report strong 12 percent revenue growth. The agri business should report strong growth in revenue while profitability would be muted due to rise in commodity prices. Paper performance could be muted.

Margins: Cigarette margins will be under pressure as a result some inflation in leaf tobacco and other raw material inputs. FMCG margins will decline on-year as price hikes have lagged commodity inflation. Overall, EBITDA margins are expected to remain flat or see a marginal decline.

What to look out for in the quarterly show?Analysts will closely monitor demand in metro areas compared to the rural outlook, along with the competitive intensity.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.