ABB India, which is expected to announce its Q3 results on November 4, is likely to report a 17 percent YoY increase in revenue to around Rs 3,243.1 crore on the back of order inflow, strong execution in Motion & Electrification segment and momentum in new areas.

The company follows the January to December financial year.

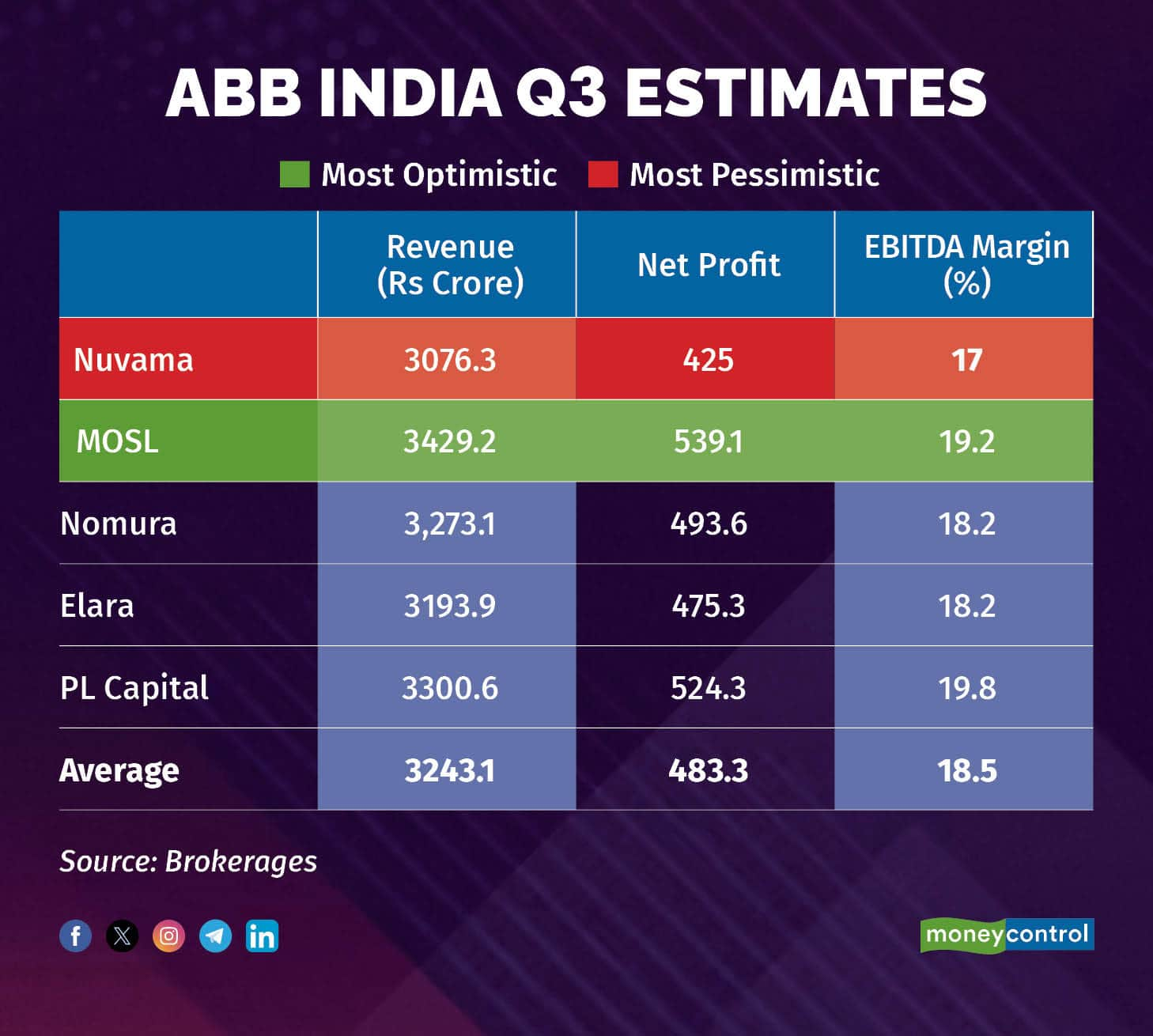

Based on the average of five brokerages, net profit is expected to see a 10 percent YoY increase to Rs 483.3 crore, and an EBITDA margin expansion from 15.8 percent in Q3FY24 to 18.2 percent in the reporting quarter.

According to estimates, Nuvama predicts ABB India's Q3 revenue at Rs 3,076.3 crore, net profit at Rs 425 crore, and an EBITDA margin of 17 percent, which is the most pessimistic. Motilal Oswal Securities, on the other hand, provides the most optimistic estimate with a revenue of Rs 3,429.2 crore, a net profit of Rs 539.1 crore, and an EBITDA margin of 19.2 percent.

Analysts at Prabhudas Lilladher, which has an Accumulate call on the stock, note that ABB India’s prospects will continue to remain strong driven by increasing demand for its energy-efficient and premium products, its focus on high-growth industries and robust domestic order pipeline. They estimate the company to report a revenue CAGR of around 22.6 percent over CY2023 and 26E.

Over the last year, ABB India's stock has gained around 82.74 percent and closed at Rs 7,410 on October 31.

What will impact the earnings

Here is what brokerages say could impact ABB India's earnings.

Order pipeline

Most brokerages remain positive on the stock on the back of strong order flows. Analysts at Motilal Oswal Securities estimate ABB to be the key beneficiary of an improved addressable market for short-cycle orders from the private sector as well as transmission, railways, data centres, and PLI-led spending.

Similarly, analysts at Nuvama state, "Short-cycle momentum in new orders and margins are expected to sustain given order inflows coming off new-age areas such as data centres, electronics, warehouse/logistics, railways/metros, etc. is driving growth and operational efficiency and therefore offsetting weakness from moderate growth areas."

Elara estimates that the revenue may surge 15 percent YoY on a healthy backlog.

Prabhudas Lilladher notes that the order inflows for the quarter are likely to be led by the Electrification, with continued traction in large orders from data centers. The report adds that management commentary on base order inflow and data center demand will be key monitorable.

Improved product mix and localisation

Nomura analysts expect that the margin is likely to sustain above 18 percent led by an improved product mix supported by premiumization trend, higher capacity utilization, increasing localization and moderation in commodity prices.

What to watch out for: Expansion and investments in new areas and order outlook.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.