Jitendra Kumar Gupta

Moneycontrol Research

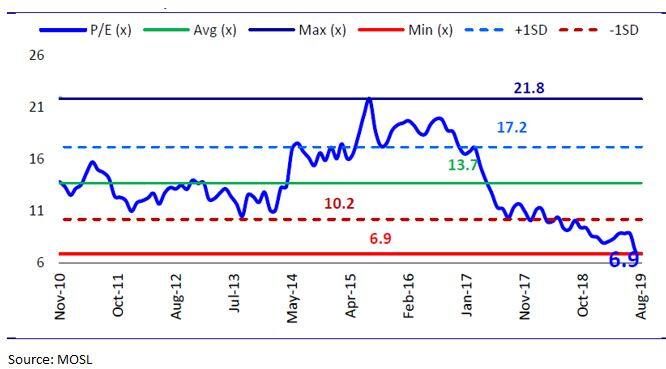

If one can live without the excitement often driven by growth, Coal India at 9-10 percent dividend yield is a good option. While earnings growth remains elusive, a 33 percent correction in the past one year has brought the stock below its historical valuations.

Coal India, which is sitting on a cash of close to Rs 33,000 crore or 27 percent of its market capitalisation, is trading at 7.2 times its FY21 estimated earnings.

In 2019-20, it is expected to earn profit of close to Rs 17,000-18,000 crore on net worth of about Rs 27,000 crore and a cash bank of close to Rs 32,000 crore. What is more, the consensus is clearly favouring investors.

According to Reuters data that covered 24 analysts tracking the coal behemoth, 75 percent have buy or outperform rating. The lowest price target is almost at the level of current market price of the stock and the highest price target is higher than the current price by close to 81 percent.

The only reason for pessimism on the stock is absence of growth. Going by the consensus, the company is expected to earn Rs 28 a share in FY21 almost equal to what it earned in FY19.

Back to slow growth

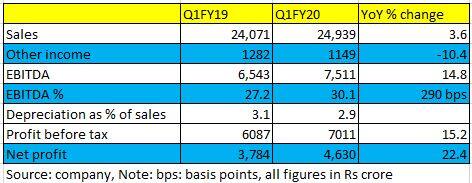

These things are already reflecting in its financials. During the quarter, the company reported a marginal 3.6 percent growth in sales. The lower volume has been a sticky issue. In the June quarter, its production was 136.9 million tonnes (mt), similar to what it posted in the same quarter last year. On top of this, the volumes under the Fuel Supply Agreement (FSA), accounting for 85 percent of the sales volume, was flat at 130 mt.

While FSA volumes suffered because of the lower production and offtake, lower contribution from the e-auction volumes due to drop in demand and realisations added to its woes. During the quarter under review, realisations in the e-auction fell to Rs 2,155 per tonne as against Rs 2,399 a year ago.

Apart from the core business, the cash levels declined. Other income too fell 10 percent year on year to Rs 1,150 crore.

Lower cost drives profitability

Thankfully, it was able to manage its cost well. During the quarter, cash cost, excluding wages, was lower by 5 percent YoY. The company has been taking measures to reduce cost like shutting down of the old mines, spending on productivity like replacing old equipment and the like. These things are yielding good results and driving profitability, partly offsetting concerns about revenue growth.

For instance, during April-June, despite marginal growth in sales, the company posted EBITDA growth of 15 percent on a YoY basis. In addition to lower tax, depreciation during the quarter helped the company report 22.4 percent growth in net profits. Due to change in the policy, depreciation as percentage of sales declined to 2.94 percent in Q1 FY20, from 3.1 percent in Q1 FY10.

What to expect?

It is expected that in the current environment where demand is contracting and coal prices are falling, one should have little expectations in terms of growth. This further gets affirmed from Coal India’s own sticky issues of coal production and logistical challenges pertaining to evacuation of coal to its customers.

However, we do not see much downside. Growth could be flat or marginally up from here, which is already reflecting in the market price. It means investors have nothing or very little to lose at the current valuations.

For more research articles, visit our Moneycontrol Research Page.

Disclaimer: Moneycontrol Research analysts do not hold positions in the companies discussed here

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.