Bajaj Auto Limited, one of the largest two-wheeler (2W) manufacturers in India, continues to be plagued by the slowdown in the domestic 2W industry and is expected to witness another dull quarter in terms of financial performance.

The largest three-wheeler (3W) manufacturer in the country is expected to register a 25 to 30 percent slump in its profit after tax (PAT) when it will declare its results on April 27 for the quarter and financial year ended March 2022. Brokerages expect the company to report a profit between Rs 920 crore and Rs 1,030 crore for the quarter. On a sequential basis, this is a decline of 15 to 24 percent.

The revenue from operations for the reported quarter is forecasted to decline by 12 percent on year to Rs 7,580 crore. On a sequential basis, the decline in revenue is 16 percent. The year-on-year decline in revenues is a result of the significant drop in domestic 2W volumes. Its export volumes in the 2W category also witnessed a decline during the quarter which impacted the revenues. The company also witnessed a decline in 3W volumes in the export market. However, it was partly negated by the spike in volumes of 3W in the domestic market.

The Pune-based company had recorded a standalone PAT of Rs 1,332 crore during the corresponding quarter last year when it had achieved the standalone revenues of Rs 8,596 crore.

Its profit during the October–December period was reported at Rs 1,214 crore on revenues of Rs 9,022 crore.

Views from the street

The data shows that the volumes for the company declined by 17 percent YoY in the reported quarter, which was led by a decline in both the 2W and 3W volumes. The domestic 2W volumes declined by 30 percent YoY due to supply challenges while export volumes slid 7 percent on year.

The 3W volumes were down 11 percent YoY in the export market. However, an 8 percent increase in the 3W domestic volumes provided some comfort.

“We expect revenues to decline by 12 percent YoY led by 17 percent YoY decline in volumes and 5 percent YoY increase in average selling prices (ASPs) due to price hikes taken over the past few quarters in 4QFY22,” a report from Kotak Institutional Equities Research said.

The brokerage expects the company to achieve an EBITDA (earnings before interest, tax, depreciation and amortisation) of Rs 1,134 crore, declining by 25.6 percent on year and by 17.3 percent on quarter.

It expects the EBITDA margin to decline by 270 bps on year and by 20 bps on quarter to 15 percent. The decline in EBITDA margins is due to negative operating leverage, partly offset by price increases taken during the quarter (RM impact will come with a lag of one quarter) and cost control measures.

Kotak expects the automaker to report a PAT of Rs 1,026 crore, a decline of 23 percent from the same period last year and a sequential decline of 15.5 percent.

The company sold 9,76,651 units during the quarter as compared to 11,81,361 units in the preceding quarter and 11,69,656 units in the corresponding quarter a year ago.

“2W domestic market continues to remain weak while the 3W volumes recovery seems to be in place; realisation growth is largely due to price hike associated with impact of cost inflation,” a report from Motilal Oswal said.

It expects a 6 percent improvement in average realisations to Rs 78,000 per unit as compared to Rs 73,492 per unit during the same period last year.

This helped stall the decline in revenues for the quarter which are expected at Rs 7,618 crore with an on-year decline of 11.4 percent. On a QoQ basis, the revenues are seen declining by 15.6 percent.

EBITDA margins at 14.7 percent for the reported quarter are down 300 bps from the same period last year and down by 50 bps over the previous quarter.

The brokerage expects that the PAT is likely to slump by 27 percent on year to Rs 969.3 crore, a sequential decline of 20 percent.

ICICI Securities on the other hand expects the average realisations to improve five percent on year and one percent QoQ to Rs 77,200 per unit. It expects the total operating income to clock Rs 7,540 crore registering a decline of 12 percent from the year-ago quarter and a sequential decline of 16 percent.

“We expect slight improvement in realisations on account of better mix while gross margins are expected to decline 75 bps QoQ on raw material cost pressures leading to EBITDA margin contraction of 198bps QoQ,” ICICI Securities added in its report.

EBITDA margins are likely at 13,2 percent, tanking by 450 bps on year. ICICI is quite pessimistic about the bottomline of the company which it expects would slump 31 percent year on year and 24 percent quarter on quarter to Rs 919 crore.

Key things to focus

The experts suggest that it would be important to focus on the outlook on 3W business, increased competition in the 125cc segment, premiumisation trends, and outlook on demand in key export markets.

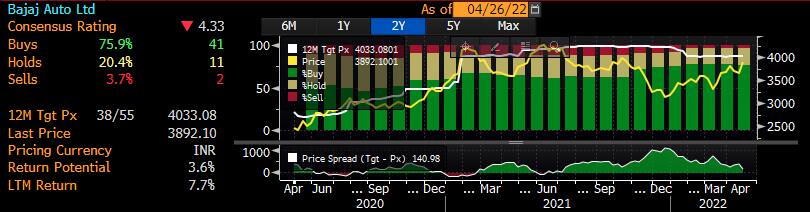

As per the above chart from Bloomberg, 41 brokerages have a 'buy' rating for the stock compared to 11 'holds' and 2 'sells'. The stock has a 12 month target price of Rs 4,033.08 with a return potential of 3.6 percent.

Disclaimer: The views and investment tips of investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!