Madhuchanda Dey

Moneycontrol Research

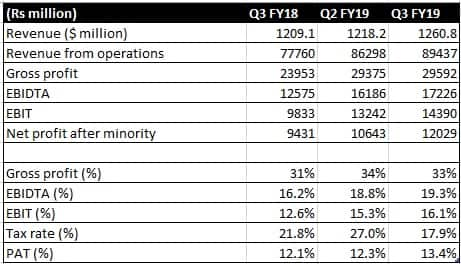

Tech Mahindra reported a very strong set of numbers for Q3FY19 that was marked by strong traction in revenue, improvement in operating margin and business traction.

Source: Company

Revenue in reported currency at $1,260.8 million exhibited YoY and sequential growth of 4.3 and 3.5 percent, respectively. In fact, the sequential revenue growth in constant currency was a strong 4.3 percent.

The growth was supported by both communications as well as enterprise with the former growing 2.5 percent sequentially on the top of a good growth registered in the previous quarter. Enterprise also aided with a robust 4 percent quarter on quarter growth. Manufacturing, retail, transport and logistics were the drivers within the enterprise.

In terms of geographies, the Americas and the rest of the world (RoW) was strong whereas Europe was a tad soft.

The company continued to see an improved margin trajectory with operating margin jumping 50 basis points sequentially to 19.3 percent. The improvement in utilisation and fall in sales and marketing expenses were worth taking note of.

Client matrix also showed improvement with the company adding one net new client in the top brackets of $50 mn and $ 20 mn plus.

The continued rise in attrition rate was noted and will have to be monitored.

The stock looks reasonably valued at 14X FY20e (estimated) earnings.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.