Coal India is anticipated to report a softer net profit for the December quarter (Q3FY25), primarily due to reduced realisations driven by weaker e-auction premiums. This impact is expected to be partially mitigated by higher total offtake volumes. The state-run coal miner's Q3 earnings report is scheduled for a release on January 27.

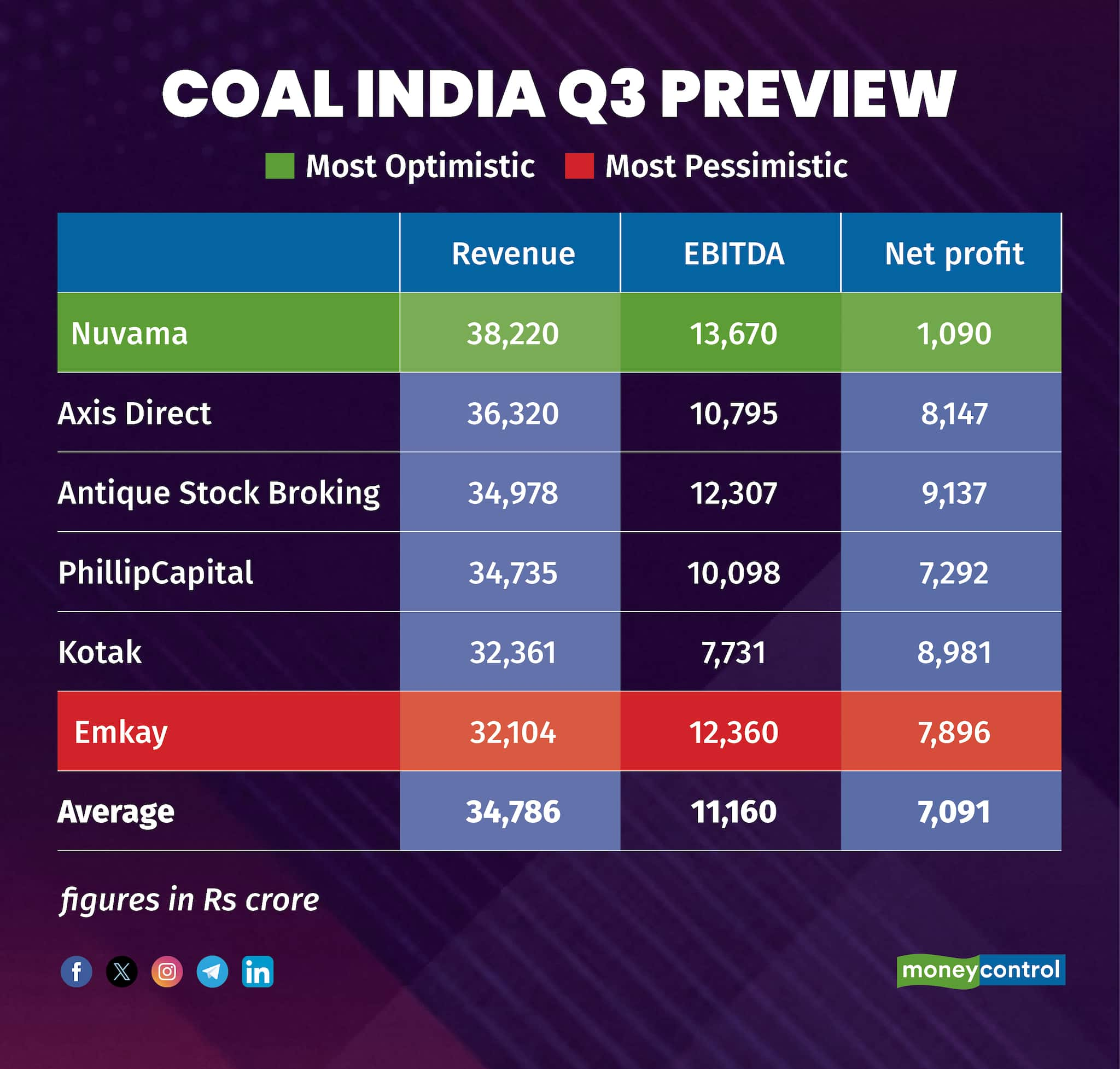

A Moneycontrol poll of five brokerages estimated net profit to decline 22 percent year-on-year (YoY) to Rs 7,090.5 crore but may register a sequential (quarter-on-quarter, QoQ) growth of 13 percent. Revenue is forecasted to decrease by 4 percent YoY to Rs 34,786 crore but rise sequentially, according to five brokerages polled by Moneycontrol.

Earnings before interest, taxes, depreciation, and amortization (EBITDA) are expected to fall 2 percent YoY to Rs 11,160 crore but improve 29.5 percent QoQ, supported by higher volumes. Sequentially, improved volumes have been the key driver of EBITDA recovery.

Coal India produced 202 million tonnes (MT) in Q3FY25, reflecting a 2 percent YoY increase and a robust 32.8 percent QoQ growth compared to 152 MT in Q2FY25. Subsidiaries such as SECL and MCL contributed significantly to this incremental production. Deliveries grew to 193 MT in Q3FY25, up 1 percent YoY and 16.1 percent QoQ, with SECL and NCL driving the increase.

What factors are driving the earnings?

Experts noted that although e-auction premiums may be lower than in the base quarter, leading to a decline in profitability, the impact is partially mitigated by higher total offtake volumes. EBITDA is expected to decrease year-on-year, driven by weaker realidations stemming from reduced e-auction premiums.

Blended realisations: Average blended realizations stood at Rs 1,660 per tonne, a 4 percent YoY decline, largely due to a sharp drop in e-auction realizations.

E-auction volumes: Experts estimate e-auction sales accounted for 8.2 percent of total offtake in Q3FY25, consistent with Q3FY24. However, e-auction realizations weakened significantly to Rs 2,465 per tonne, down from Rs 3,321 per tonne YoY.

Higher offtake volumes: Sequential improvement in offtake, up 16 percent QoQ, supported EBITDA growth despite weaker realizations.

What to look out for in the quarterly show?

In Coal India’s quarterly performance, key aspects to watch include e-auction realizations, which have been under pressure and are crucial for profitability. The volume mix, particularly the share of e-auction volumes in total offtake, will also be significant. Additionally, the interim dividend announcement will be a key highlight to watch for in the quarterly report.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!